Analysis of Trades and Trading Tips for the Japanese Yen

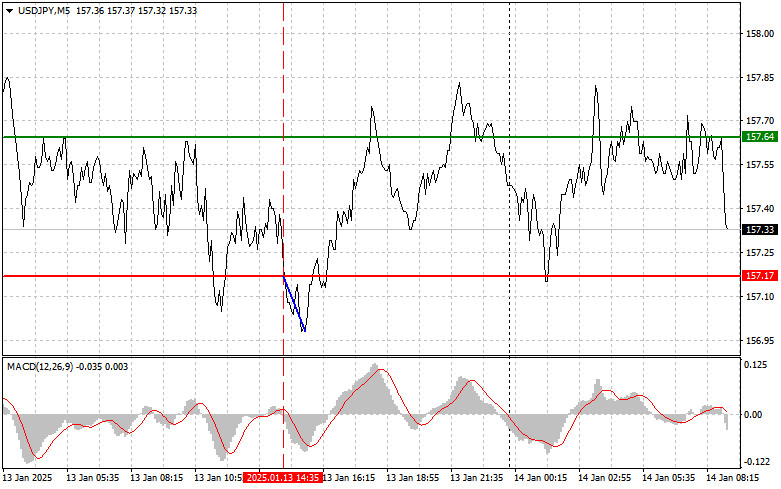

The test of the 157.17 price level coincided with the MACD indicator starting its downward movement from the zero line, confirming a valid entry point for selling the dollar. Consequently, the pair declined by only 20 pips, after which selling pressure on the dollar weakened.

Today, Japan has released data on changes in bank lending, the current account balance, and the Economy Watchers Survey. None of these factors have significantly impacted the USD/JPY pair, which maintains an upward trend. Recent data indicates that bank lending in Japan continues to grow, demonstrating sustained demand for credit resources. This growth positively influences economic activity and boosts investor confidence. Additionally, consistent lending growth provides Japanese companies with more opportunities in a globally competitive environment. The current account balance also shows positive dynamics, reflecting the stability of Japan's external economic ties. Stable export figures support the yen's strength and contribute to positive economic prospects for Japan in the coming months.

The Economy Watchers Survey indicates that expectations for continued growth are optimistic. However, the lack of significant changes in forecasts suggests that analysts are exercising caution. As a result, this keeps the pair within a horizontal channel, which will form the foundation of my trading strategy.

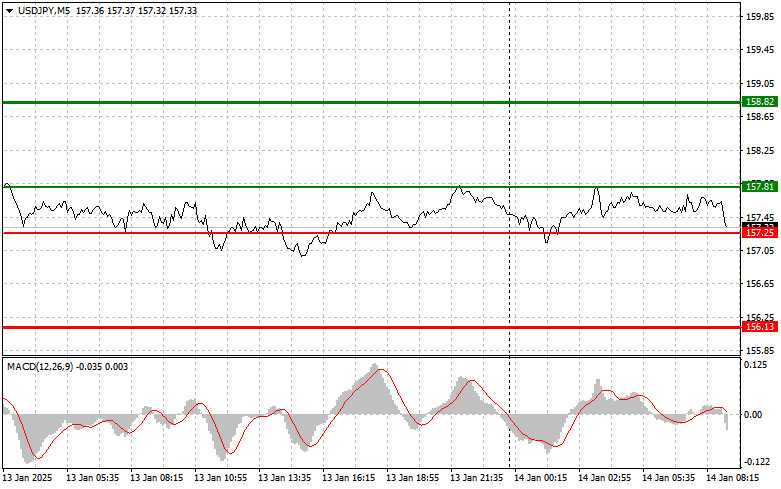

For intraday trading, I will concentrate on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point near 157.81 (green line on the chart) with a target of 158.82 (thicker green line). Around 158.82, I intend to exit purchases and open sales in the opposite direction (expecting a movement of 30–35 pips in the opposite direction). It is best to focus on further pair growth and buy on pullbacks. Important! Before buying, ensure the MACD indicator is above the zero line and just beginning its upward movement.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the 157.25 price level, with the MACD indicator in the oversold zone. This will limit the pair's downside potential and lead to an upward market reversal. Growth toward the opposite levels of 157.81 and 158.82 can be expected.

Sell Signal

Scenario #1: I plan to sell USD/JPY today only after breaking below the 157.25 level (red line on the chart), which would lead to a quick decline in the pair. The key target for sellers will be the 156.13 level, where I plan to exit sales and immediately open purchases in the opposite direction (expecting a movement of 20–25 pips in the opposite direction). Significant pressure on the pair is unlikely to return today. Important! Before selling, ensure the MACD indicator is below the zero line and just beginning its downward movement.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the 157.81 price level, with the MACD indicator in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 157.25 and 156.13 can be expected.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.