To open long positions on GBP/USD, you need:

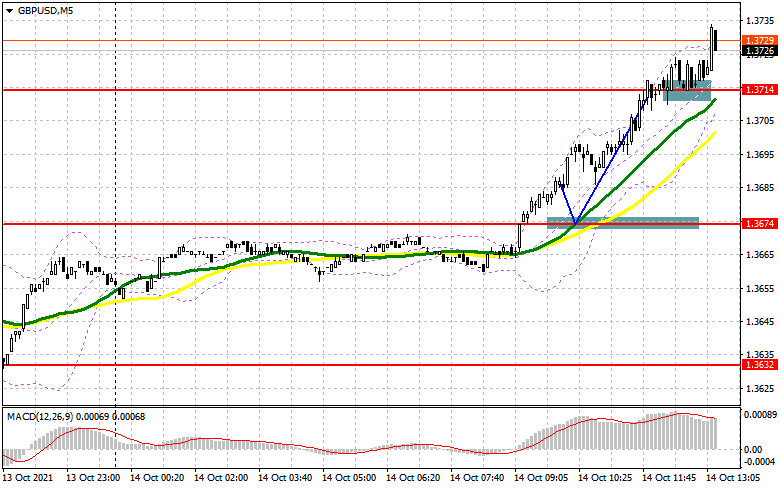

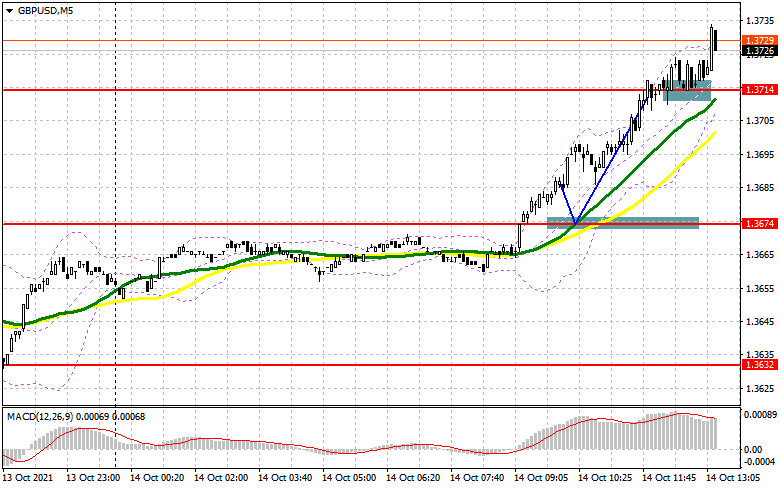

As expected, the growth of the British pound continued against the US dollar. Let's look at the 5-minute chart and talk about what happened. The breakout of the 1.3674 resistance allowed buyers to increase long positions in the continuation of the uptrend. Unfortunately, I did not wait for the reverse test of this level from top to bottom, so I could not get a convenient entry point. Growth in the area of 1.3714 and consolidation at this level led to the formation of a signal to buy the pound. At the time of writing the forecast, the upward movement was about 20 points. The technical picture has completely changed, so it's worth paying attention to the new levels.

The main focus will be placed on data on the American labor market. A bad report will certainly force holders of the US dollar to continue to get rid of it in favor of the British pound, which will lead to further growth of the pair. The primary task of buyers is to protect the support of 1.3703. The formation of a false breakdown there in the case of very strong data on the number of applications for unemployment benefits in the United States forms just an excellent signal to open long positions in the continuation of the pound's growth. In this scenario, the next resistance will be 1.3748. A breakout and a reverse test of this range from top to bottom will form an additional entry point into long positions, which will open a direct road to the highs of 1.3803 and 1.3839. A strong report may lead to a breakout of the 1.3703 level. Therefore, if there are no buyers in this range in the afternoon, the optimal scenario for buying will be a test of the next support of 1.3662, just below which the moving averages pass. I advise you to look at long positions of GBP/USD immediately for a rebound only from the minimum of 1.3623, based on an upward correction of 25-30 points within a day.

To open short positions on GBP/USD, you need:

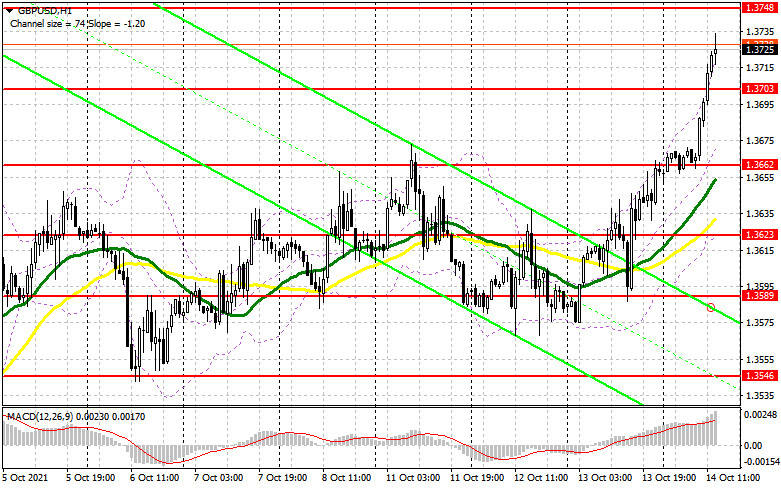

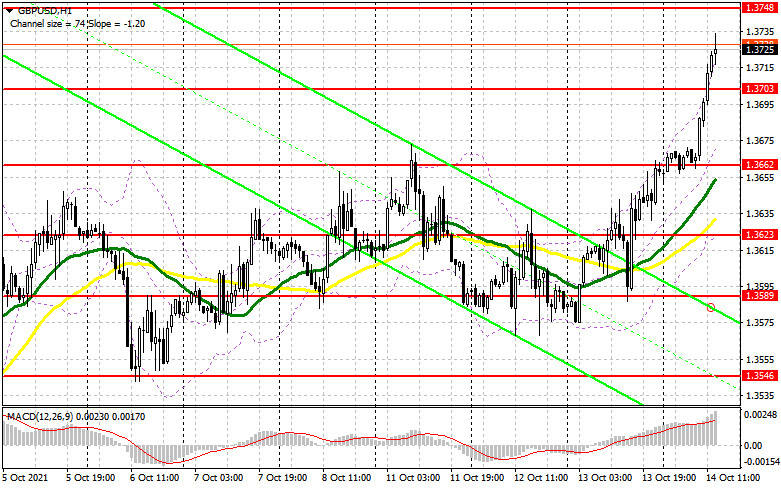

The sellers' focus in the afternoon will be shifted to the protection of the 1.3748 level, as its breakdown will create many problems and open the way to the 38th figure, which will put the final "cross" on the September bearish trend. If we see an unsuccessful attempt to consolidate above this range after the US data, as well as the formation of a false breakdown there, I advise you to open short positions on the pound with the aim of a downward correction of the pair to the support of 1.3703. A breakthrough in this area will seriously hit the buyers' stop orders, which will lead to a rapid movement of GBP/USD down to the area of 1.3662, where I recommend fixing the profits. The support of 1.3623 will be a more distant goal. However, we are unlikely to reach it today with such optimism present in the market. In case of further recovery of the pound and the absence of those willing to sell at 1.3748, only the formation of a false breakdown in the area of the next resistance of 1.3803 will be a signal to open short positions in GBP/ USD. I advise selling the pound immediately for a rebound from a larger resistance of 1.3839, or even higher - from a maximum of 1.3878, counting the pair's rebound down by 20-25 points inside the day.

The COT reports (Commitment of Traders) for October 5 recorded a sharp increase in short positions and a reduction in long ones, which led to a move to the negative zone of the total net position. Despite a fairly active recovery of the pair a week earlier, it was not possible to continue the bullish trend for the pound. However, there were all the prerequisites for this. As the data showed, problems in the supply chains in the UK remain at a fairly high level, which causes prices to creep up. It is unlikely that such a development of the situation will force the Bank of England to stand aside for a long time and watch the inflationary spiral unfold. The minutes of the meeting of the British regulator, which was published a week earlier, indicated that changes in monetary policy could be adopted as early as November this year. Therefore, the only problem that stands in the way of buyers of the pound is the US Federal Reserve, which is also heading for tightening monetary policy. Despite all this, I advise buying the pound with its significant corrections, as the growth of the trading instrument is expected in the medium term. The COT report indicates that long non-commercial positions decreased from the level of 57,923 to 48,137.

In contrast, short non-commercial positions jumped from the level of 55,959 to the level of 68,155, which led to a partial increase in the advantage of sellers over buyers. As a result, the non-commercial net position returned to the negative zone and dropped from the 1964 level to the -20018 level. The closing price of GBP/USD dropped 1.3606 against 1.3700 at the end of the week.

Signals of indicators:

Moving averages

Trading is conducted above 30 and 50 daILy moving averages, which indicates the continued growth of the pound in the short term.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline in the pair, the lower border of the indicator in the area of 1.3632 will provide support.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.