The EUR/USD currency pair managed to stay above the moving average line on Thursday. We can consider this a small victory for the European currency. There was no macroeconomic and fundamental background yesterday, however, the euro managed to avoid a new fall. Of course, it is still too early to open champagne about the growth of the euro. Even the illustration above shows how insignificant the current growth is in comparison with the previous fall. The pair still has not even been able to update its previous local maximum near the Murray level of "3/8"-1.0620, not to mention something more. Therefore, we believe that the pair has taken the first step towards ending the downward trend, but this is just one step, which is far from the fact that the second and third will follow. The worst thing for the euro now is that it is still supported only by the technical factor, which requires a strong correction from the pair. The "foundation" and "macroeconomics" continue to support the US currency to a greater extent. Although there is disastrous data from time to time, like the latest GDP report. But it is the dollar that remains the world's reserve currency. And what do they do with the reserve currency when they don't even want to look at the geopolitical background? That's right, they're buying it up.

Since geopolitics is now such that the military conflict in Ukraine can easily spill out into other territories, it is quite logical that traders and investors prefer to deal with the dollar rather than the dangerous euro or pound. Recall that if the geopolitical conflict goes beyond the borders of Ukraine, it will come out on the territory of Europe. Either to Finland and Sweden, or the Baltic States, or Poland. That is, in any case, the EU countries will suffer from this conflict much more than the United States. Consequently, both the euro and the pound continue to remain in the "risk zone". The slightest expansion of a military conflict or the outbreak of a new one, and the euro and the pound can go to conquer new lowlands.

Hungary demands 18 billion euros from the European Union.

Well, the sixth package of EU sanctions against Russia has not yet been buried, but contrary to our expectations, Hungary, which is blocking this package, has not yet been persuaded. It is noteworthy that the top officials of the EU are confident that Budapest will change its decision because otherwise, it will be against the rest of the EU and sanctions may follow against it. Recall that the European Union is an alliance where all countries should strive to come to a common solution, and not an alliance whose main goal is to pump the interests of each country. Hungary is currently demanding either a delay from abandoning Russian oil for 5 years, or compensation of 18 billion euros from losses from the embargo, or maybe both at the same time ("and it is possible without bread"). However, the European Union, of course, is loyal, but it is unlikely to meet these requirements. It is much easier to vote and exclude Hungary from the EU than to follow her lead. European Commissioner for Economic Affairs of the European Commission Paolo Gentiloni said that negotiations are continuing, but so far there is no progress in them.

Meanwhile, European Commission President Ursula von der Leyen said that the European Union will switch to solar panels to reduce gas consumption and refuse supplies from Russia. By 2025, it is planned to install solar panels on the roofs of commercial and public buildings, and by 2029 - on the roofs of residential buildings. "This is quite an achievable task," the head of the European Commission said. This plan will require the allocation of 300 billion euros and an additional 200 billion will go to EU defense spending. Thus, the European Union has already clearly set a course to abandon hydrocarbons from Russia, which is why we believe that Hungary's position will not be a "stick in the wheel" for Brussels. Most likely, within a couple of years, the EU will abandon both gases from the Russian Federation and oil.

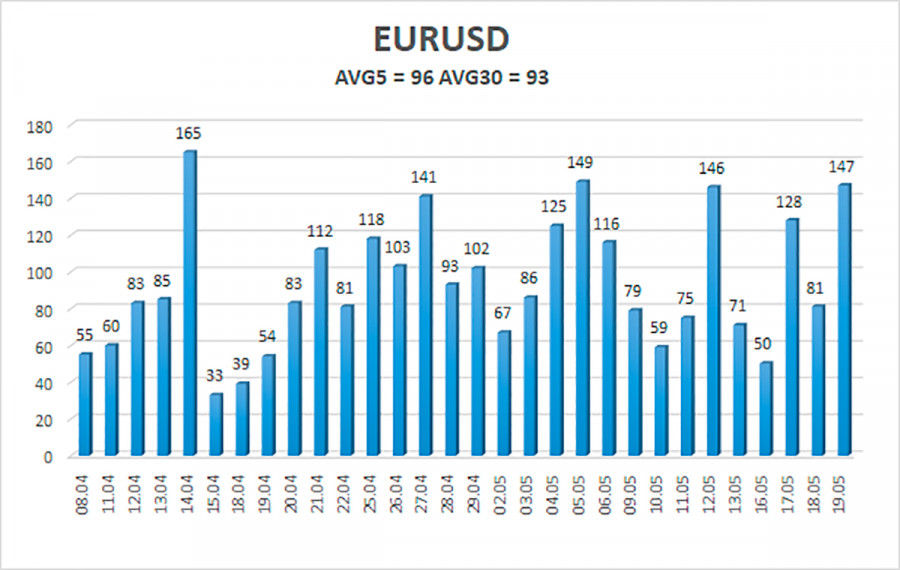

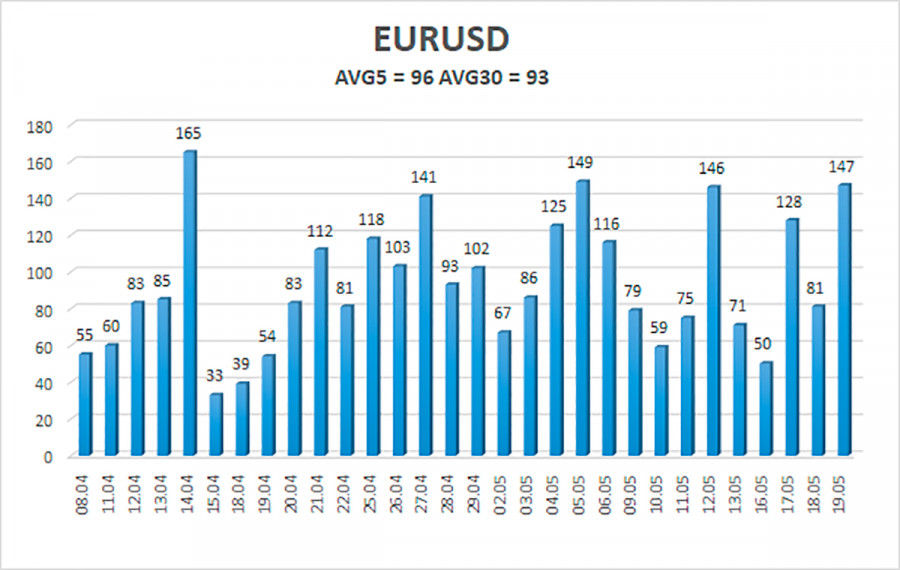

The average volatility of the euro/dollar currency pair over the last 5 trading days as of May 20 is 96 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0505 and 1.0696. A reversal of the Heiken Ashi indicator back down will signal a round of corrective movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading recommendations:

The EUR/USD pair continues to be located above the moving average and is trying to maintain the formation of a new upward trend. Thus, now we should stay in long positions with targets of 1.0696 and 1.0742 until the Heiken Ashi indicator turns down. Short positions should be opened with a target of 1.0376 if the price is fixed below the moving average.

Explanation of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.