US stock index futures traded virtually unchanged on Wednesday morning as investors prepare for the long-awaited decision by the Federal Reserve on Wednesday to tighten monetary policy. Yesterday, many took profits after an unsuccessful attempt by bulls to break through to the next historical highs earlier this week in the hope of a smoother change in the policy of the central bank due to the risk of a negative impact on the economy of a new strain of coronavirus – omicron.

When it became clear that changes could not be avoided, and high inflation, which broke records in the 1980s, was to blame, traders preferred to lock in profits. Particular pressure was observed in the high-tech NASDAQ index. This morning, Dow futures added 30 points, while the S&P 500 did not change. Nasdaq 100 futures fell 0.2%.

In the evening, the Federal Reserve System will conclude its two-day monetary policy meeting, and the public will hear from central bank Chairman Jerome Powell the whole concept that the central bank is going to adhere to next year. We are waiting for the results of the Fed meeting. Let me remind you that the Fed is struggling with the highest inflation rate in 39 years, and it is expected that the central bank will announce an acceleration of the reduction of its bond purchase program, which was used during the pandemic to support the economy.

Is there a trump card up your sleeve

On the other hand, if everything goes fairly smoothly and according to plan, market demand may return, since the Fed's tougher approach to its policy is not news to anyone. The main thing, in this case, is that Powell does not announce new changes that the markets are not counting on. In any case, it should be understood that today's decisions will lead to radical changes in the Fed's policy, which will clear the way for the first interest rate hike next year. At least two such increases are expected.

Market expectations are that the Fed will halve the pace of bond purchases to $30 billion – this will put an end to $120 billion in monthly asset purchases by about March next year. Then, according to forecasts, the central bank will raise rates three times in each of the next two years, starting in June 2022.

But some believe that the Fed chairman is unlikely to offer any specific time frame when the funds' rate hike will begin. Most likely, he will confirm that it is necessary to move faster than previously stated. However, whether he will abandon the statement that the central bank will start raising interest rates only after the situation on the labor market and in the economy has fully stabilized is a big question.

Most agree that the Fed will not say something new that financial markets do not expect. Some recent stock market volatility may decrease after this two-day meeting and its press conference, and after that, there will be another wave of growth, which will be supported by a stable and developing American economy.

Retail sales data for November of this year are also expected today. Economists expect retail sales to have risen 0.8% in November, compared with an increase of 1.7% in October.

And before going through the premarket, I would like to draw attention to the fact that Americans can count on additional payments from the US tax office by the end of this year. The American Rescue Plan Act abolished the 2020 federal unemployment benefits tax of up to $10,200 per person. To date, the IRS has identified 16 million people who can claim tax refunds or other benefits. As of November 1, the agency has sent more than 11.7 million refunds worth $ 14.4 billion. The IRS plans to send another tranche by the end of the year. However, many people eligible for tax breaks filed their annual tax returns before President Joe Biden signed the law on March 11. This requires a review and a longer consideration of applications for compensation.

Now let's run through the premarket and look at the company news:

Tesla's securities continue to trade on the premarket in the red, having lost about 0.63% after closing yesterday in the red zone. Another profit-taking and the "drain" of the company's shares by its CEO, Elon Musk, does not inspire confidence in investors, but this is not critically reflected in the market in any way. More details in the article: Elon Musk continues to get rid of Tesla shares.

By the way, Elon Musk was named "Man of the Year" by the Financial Times newspaper today, two days after receiving a similar recognition from Time magazine. The FT said it had chosen Musk as the initiator of a historic shift in the global automotive industry towards electric vehicles.

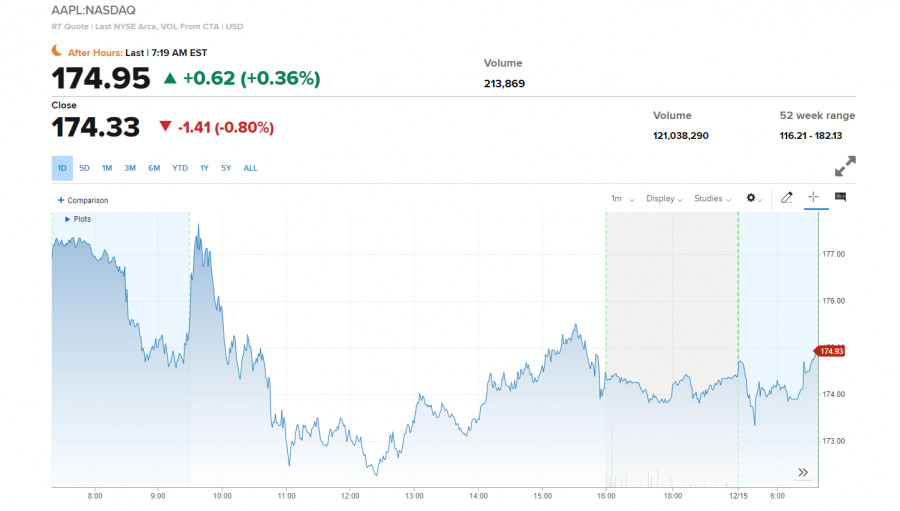

Shares of Apple Inc sank slightly in the premarket, but then returned to yesterday's closing level due to the risks of a new strain of omicron coronavirus. The company said in a statement that all customers and employees must now wear masks at their retail stores in the United States. Last month, Apple lifted its ban on masks for customers at more than 100 of the company's roughly 270 stores in the United States as the number of coronavirus cases declined.

As for the technical picture of the S&P 500

The bulls failed to return above $4,665, which led to an instant sale of the trading instrument. Only a return above this range will allow us to count on updating the highs and on the index going to the area: $4,718 and $4,761. If traders fail to regain the $4,665 level today, and much depends on the results of the Fed meeting, the decline may continue. A break of $4,611 will strengthen the market correction, which will collapse the trading instrument to the area of $4,551. However, many market participants do not expect serious pressure on the indices after the final meeting of the central bank.