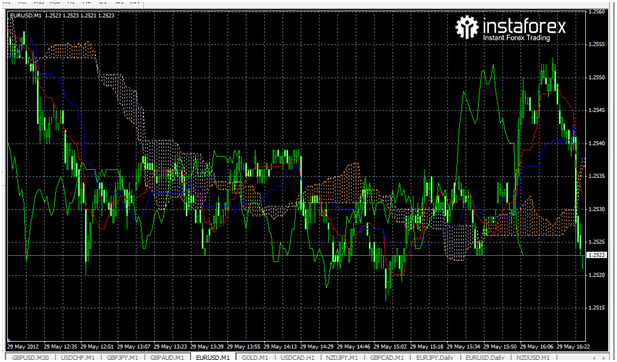

Ichimoku (Ichimoku Kinko Hyo ― Japanese for “one glance at the balance chart”) unites various approaches to forecasting price movements and combines a series of indicators. It is employed to indicate a market trend, determine support and resistance levels and produce signals to sell and to buy. The Ichimoku indicator was developed by analyst Goichi Hosoda (Ichimoku Sanjin) in the 1930-ies with an aim to predict behavior of Nikkei stock index on weekly and daily timeframes.

Tenkan-sen (turning line) painted red in the chart displays the average price value during the first time interval defined as the sum of maximum and minimum within this time, divided by two. It shows the direction of a short-term trend.

Kijun-sen (standard line; base line) is blue. It shows the average price value during the second time interval. Kijun-sen is used to indicate a market trend. When the price is higher than Kijun-sen , the market is bullish; if the price is lower than Kijun-sen , the market is bearish.

Senkou A (first leading line) shows the middle of the distance between two previous lines shifted forwards by the value of the second time interval.

Senkou B (second leading line) shows the average price value during the third time interval shifted forwards by the value of the second time interval.

Kumo (cloud) is the crosshatched space between senkou span A and B. Prices within Kumo are signs of a trendless market, and in this case the top and bottom lines of the cloud act as support and resistance. If the price is above Kumo, the top line of the cloud acts as the first support, while the bottom line acts as the second support. When the price is below Kumo, the bottom line of the cloud appears to be the nearest resistance, and the top line ― the second resistance.

Chinkou Span (lagging line) is based on current closing prices. It shows the closing price shifted backwards by the value of the second time interval. If Chinkou Span crosses the price chart from bottom upwards, it is a signal to buy. A sell signal occurs when it crosses the price chart in the top-down direction.

Tenkan, Kijun and Senkou lines employed all together function as the MACD indicator. Chinkou Span is similar to a standard MetaTrader4 indicator — Momentum.

The developer of this indicator recommends setting the following parameters: Tenkan-sen: 9; Kijun-sen: 26; Senkou A: 52; Senkou B: 26. These are the optimal parameters for weekly trading on the stock market of Japan. They are also effective for other timeframes and markets.

Ichimoku trading signals

When Tenkan-sen crosses Kijun-sen from the bottom upwards, it is a signal to open a long position. If it crosses Kijun-sen from top downwards, it is a signal to go short.

If Senkou A and Senkou B cross each other in the bottom-up direction, it is a signal to buy. It they cross each other in the opposite direction, it is time to sell.

The indicator generates a signal to buy, when the price chart is crossed from the bottom upwards. And, vice versa, it is time to sell when the Ichimoku lines cross the price chart from top downwards.

If Chinkou Span traverses the price chart in the bottom-up direction, it is a signal to buy. If Chinkou Span crosses the price chart in the top-down direction, it is a signal to sell.