The GBP/USD currency pair easily and calmly fell on Wednesday. Recall that the euro/dollar at the same time is inside the side channel (albeit near its 20-year lows), and the pound sterling is falling. It is unclear why. No, all the factors that brought the pound so low remain in force. Therefore, they can continue to put pressure on the British pound. But why isn't the euro falling? After all, the factors are almost the same.

On the contrary, we would even say there are fewer reasons for the pound to fall because, after all, the Bank of England has already raised the rate six times in a row and, it seems, is going to do it for the seventh time in September. By the way, we draw traders' attention to the fact that BA is tightening monetary policy quite aggressively, but at the same time, the pound is still falling. Whether an ECB rate hike can help the euro currency is a question. Thus, the technical picture for the pound remains unchanged. All indicators point downwards, and the pair is racing towards its 37-year low at full speed. It seems that the goal of the pound is to "catch up" with the euro. For the last six months or a year, the British currency has shown higher resistance against the dollar, and now it is catching up. One could also explain the current fall with a bad foundation or macroeconomics, but this week in the UK, there is neither one nor the other. The situation is generally strange but favorable for traders who can only follow the trend and sell the pound.

The UK's foreign policy will not change with the arrival of the Tracks.

One could say that the pound is falling because of another political crisis, the rising cost of living in the UK, high inflation, or a guaranteed recession. But the situation in the States is not much better now. Inflation also remains high, the cost of living is rising, a recession cannot be avoided, unemployment will start to rise, and the labor market will shrink. Why is the dollar rising and the pound falling under almost equal conditions? Geopolitics? Of course, this is a very important factor, but if the pound continues to fall due to the Ukraine conflict, how much longer can it theoretically be under the influence of this factor? And if the conflict in Ukraine drags on for many years, will the British pound drop to $0.5?From our point of view, the downward trend persists, but at the same time, traders are already on the verge of turning it up. The Fed will slowly ease its pressure on the economy, but the Bank of England will continue to struggle with the highest inflation. This means there will come a month when the Fed will not raise its rate, but the BA will raise its rate. Such a moment or the expectation of such a moment in the near future may trigger the end of a long-term downward trend. Of course, before this happens, the pound may fall even below the level of 1.1400, from which it remains to pass 150-200 points. But it's better late than never. And "never" - there is no such word in the foreign exchange market. 10 years ago, we believed oil could not cost $0 per barrel. The pandemic crisis has shown that it can.

As for the election of the Prime Minister in the UK. On September 5, the name of the new leader of the Conservative Party, who will become Prime Minister, should be announced. With a high degree of probability, it will be Liz Truss, but this is no secret to anyone. Another surprising thing is that there are already five days left before the inauguration date, and there is no new data on the voting process. There are no new opinion polls, and there are no social studies. Of course, this may be just a coincidence, but the information vacuum is still a little annoying. However, we have to wait anyway. I want to note that Truss is a direct follower of Boris Johnson's ideas, so foreign policy is unlikely to change much with her coming to power. Specific changes may follow within the country. In particular, the VAT tax may be lowered by a record value of 5%. However, the UK budget will suffer, but not much, since the country has one of the highest tax rates in the world. There is no doubt that as soon as the crisis is overcome, VAT will be returned to its previous level quickly. Conservatives need to "prepare a sleigh for the summer" and prepare for parliamentary elections.

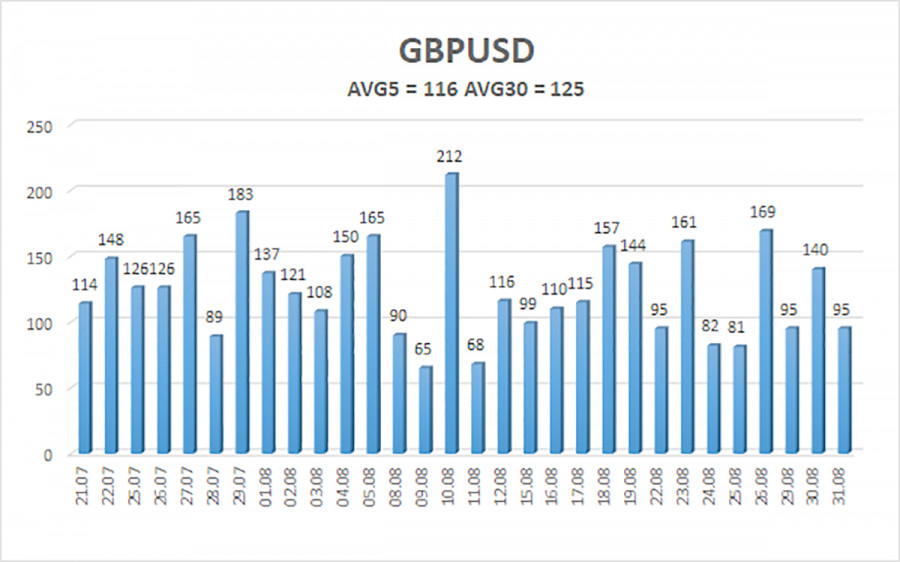

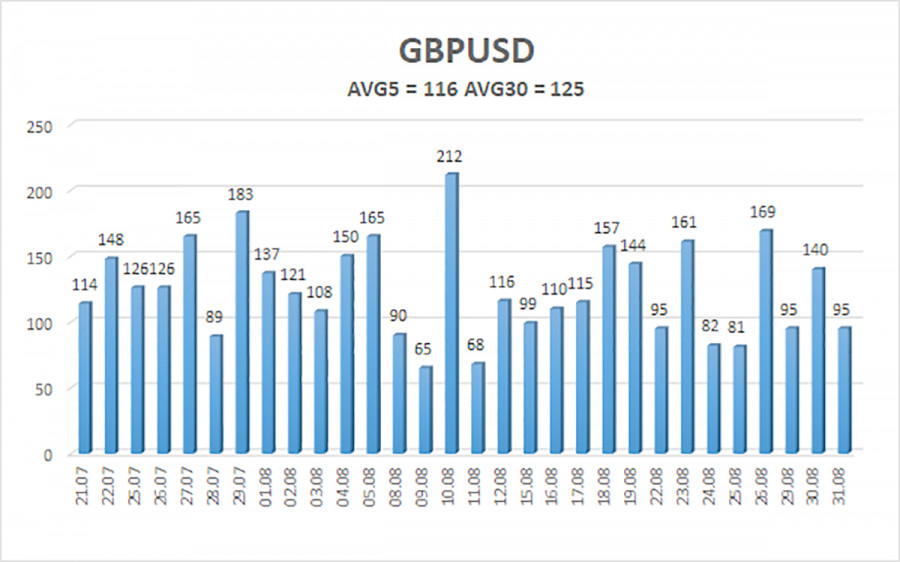

The average volatility of the GBP/USD pair over the last five trading days is 116 points. This value is "high" for the pound/dollar pair. Therefore, on Thursday, September 1, we expect movement inside the channel, limited by the levels of 1.1523 and 1.1755. A reversal of the Heiken Ashi indicator upwards will signal a new round of correction.

Nearest support levels:

S1 – 1.1597

Nearest resistance levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading Recommendations:

The GBP/USD pair continues its downward movement in the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1.1597 and 1.1523 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixing above the moving average line with targets of 1.1841 and 1.1902.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.