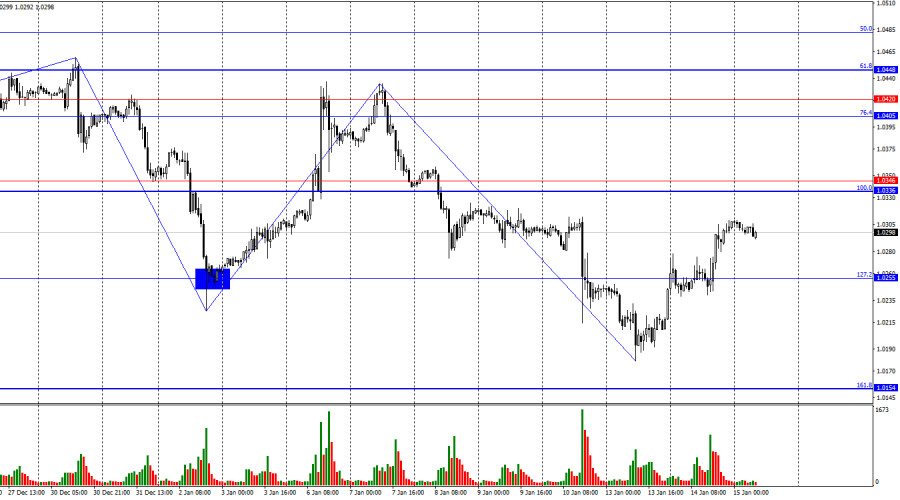

On Tuesday, the EUR/USD pair consolidated above the 127.2% Fibonacci retracement level at 1.0255 and continued its upward movement toward the resistance zone at 1.0336–1.0346. A rebound from this zone would support the US dollar, potentially resuming the downward trend and maintaining the bearish outlook. Conversely, a firm consolidation above this zone would not invalidate the bearish trend but could lead to further growth toward the next resistance zone at 1.0405–1.0420.

The wave structure remains clear. The last completed upward wave did not break the previous high, while the new downward wave has already broken the previous low twice. This confirms the continuation of the bearish trend with no signs of reversal. For such a reversal to occur, the euro must achieve a confident rise above the 1.0460 level and close above it.

Tuesday's fundamental backdrop was weak, although bulls managed to drive the pair higher throughout the day. The most disappointing news for bears came from the US Producer Price Index (PPI), which failed to meet expectations high enough to ease concerns about future Federal Reserve rate cuts. However, the PPI report is not a primary indicator of inflation in the US.

Today's release of the main and core Consumer Price Index (CPI) reports will play a decisive role. These reports could either enable bears to continue their offensive or prompt a new attack. A higher-than-expected CPI would make it unlikely for the Federal Reserve to ease monetary policy in the coming months or even quarters. If rates are not reduced, the dollar may strengthen further. Conversely, if the CPI comes in lower than 2.8%, the dollar could extend its recent losses, as the market currently anticipates less easing—possibly below 0.50%. Nonetheless, the overarching bearish trend remains intact, and even a disappointing CPI is unlikely to shift the trend to bullish.

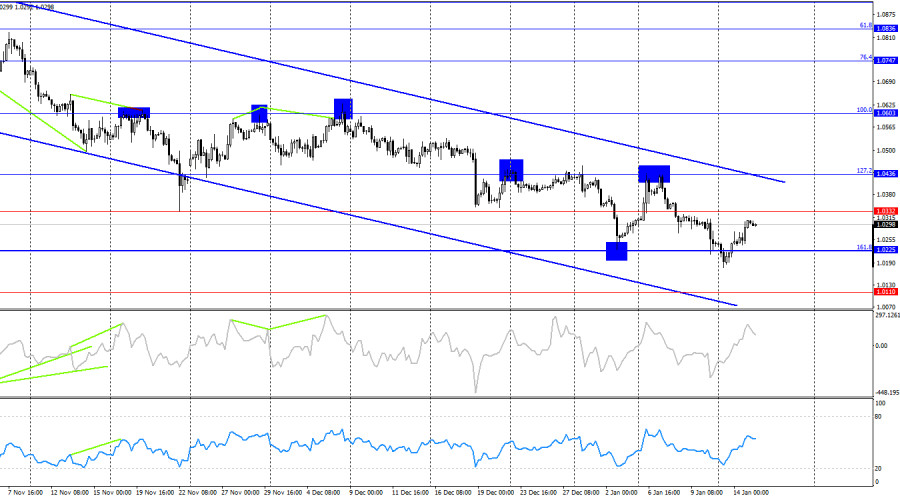

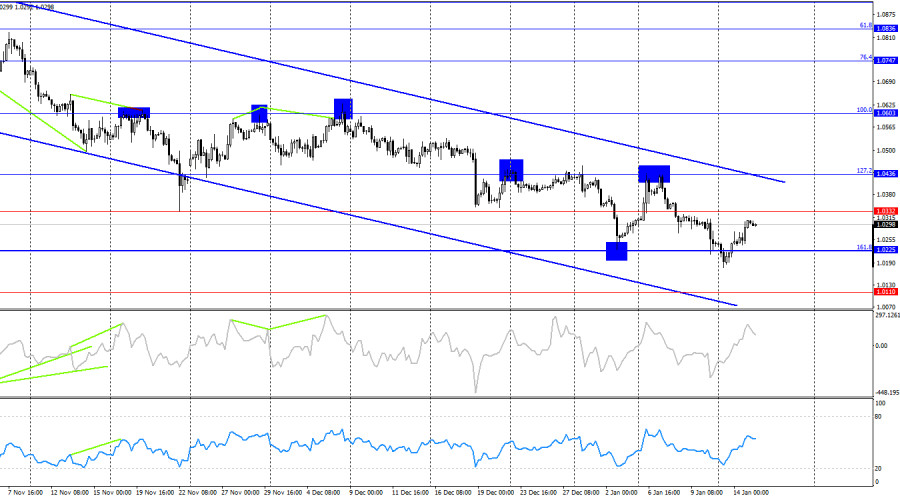

On the 4-hour chart, the pair made two rebounds from the 127.2% Fibonacci retracement level at 1.0436 and consolidated below the 1.0332 level. This suggests that the decline may continue if bears manage to push below the 161.8% level at 1.0225 for the second time or if a rebound occurs from the 1.0332 level. In this scenario, the target would shift to the 1.0110 level. The downward trend channel clearly reflects current market sentiment, and a significant rise in the euro is not expected until there is a breakout above this channel. No divergences are observed today.

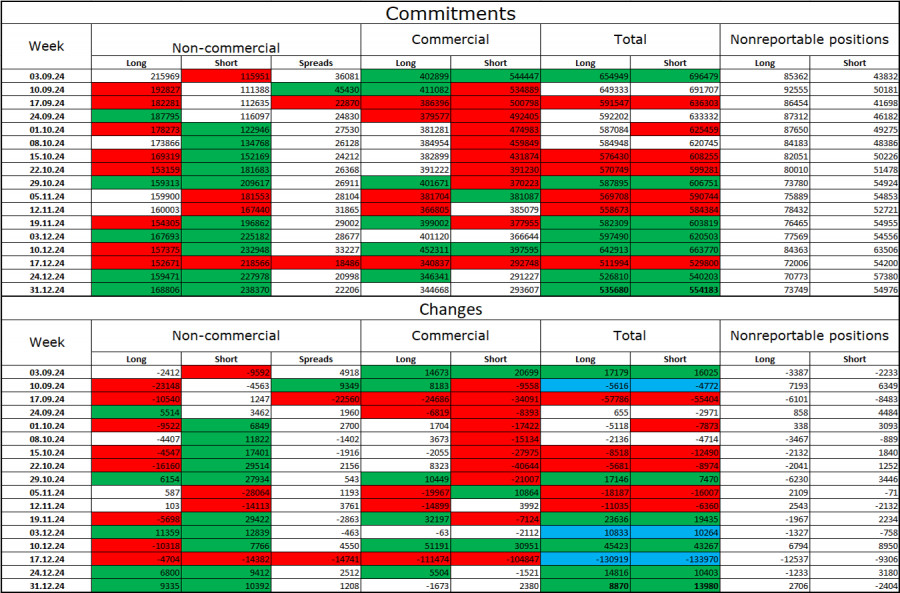

Commitments of Traders (COT) Report

In the latest reporting week, speculators added 9,335 long positions and 10,392 short positions. The "Non-commercial" group remains bearish, with sentiment strengthening and signaling further declines for the pair. The total number of long positions held by speculators now stands at 168,000, while short positions total 238,000.

For sixteen consecutive weeks, major players have been reducing their holdings of the euro, signaling a clear bearish trend. Occasionally, bulls dominate in individual weeks, but this remains the exception. The primary factor for the dollar's previous decline—expectations of Federal Reserve easing—has been priced in, leaving no immediate reason for the market to continue selling off the dollar. While new reasons may emerge over time, the dollar's rally remains the more likely scenario. Technical analysis also supports the continuation of the long-term bearish trend for EUR/USD.

News Calendar for the Eurozone and the US:

- Eurozone: Industrial Production Change (10:00 UTC)

- US: Consumer Price Index (13:30 UTC)

January 15 features two key events on the economic calendar. These are expected to have a significant impact on market sentiment, particularly in the second half of the day.

Forecast and Trading Recommendations for EUR/USD:

Short positions were viable following a rebound from the 1.0405–1.0420 zone on the hourly chart, targeting 1.0336–1.0346 and 1.0255. All targets have been reached. New short positions can be considered following a rebound from the 1.0336–1.0346 zone on the hourly chart, with targets at 1.0255 and 1.0154. Long positions are viable after rebounds from the 1.0154 and 1.0110 levels.

Fibonacci retracement levels:

- Hourly Chart: Built from 1.0336 to 1.0630

- 4-Hour Chart: Built from 1.0603 to 1.1214