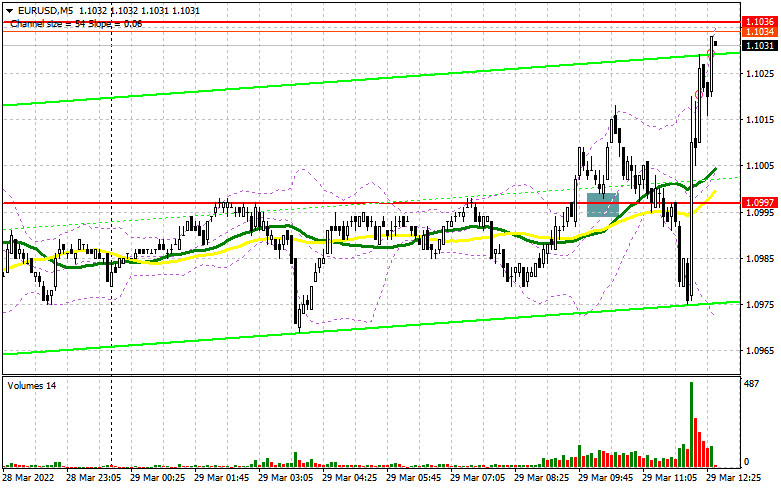

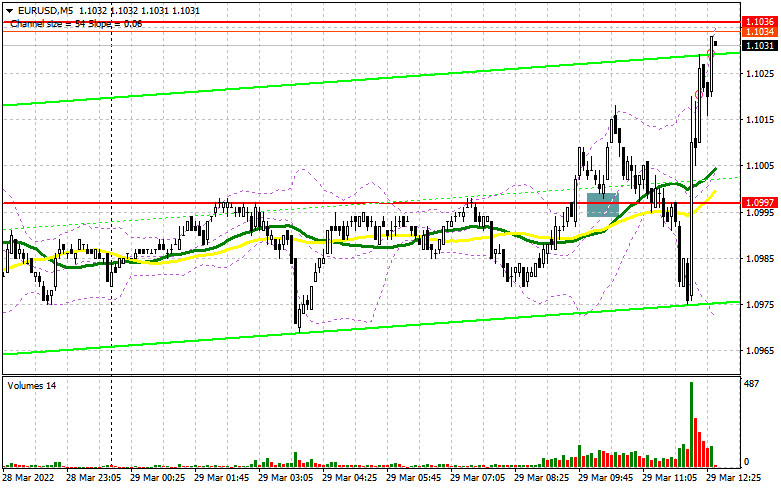

In my morning forecast, I paid attention to the level of 1.0997 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. The lack of fundamental statistics led to a small spike in volatility in the first half of the day, as well as to a breakdown and consolidation above 1.0997. The top-down test of this level gave an excellent entry point into long positions, but it was not possible to demonstrate growth by more than 20 points. A repeated test of this area led to a drop in the pair, but the news about the beginning of the meeting of representatives of Russia and Ukraine returned the demand for risky assets. Quite a lot depends on the results of the negotiations, but I would not advise hoping for any significant breakthrough. From a technical point of view, nothing has changed for the second half of the day. The fight will now go for the resistance of 1.1036. And what were the entry points for the pound this morning?

To open long positions on EURUSD, you need:

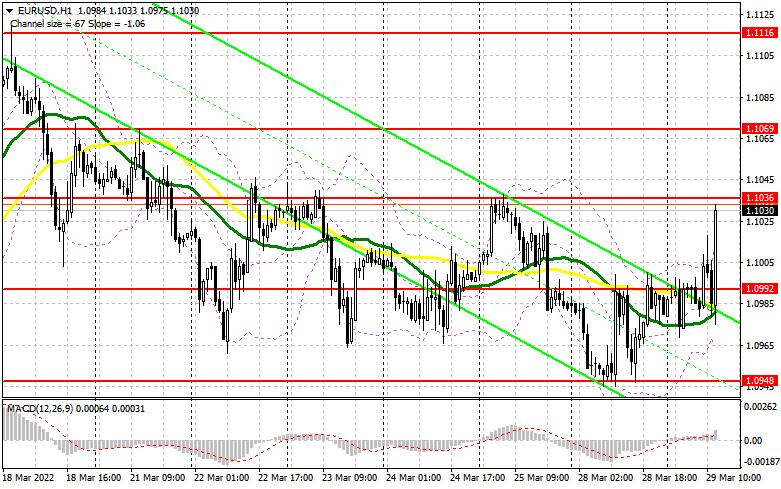

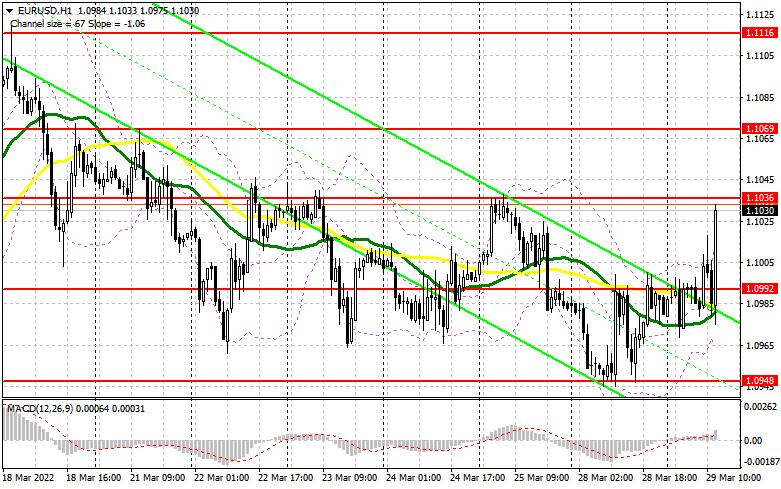

At the time of writing, the pair has come close to the resistance of 1.1036, and a lot now depends on the actions of buyers at this level. It is clear to everyone that the focus will be shifted to the results of the negotiations between the representatives of Russia and Ukraine, but do not forget about the speech of employees of the Federal Reserve System, who will continue to promote the topic of a more aggressive change in the policy of the Central Bank. FOMC member John Williams is expected to make a speech today, and the reaction to his statements may help the dollar win back some of its positions in a pair with the European currency. Also scheduled for today is the publication of a report on the US consumer confidence indicator, which will be worse than economists' forecasts, and will push the euro up to new weekly highs. Nevertheless, the primary task of the bulls for the second half of the day today remains the protection of the new support of 1.0992. A repeated fall to this level may occur after macroeconomic indicators, but only a false breakdown will give another signal to enter the market in long positions. An equally important task will also be a breakthrough and consolidation above 1.1036. A test of this range from top to bottom will give a buy signal and open up the possibility of restoring the pair to 1.1069. A more distant goal will be a maximum of 1.1116, where I recommend fixing the profits. A breakdown of this range will reverse the bearish trend and hit the sellers' stop orders, opening a straight road to 1.1181. But for this scenario, the negotiations between Russia and Ukraine should go as well as ever. If the pair falls and there are no bulls at 1.0992, it is best to postpone long positions. The optimal scenario for buying would be a false breakdown of the minimum in the area of 1.0948, but it is possible to open long positions on the euro immediately for a rebound only from 1.0903 with the aim of an upward correction of 30-35 points within a day.

To open short positions on EURUSD, you need:

Sellers tried to return the pressure on the pair in the first half of the day, but nothing good came of it - some too many people want to buy risky assets based on political events. The primary task of the bears now is to protect the resistance of 1.1036. The formation of a false breakdown there will lead to the first sell signal, and strong US data and hawkish statements by representatives of the Federal Reserve System will once again remind investors of the strength of the US dollar, which will lead to a decline in the EUR/USD pair. A breakthrough and a reverse test of the 1.0992 level, to which the euro may fall if the scenario is implemented higher, will give an additional signal to open short positions with the prospect of a decline to a minimum of 1.0948. A more distant target will be the 1.0903 area, I recommend fixing the profits. In the event of a rise in the euro and the absence of bears at 1.1036, bulls will continue to increase long positions in the expectation of a return to monthly highs. Given that much will now depend on the further development of geopolitical events, it is better not to bet on the growth of the euro in the current conditions. It is unlikely that the parties will come to an agreement that would suit everyone. If there is no one at 1.1036, it is better not to rush with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1069. You can sell EUR/USD immediately on a rebound from 1.1116, or even higher - around 1.1181 with the aim of a downward correction of 20-25 points.

The COT report (Commitment of Traders) for March 22 recorded a reduction in short positions and a sharp increase in long ones. Finding the pair in the area of the next annual lows and large support levels has a positive effect on the euro. However, if you look at the numbers, you can see that the reduction of short positions was minimal. The pressure on the EUR/USD pair has returned after Fed Chairman Jerome Powell abruptly changed his position to a more aggressive one last week. On Monday, the head of the Central Bank said that he expects a 50-point increase in the key interest rate at the next meeting of the committee. A similar number of statements were made by other representatives of the Federal Reserve System, which led to a revision of forecasts by several market participants. The risk of higher inflation in the US is the main reason for such changes in Central Bank policy. However, it is worth remembering that the European Central Bank also held a meeting recently, at which President Christine Lagarde announced plans to more aggressively curtail measures to support the economy and raise interest rates - this is good for the medium-term prospects of the European currency, which is now heavily oversold against the US dollar. The positive results of the meeting of representatives of Russia and Ukraine and the reduction of the geopolitical conflict will play on the side of buyers of the European currency - this also needs to be taken into account. The COT report indicates that long non-commercial positions increased from the level of 202,040 to the level of 207,051, while short non-commercial positions decreased from the level of 183,246 to the level of 183,208. At the end of the week, the total non-commercial net position increased to 23,843 against 18,794. The weekly closing price increased slightly - from 1.0942 to 1.1016.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daily moving averages, which indicates an attempt by the bulls to take the initiative.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a decline, the lower limit of the indicator around 1.0960 will act as support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.