The EUR/USD currency pair traded leisurely again on Tuesday, with no urgency. And why should it rush? This week, the U.S. inflation report is the only significant event. It could move the EUR/USD pair either up or down. We believe that the pace of inflation decline in the U.S. is no longer as important as it used to be, just as the rate of inflation decrease in the Eurozone isn't either. Both central banks have started the process of easing monetary policy, so the speed at which inflation is falling is now less relevant. What matters now is how quickly both central banks will cut interest rates. However, as we've seen recently, the pace of rate cuts is no longer solely dependent on inflation. The labor market is a significant concern for the Federal Reserve, while the state of the economy is critical for the European Central Bank (ECB). Both central banks are now accelerating their easing measures. The ECB promises to lower rates in both October and December, while the Fed has started easing with a 50 basis point cut, and we cannot entirely rule out the possibility of a similar move in November.

In our view, the key issue is the market's full or near-full pricing in the Fed's rate cut factor. Let's recall that the U.S. dollar has been falling for two years, and even in recent months (when the ECB was cutting rates), the dollar has continued to decline. The latest reports on the labor market and unemployment were positive, diminishing the need for a 50 basis point cut in November. However, the market still anticipates the most dovish scenario. According to FedWatch, the probability of a 0.5% rate cut on November 7 is now 86%. If the inflation report shows weaker deceleration, this probability will reach 100%. In any case, the September labor market and unemployment reports will be published before the next Fed meeting, so only after these can we confidently assess how much the Fed may lower the key rate.

As for the euro, it is now entirely dependent on the dollar. Essentially, it wasn't the euro that rose in 2024 but the dollar that fell amid the ever-growing dovish market expectations. We still consider the euro overbought and unjustifiably expensive, so we only expect it to fall. The first two days of the week didn't clarify the current technical picture since the movements were very weak. In the weekly time frame, the pair has been on a flat trend for a year and a half. Therefore, we are only expecting a decline. There could be an upward correction this week, and the U.S. inflation report might contribute to that. Inflation would need to slow down more than 2.3% for this to happen. In that case, the market would be confident in a 0.5% Fed rate cut on November 7, which would temporarily pressure the U.S. dollar. However, we do not expect significant growth for the pair.

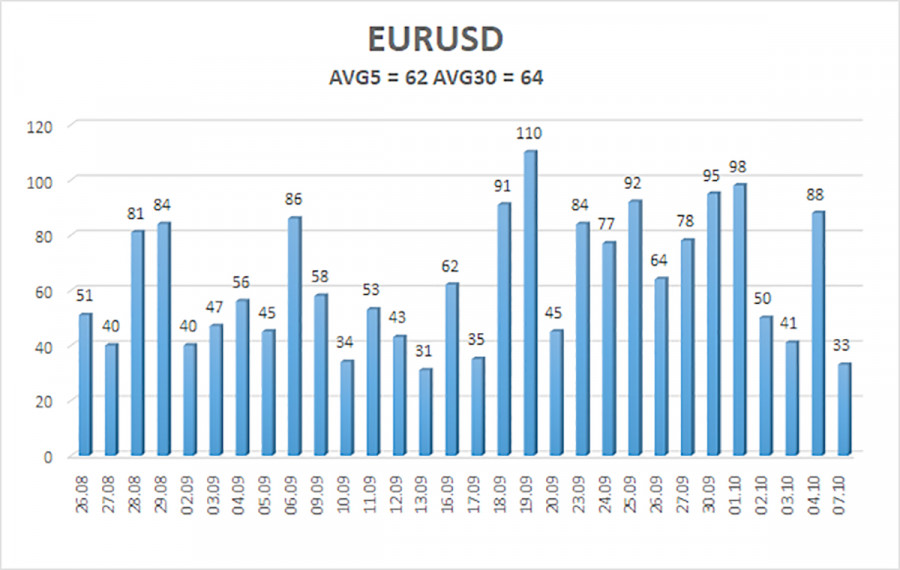

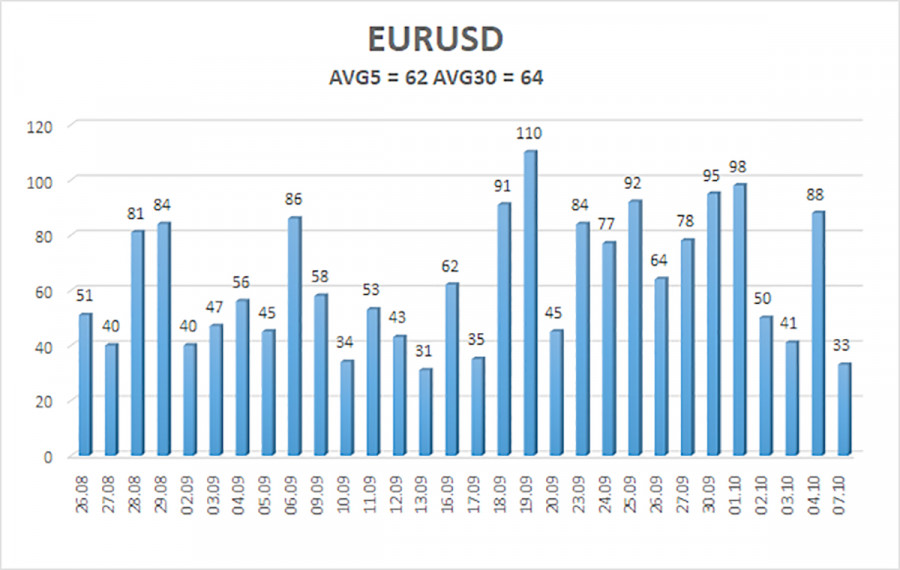

The average volatility of the EUR/USD currency pair over the past five trading days as of October 9 is 50 points, characterized as "moderate-low." We expect the pair to move between the levels of 1.0923 and 1.1023 on Wednesday. The higher linear regression channel points upward, but the overall downward trend remains. After repeatedly entering the overbought zone, the CCI indicator has now dipped into the oversold zone and formed a bullish divergence, indicating a possible correction.

Nearest support levels:

- S1 – 1.0925

- S2 – 1.0864

- S3 – 1.0803

Nearest resistance levels:

- R1 – 1.0986

- R2 – 1.1047

- R3 – 1.1108

Trading Recommendations:

The EUR/USD pair has started a downward movement. In previous reviews, we mentioned that we expect only a decline in the euro in the medium term, as any new rise would seem absurd at this point. There is a possibility that the market has already priced in most, if not all, of the future Fed rate cuts. If that's the case, the dollar has no reason to fall. Short positions can be considered with targets at 1.0925 and 1.0917. If you're trading based purely on technical analysis, long positions may become relevant if the price settles above the moving average line. Momentum could drive the pair's growth for some time, but we still cannot recommend buying the pair.

Explanation of the Illustrations:

Linear regression channels: help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

Moving average line (settings 20,0, smoothed): determines the short-term trend and the direction in which to trade.

Murray levels: target levels for movements and corrections.

Volatility levels (red lines): the probable price range the pair will trade over the next 24 hours, based on current volatility indicators.

CCI Indicator: entering the oversold area (below -250) or the overbought area (above +250) signals an imminent trend reversal in the opposite direction.