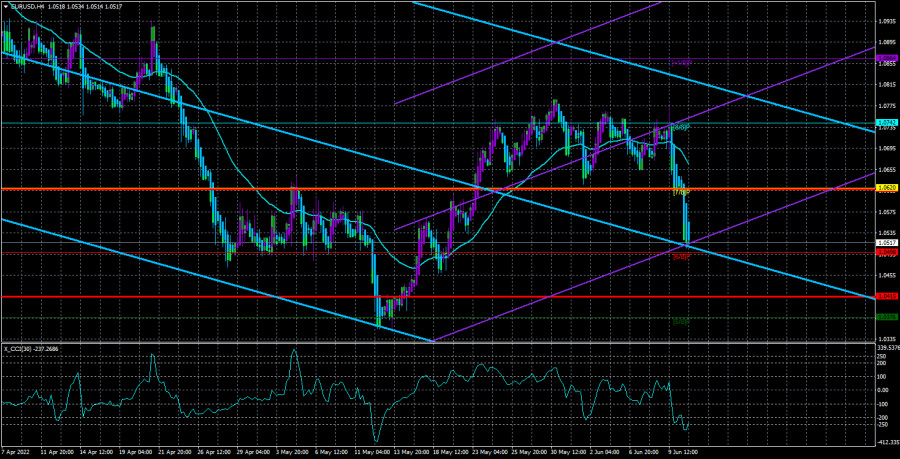

The EUR/USD currency pair collapsed by another 100 points on Friday. Thus, the downward movement resumed rather abruptly. It may still be a simple correction, but, to be honest, a decrease of 200 points in two incomplete days does not look like a simple correction. The bulls showed their inability to do "great things" near the Murray level of "8/8"-1.0742. In total, the pair adjusted by 450 points against the downward trend, which almost exactly coincides with the size of previous corrections within the same trend. That is, we can even conclude that everything is going according to plan. We assumed some time ago that the downward trend was over since the market already had the opportunity to work out all the factors supporting the US currency several times. But it seems that it will not do without updating the 20-year lows for the euro/dollar pair.

In recent articles on bitcoin, we said that the fundamental background has not changed recently and will remain the same for a long time as it is now. The same applies to the European currency. It is already clear to absolutely everyone that EU sanctions against Russia are for a long time and the only thing that can change in this matter, sanctions will become even tougher. And any sanctions work both ways. Therefore, the European economy may suffer very much. Against the background of the American one, that's for sure. It is clear to everyone that the geopolitical conflict in Ukraine has been going on for a long time. So far, Russian troops have a slight advantage in the Donbas due to the superior number of personnel and the number of heavy weapons. In addition, the Russian army refused to advance on other fronts, so it moved most of its troops to the Donbas. The APU cannot do the same, as they are forced to guard state borders to avoid a new invasion in other areas. Therefore, there is a minimal advance of the Russian army, but, according to military experts, it is insignificant. The turning point of the conflict may happen this summer when Kyiv accumulates a sufficient amount of Western weapons and goes on a counteroffensive. At least, that's what the top officials of Ukraine are saying now.

The economy is not working in favor of the EU currency.

In addition, the ECB lags far behind the Fed on monetary policy. And even after Christine Lagarde promises to raise rates at least twice this year, nothing has changed. Two rate increases are a maximum of 0.5%. In the States, the rate may rise to 2.5% this year. Accordingly, American Treasury bonds and deposits in American banks will be much more profitable than European ones. Accordingly, the flow of capital from Europe to the United States.

There will be practically nothing interesting in the European Union in the new week. On Wednesday, a report on industrial production will be published, which in the current circumstances looks uninteresting for traders. Friday is the inflation report. But it's too early to rejoice, this is only the second estimate of inflation for May, and traders are already ready for the value of 8.1% y/y. It is unlikely that the actual value of the second estimate will be very different from the previous one. Thus, these reports are unlikely to affect the movement of the pair and will not help the euro to show growth. On the first two days of the week, there will be nothing interesting in America, so these days will be very important in terms of determining the true mood of the market. Still, on Thursday and Friday, traders had formal grounds for selling the euro currency. If the sales continue on Monday-Tuesday, it will mean that traders no longer even need statistics and a "foundation" - they are set for a new round of the downward trend.

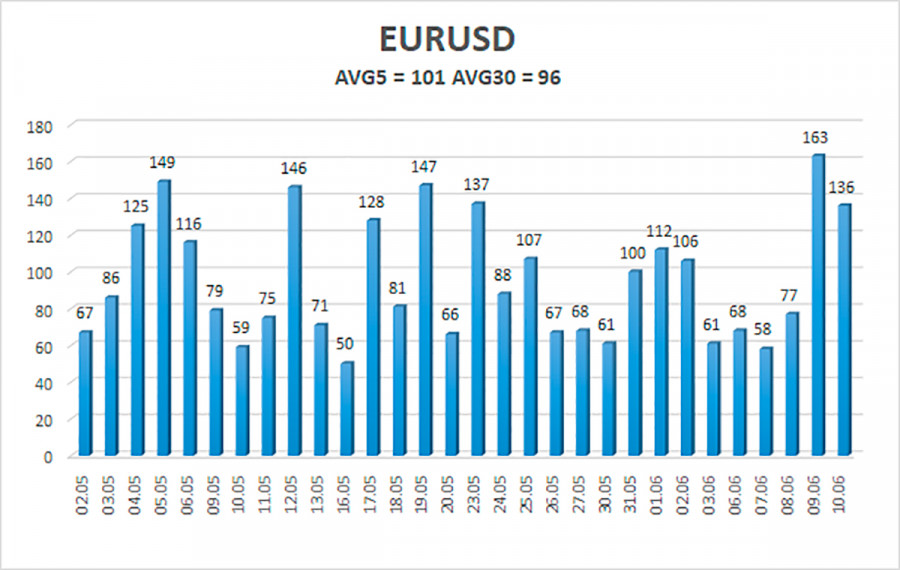

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 13 is 101 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0415 and 1.0618. A reversal of the Heiken Ashi indicator back up will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair has consolidated back below the moving average and continues to fall strongly. Thus, it is now possible to stay in short positions with targets of 1.0415 and 1.0376 until the Heiken Ashi indicator turns upwards. Long positions should be opened with targets of 1.0742 and 1.0864 if the price is fixed above the moving average.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which you should trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.