The euro and the pound sterling have fully recovered lost ground after last week's losses, clearly set to start an uptrend after New Year's Eve. However, the supply chain issues remain strong with no end in sight, according to forecasts for 2022. The vaccination campaign and the lifting of coronavirus restrictions have failed to resolve the crisis.

Old problems

An outlook by McKinsey states consumer demand for goods and services would decline in 2022 due to saturation, easing pressure on supply chains by summer. This would allow regular flow of goods to steadily resume. However, new restrictions due to the Omicron strain could keep consumer demand high and negatively affect workforce availability.

Sea-Intelligence is more bearish on supply chain issues, not expecting disruptions for high-demand goods supply to be resolved soon. "Once the port congestion is unclogged, we have a massive amount of retail inventory restocking goods to move, that have not been moving at the present freight rates. The latest U.S. Census Bureau data shows no signs that we're seeing any slowdown in US consumer spending on durable goods, so we're maintaining our outlook that we will continue to see a shortage of supply throughout 2022, with a possible resolution in 2023," analyst Alan Murphy said.

Oxford Economics forecasts the supply issue to be resolved around the second half of 2022. "Shipping disruptions are expected to ease over the course of the year. As labor supply problems throughout logistics supply chains abate and shortages in warehousing space are addressed, seaborne freight looks set to recover in the second half of 2022," Kiki Sondh of Oxford Economics commented.

If supply shortage persists, it would put pressure on both the economy and inflation. Rising prices could push down US consumer demand, but a sharp decline in availability of certain goods and services could in fact increase it, paralyzing the market temporarily.

Data releases

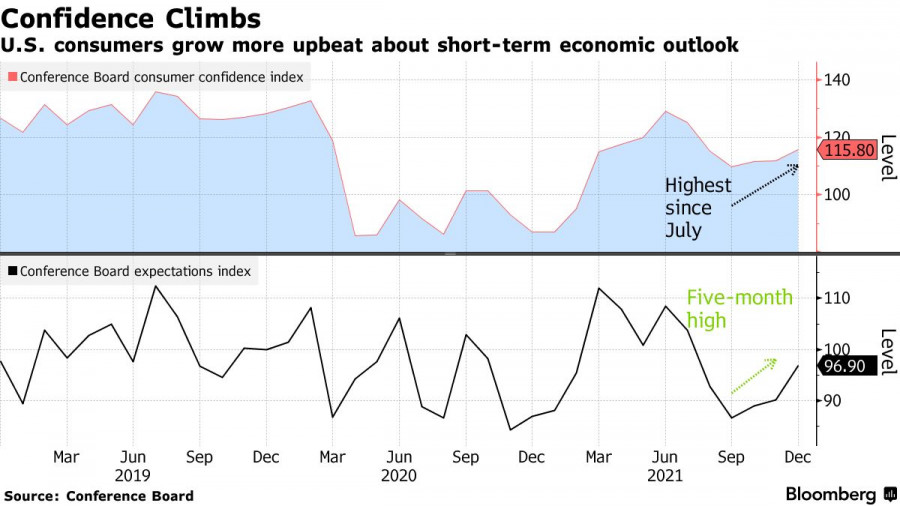

According to the yesterday's report by the Conference Board, US consumer confidence has beat expectations, with the index growing in December to.115.8 points compared to 111.9 points in November. The increase was attributed to rising employment opportunities and economic prospects, despite growing concerns over the Omicron strain. US consumers are increasingly optimistic about their economic prospects in the short term, despite the new COVID-related restrictions.

Jerome Powell, chairman of the Federal Reserve, has recently stated that every new COVID-19 is affecting the US economy less and less, as Americans adapt more easily to new virus strains. Concerns about inflation eased in December as well. A gauge that assesses what Americans expect over the next six months rose to 96.9 points, while the present situation index decreased to 144.1 points.

Existing home sales in the US also went up by 1.9% to a seasonally adjusted annual rate of 6.46 million units in November, a report by the National Association of Realtors showed. The amount of sales was expected to accelerate to an annual rate of 6.53 million. The average home price reached $353,900, rising by 13.9% from a year earlier due to growing sales of more expensive properties. However, supply remains tight for houses priced below $500,000.

The Chicago Fed National Activity Index fell to 0.37 in November from 0.75 in October, broadly matching market expectations and indicating an above-average expansion rate. Three of the four broad categories constituting the index positively contributed to it in November. However, all four categories declined compared to October. Production-related indicators contributed 0.21 points to the index, employment-related indicators declined to 0.18 points. The contribution of the sales, orders and inventories category edged down to 0.03 points, and personal consumption and housing category contributed negatively to the index, adding minus 0.05 points.

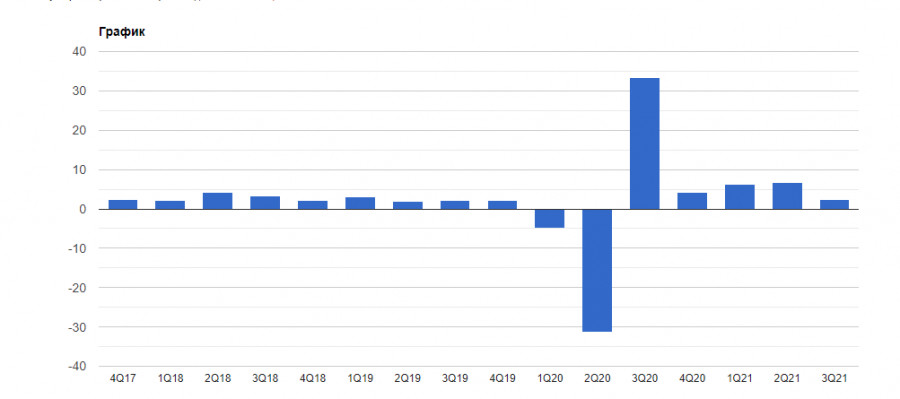

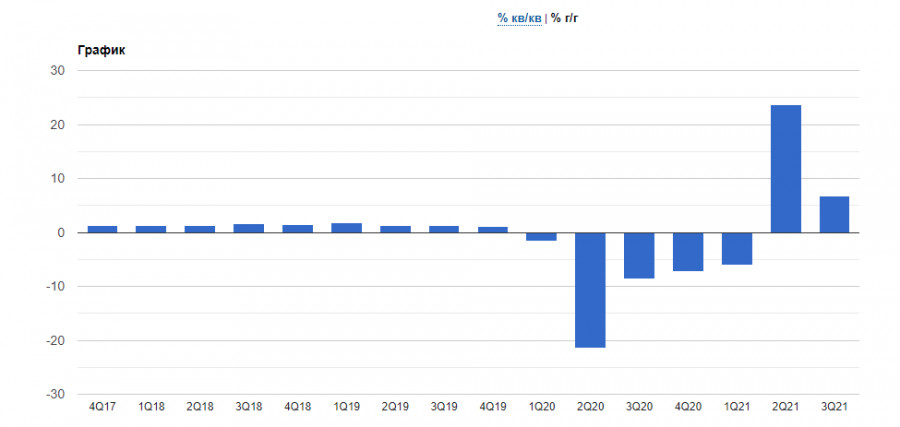

The US Commerce Department on Wednesday reported that gross domestic product increased at an annualized seasonally-adjusted rate of 2.3% in the third quarter of 2021, revised up from the 2.1% rate estimated last month. The GDP report for Q3 2021 indicated consumer spending rose to about 2% year-over-year from previously forecast 1.7%. Services spending and private inventory investment were also higher than previously reported. Consumer spending is likely to boost the economic growth in Q4 2021 as well.

On the technical side, yesterday EUR/USD bulls pushed the pair up significantly after it broke above 1.1300. However, it failed to surpass 1.1335. Now, settling above 1.1335 is the main goal for bullish traders, which could open the way to 1.1360 and 1.1415. If EUR/USD returns below 1.1300, it could fall towards 1.1260 and 1.1230.

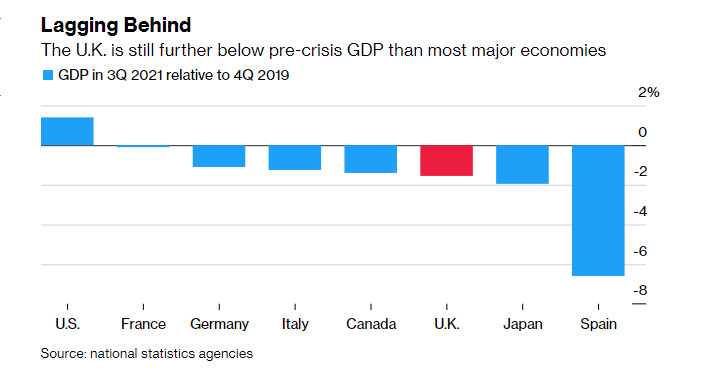

The pound sterling rose strongly against the US dollar on news of faster than expected UK economic recovery, despite falling GDP growth in the third quarter of 2021.

The Office for National Statistics reported that the UK GDP is now below pre-pandemic levels by only 1.5%, compared to 2.1% in the second quarter. The UK economy grew only by 1.1% in the third quarter of 2021. Economists forecasted the GDP to rise by 1.3%. The annual GDP growth rat in Q3 2021 was 6.8%, compared to previously forecasted 6.6%.

The UK, as well as some other European countries, is close to surpassing pre-pandemic GDP levels.

On the technical side, GBP/USD pushed new highs yesterday and approached the resistance at 1.3370, thanks to strong efforts by bulls. Settling above 1.3320 is now the most important goal for bullish traders. A breakout above 1.3370 would open the way towards the highs at 1.3410 and 1.3450.