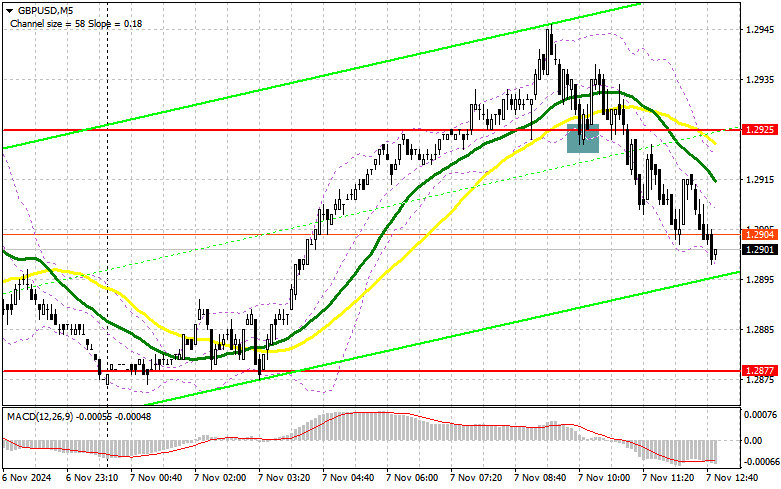

In my morning forecast, I highlighted the 1.2925 level as key for making trading decisions. Let's examine the 5-minute chart to assess the developments. A breakout and retest of 1.2925 provided a buying opportunity for the pound. However, as the chart indicates, significant growth did not materialize. The technical outlook has been updated for the second half of the day.

To Open Long Positions on GBP/USD:

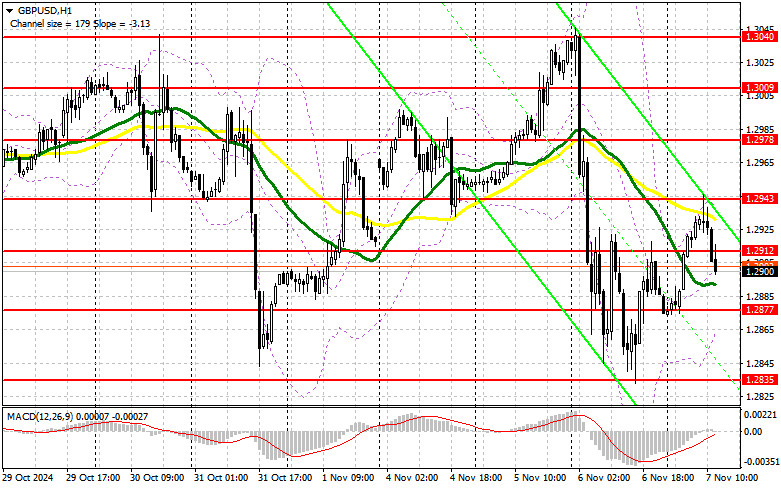

As discussed in the morning forecast, the pound's reaction to the Bank of England's decision will be pivotal. For the second half of the day, attention will shift to the FOMC rate decision and Powell's press conference. If Powell adopts a hawkish tone, selling pressure on the pound is likely to return, leading to further declines in the pair. Conversely, if bulls retain control after the BoE meeting, further upward corrections could be expected.

An ideal buying scenario would involve a decline and a false breakout at the new support level of 1.2877, formed during the first half of the day. This would confirm an entry point for long positions, targeting a recovery toward 1.2912. A breakout and retest of this range would present another buying opportunity, aiming for targets at 1.2943 and potentially 1.2978, where I plan to secure profits.

If GBP/USD declines and there is no bullish activity at 1.2877, the pair risks further losses toward the 1.2835 low. Only a false breakout at this level would justify opening long positions. I will consider buying on a rebound from the 1.2800 low, targeting a 30-35 point correction.

To Open Short Positions on GBP/USD:

Sellers asserted themselves after the pound's attempted rise earlier in the day. If the pair rises again following BoE Governor Andrew Bailey's speech, focus will shift to the 1.2943 resistance level. A false breakout at this level would provide a selling opportunity, targeting a decline toward the 1.2877 support.

A breakout and retest from below this range would weaken bullish positions, triggering stop orders and paving the way toward 1.2835. The ultimate target is the 1.2800 zone, where profits will be secured. Testing this level is only likely if the Fed adopts a particularly cautious stance at its meeting.

If GBP/USD rises without bearish activity at 1.2943, buyers may attempt a stronger correction. In this scenario, sellers may retreat toward the 1.2978 resistance level. I will sell only after a false breakout. If no downward movement occurs there, I will look for selling opportunities around 1.3009, aiming for a 30-35 point downward correction.

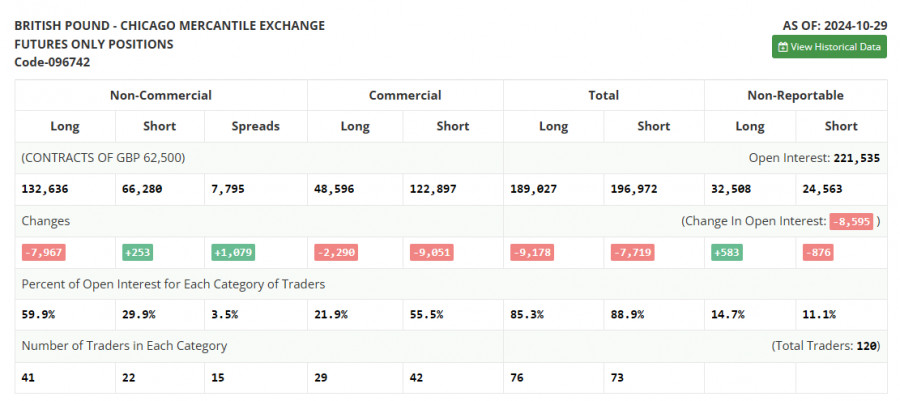

COT Report Analysis:

The Commitment of Traders (COT) report for October 29 showed reduced long positions and minimal growth in short positions. The likelihood of a Bank of England rate cut at its upcoming meeting continues to weigh on the pound. Combined with recent UK budget challenges, including proposed tax hikes by the new Prime Minister, the outlook for pound growth remains unfavorable.

Amid U.S. elections and expected BoE rate cuts, the pound is likely to face further struggles. The latest COT report indicated that long non-commercial positions decreased by 7,967 to 132,636, while short positions grew by 253 to 66,280. Consequently, the net spread between long and short positions widened by 1,079.

Indicator Signals:

Moving AveragesTrading occurs around the 30- and 50-day moving averages, indicating a sideways market.

Note: The author analyzes moving averages on the H1 hourly chart, which differs from the standard definition of daily moving averages on the D1 chart.

Bollinger BandsIn case of a decline, the lower boundary of the indicator around 1.2860 will act as support.

Indicator Descriptions:

- Moving Average (MA): Smooths out volatility and noise to identify the current trend. Period – 50, marked in yellow on the chart.

- Moving Average (MA): Smooths out volatility and noise to identify the current trend. Period – 30, marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Measures the convergence/divergence of moving averages. Fast EMA – period 12, Slow EMA – period 26, SMA – period 9.

- Bollinger Bands: A volatility indicator with a period of 20.

- Non-commercial traders: Speculators like individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific criteria.

- Non-commercial long positions: The total long positions held by non-commercial traders.

- Non-commercial short positions: The total short positions held by non-commercial traders.

- Net non-commercial position: The difference between non-commercial traders' long and short positions.