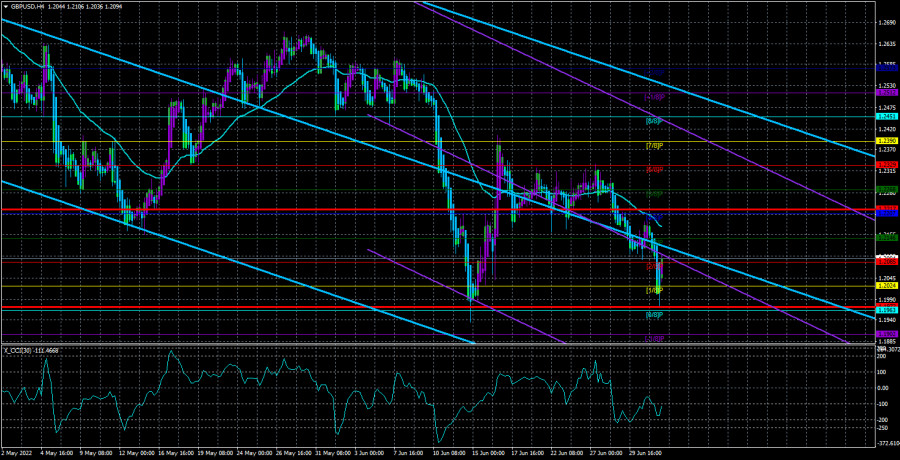

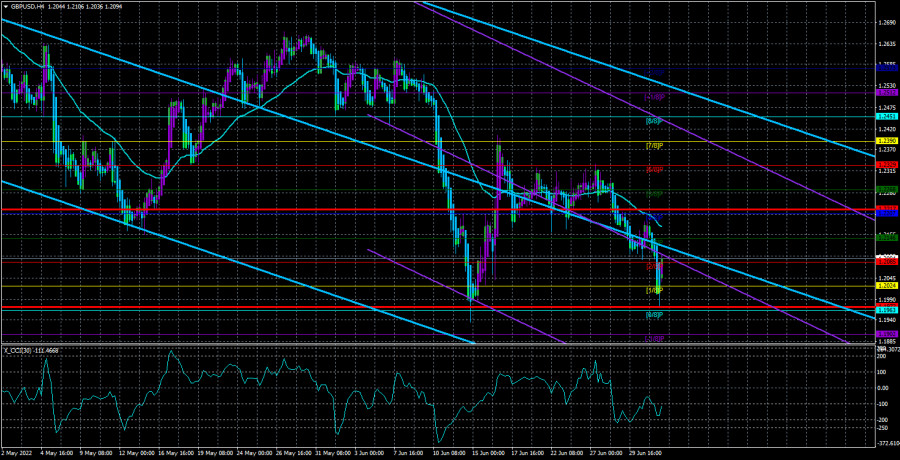

Last week, the GBP/USD currency pair traded using the "euro currency scenario." It decreased in value in relation to the US dollar. Once more, there were no legitimate justifications or grounds for such a movement. Yes, Jerome Powell and Andrew Bailey both gave statements that reaffirmed that their regulators were prepared to continue combating inflation by increasing the key rate. But we already knew all of this. Although it is trying to catch up with the Fed, the Bank of England is lagging in tightening monetary policy because it is not yet prepared to raise interest rates at the Fed's rate. It does not imply that BA is adopting the same passive stance as the ECB. After all, the rate has grown five times in a row, and there is a good chance it will increase again in early August. Because BA's efforts to reduce inflation are currently virtually entirely ineffective, it might even be by 0.50% all at once. However, traders do not take any of this into consideration. The pound/dollar exchange rate is declining once more and hit a 2-year low last week. Pay close note to the most recent upward correction, during which the pound failed even to pass the moving average line, and neither of the linear regression channels had a chance to rise. As a result, all indicators at this point to the negative trend continuing.

The same is true of other variables. Global markets continue to see strong demand for the dollar while geopolitics remain complicated. Macroeconomic data occasionally favors the pound, but what does a 100-point increase in the pound's value mean today? The market's interpretation of these approaches, rather than the differences between the monetary policies of the Fed and the BA or their aggressiveness, currently best expresses the basic background. Unambiguously, the market replies by refusing to buy the pound. What causes the British pound to be moving north now?

Another false optimism for the pound is the non-farm payrolls in the USA.

The coming week won't feature many significant macroeconomic facts or occurrences. On Tuesday, Andrew Bailey will deliver a speech in addition to the UK's release of the business activity index. Remember that of the "big three," the head of BA is the most reserved with their opinions (Lagarde, Powell, Bailey). Since it is not common for Britain to announce a hike in the key rate, we do not anticipate them to provide any significant information. Furthermore, Bailey will not disclose the amount the monetary committee members can raise. It is the only thing scheduled for this week in the UK.

The scenario with the events will be a little more intriguing in the States. The ISM business activity index and the Fed minutes are released on Wednesday, and the ADP report on changes in the number of people employed in the private sector is released on Thursday. Monday is a holiday. Tuesday is a blank day. Of course, the movement of all currency pairs that involve the dollar might be influenced by the ISM index and the ADP data. However, there hasn't been a response to the ADP report in a very long time, and for there to be one, the ISM index must be significantly different from the forecast (54.5-55.2). On Friday, the action will be the most intriguing. The number of new jobs outside the agriculture industry, the unemployment rate, and the change in pay (Nonfarm Payrolls). The first two reports will also be of little use. Since the US unemployment rate has long since reached its lowest level, an increase of 0.1% will not significantly impact.

Additionally, the market is now not interested in wages. So Nonfarms will be the sole topic of discussion this week. Forecasts state that between 270,000 and 300,000 new jobs were generated in June. Remember the last three reports showed that 390-436 thousand new jobs were being created each month? The dollar is unlikely to decrease due to this data unless there is a significant decline in this indicator. Even 200-250 thousand new jobs are, in our opinion, quite a typical number. However, the forecast must be used as a starting point because the market will compare it to the actual value.

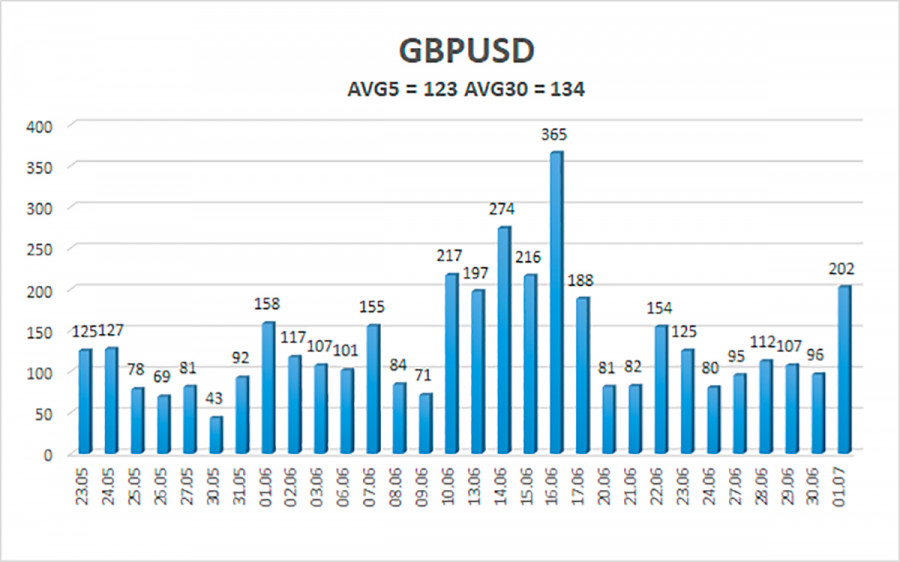

Over the previous five trading days, the GBP/USD pair has experienced average volatility of 123 points. This figure is "high" for the dollar/pound exchange rate. As a result, on Monday, July 4, we anticipate movement constrained by the levels of 1.1972 and 1.2217 remaining inside the channel. A new round of upward correction will begin when the Heiken Ashi indicator reverses to the upside.

Nearest support levels:

S1 - 1.2085

S2 - 1.2024

S3 - 1.1963

Nearest resistance levels:

R1 - 1.2146

R2 - 1.2207

R3 - 1.2268

Trading recommendations:

In the 4-hour period, the GBP/USD pair finished the "swing" pattern and started moving lower again. Therefore, when the Heiken Ashi indicator moves down again, short trades with objectives of 1.2024 and 1.1972 should be considered. When fixed above the moving average, buy orders should be placed with targets of 1.2268 and 1.2329.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal in the opposite direction is approaching.