What is needed to open long positions on GBP/USD

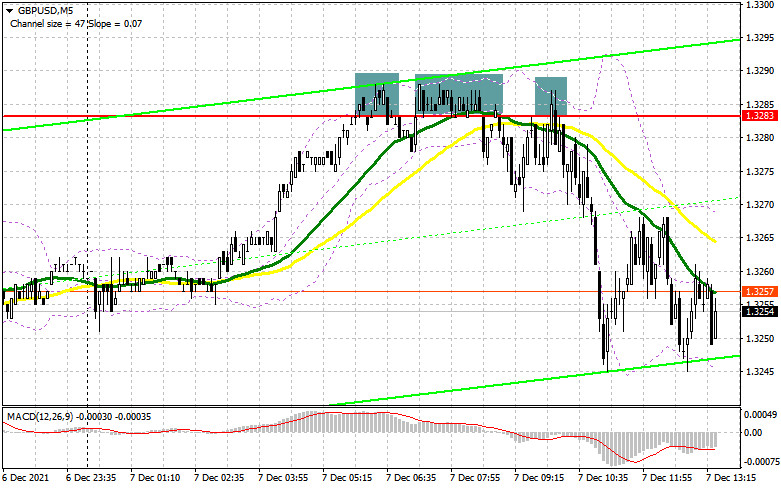

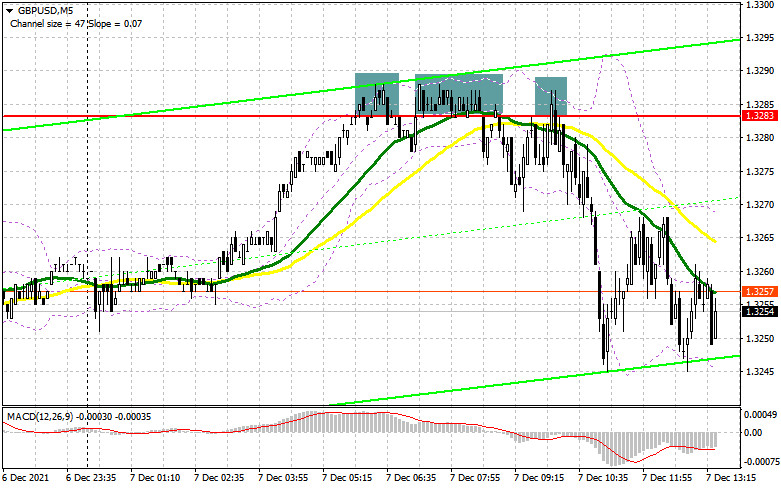

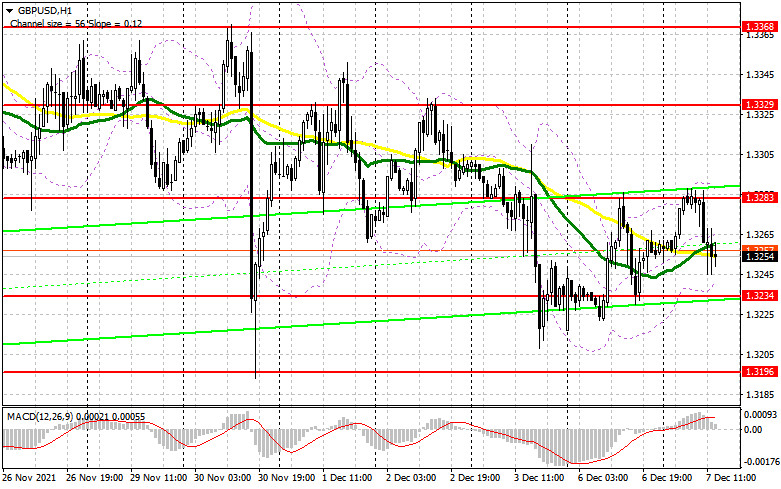

In the morning article, I turned your attention to the level of 1.3283 and recommended making trading decisions on the market entry with this level in focus. Let's look at the 5-minute chart and try to reckon what has happened. Apparently, the buyers are doing their utmost to take over control over resistance of 1.3283. But every time, their efforts are in vain. After three failed attempts, the bears made more active efforts that created a fake breakout and generated an excellent sell signal for GBP/USD. A as result, the currency pair shed 40 pips. GBP/USD is trading under downward pressure at the moment of writing the article. Technically, nothing has changed since the morning review.

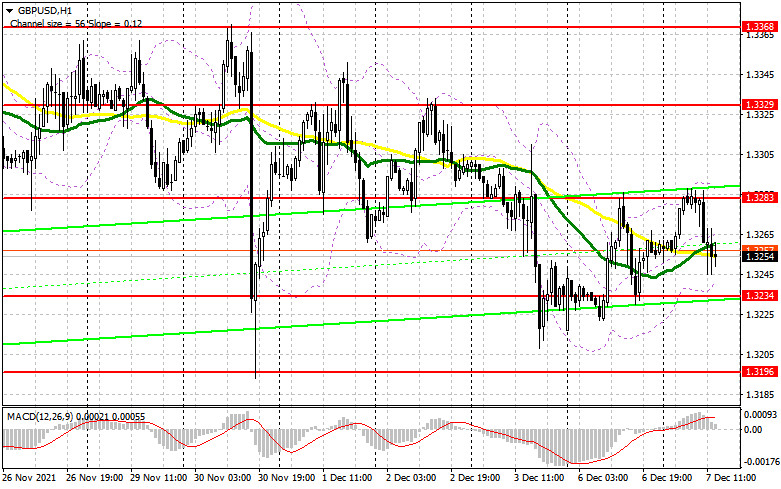

In the second half of the day, the economic calendar has no crucial fundamental data, albeit there are reports of secondary importance such as a US trade balance for October, and US nonfarm productivity for Q3 2021. The data will hardly provide GBP buyers with serious support. Thus, it would be a wise decision to bet on a further decline of GBP/USD. Nevertheless, the bulls should not give up. The major task is to make GBP/USD settle above 1.3283. In the context of the ongoing downward move, the time is right to think that 1.3234 should be protected. In the first half of the day, 1.3283 was not broken and tested downwards. This price action suggests a nice market entry point with long positions on GBP/USD as the bearish trend is likely to halt and GBP/USD could recover to 1.3329. If this level is broken, the way will be open to the updated high of 1.3368. A more distant target is seen at 1.3407 where I recommend profit taking. In case of the bearish scenario during the American session, the important task would be the defense of support at 1.3234 that was appeared yesterday.

Once this level is breached with a fake breakout, we will see a buy signal. I would recommend opening long positions on GBP/USD immediately at a bounce off 1.3196 and even lower off 1.3130 bearing in mind a 20-25 pips correction intraday.

What is needed to open short positions on GBP/USD

GBP sellers coped well with the task to defend resistance of 1.3283. Besides, they enabled nice market entry points with sell positions. It would be great for the bears to encourage a fake breakout at this level that will generate another market entry point with short positions with the prospect of a decline towards 1.3234. Meanwhile, GBP/USD is heading towards this level. If the bears regain control over this level, the buyers will find it hard to carry on with new long positions. So, the currency pair will resume the downtrend. A reverse test of 1.3234 upwards will create an excellent market entry point with short positions that will push GBP/USD down to 1.3196 and 1.3139 where I recommend profit taking. In case GBP/USD grows during the New York trade and the sellers lack activity at 1.3283, it would be better to cancel short positions until stronger resistance of 1.3329. I would advise opening short positions there on condition of a fake breakout. You could sell GBP/USD immediately at a drop off major resistance at 1.3368 or from a higher level of 1.3407 bearing in mind a 20-25 pips correction intraday.

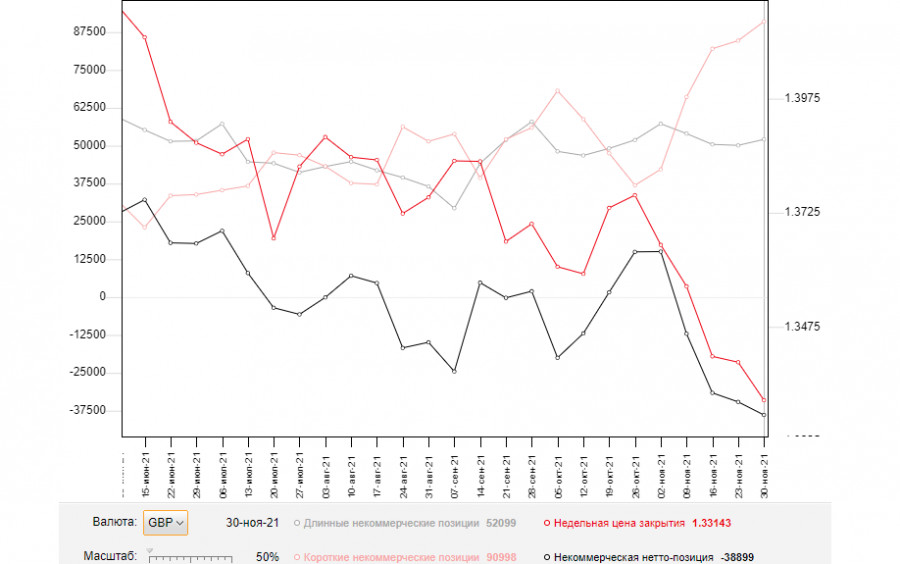

The COT report from November 30 logs growth both in short and long positions. However, the number of buy positions is bigger that leads to an increase of the negative delta. Last week, the UK released a few macroeconomic reports. All comments from Bank of England Governor Andrew Bailey were of a dovish character. This does not add up to confidence of GBP buyers. While representatives of the British regulator prefer a wait-and-see stance, on the contrary, all comments from Fed's leader Jerome Powell were hawkish. In his remarks, he expanded on a shift towards more aggressive tightening.

The reason behind such hawkishness is soaring inflation that once was termed as transitory. Now it is evident that high inflation is set to persist, thus creating problems for the US central bank.

A serious headwind for the UK economy is a new coronavirus variant, Omicron. The COVID resurgence might entail a new lockdown and tough restrictive measures. The UK authorities are closely monitoring the situation with the new variant that puts a strain on the domestic economy at the year end.

Next week, the Federal Reserve is holding the final policy meeting of the year where the regulator is expected to decide on tapering its bond purchases. The US dollar is set to enjoy high demand in the short term. According to the COT report, the number of long non-commercial positions rose from 51,122 to 52,099. At the same time, the number of short non-commercial positions grew from 84,701 to 90,998. This led to an increase of the negative non-commercial net positions. The delta came in at -38,899 against -34,579 a week ago. GBP/USD closed on Friday lower at 1.3314 against 1.3397 a week ago.

Indicator signals:

Trading is carried out below the 30 and 50 daily moving averages, which indicates that the bears are making efforts to enter the market.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakout of the indicator's lower border at 1.3234 will trigger a new bearish wave for GBP/USD. Alternatively, a breakout of the upper border at near 1.3283 will enable growth of the currency pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.