The GBP/USD pair also experienced swings on Wednesday and Thursday. The Federal Reserve meeting triggered high volatility, and the Bank of England meeting followed suit. However, it cannot be said that the U.S. dollar rose significantly or fell after these two significant events. The price fluctuated alternately, moving up and down. We had already warned that, in such emotional conditions, the market could trade in both directions, so the final assessment of the two meetings should not be made before Thursday evening. Even by Thursday evening, it was difficult to say whether the market had finally calmed down.

One thing is clear: despite all expectations, the Fed meeting cannot be called more dovish than the market anticipated. Over the past week, the dollar had been falling almost daily, so the market priced in all dovish scenarios in advance. The same applies to the BoE meeting. Its results cannot be considered more hawkish than expected. The British central bank decided not to lower the key interest rate, but this decision had been forecasted since the inflation report on Wednesday. The only surprise was that only one member of the monetary committee voted in favor of a rate cut rather than two as predicted. But does this change anything? In our view, not much. The BoE decided to reduce its stock of British government bonds on its balance sheet by £100 billion over the next 12 months. This is part of a quantitative tightening program for those who don't remember. If, during the pandemic, the BoE was accumulating bonds, injecting money into the economy to stimulate it, it is now withdrawing excess liquidity to "cool down" inflation.

The Bank of England will now wait for a decline in core inflation and inflation in the services sector. Further easing should not be expected until these two types of inflation start to decrease. However, as of August, core inflation increased, and inflation in the services sector also rose. Therefore, the BoE's monetary policy may remain hawkish for much longer than previously anticipated. But the big question is: how much has the market already priced in the Fed's policy easing and the BoE's rate hold?

Unfortunately, there is no clear answer to this question. For a long time, we have believed that the British currency lacks the foundation for further growth, and the market seems to pay no attention to anything other than the Fed's monetary policy. Let us remind you that the dollar began to fall two years ago when inflation in the U.S. started to slow down. The dollar may start to strengthen a month or two after the easing cycle begins. However, during that "month or two," the pound sterling could continue to rise due to momentum. Currently, the price remains above the moving average line, so there are no technical reasons for selling. Nonetheless, we still find it very difficult to believe in the further growth of the British pound, and we certainly cannot recommend buying the pair.

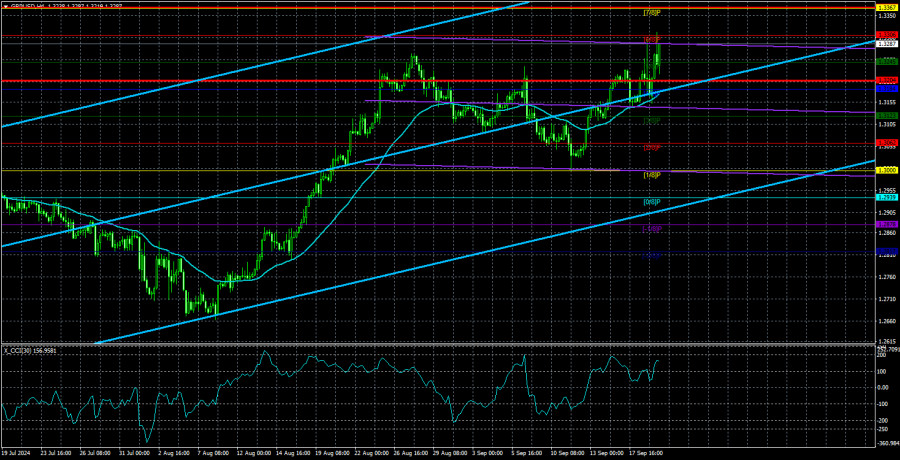

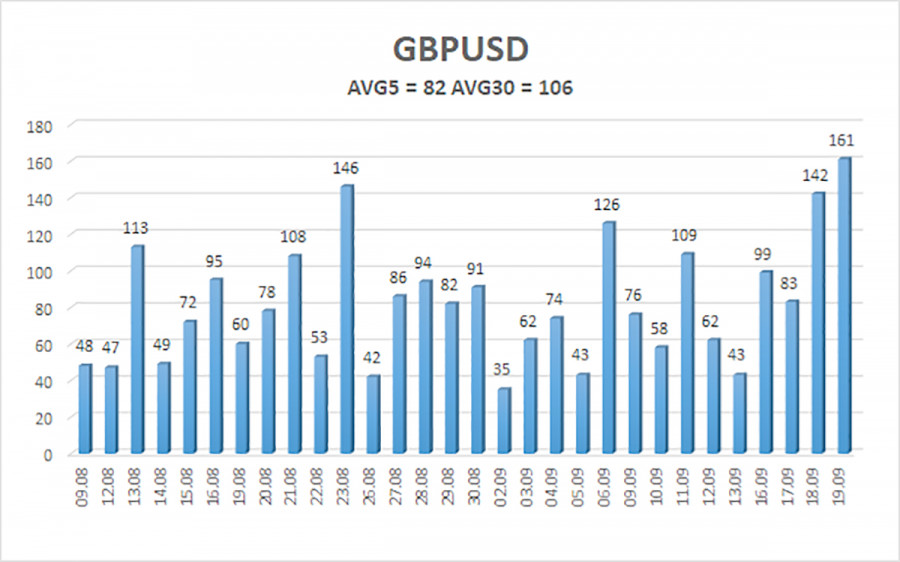

The average volatility of the GBP/USD pair over the past five trading days is 82 pips, which is considered average for this pair. Therefore, on Friday, September 20, we expect the pair to move within a range between 1.3204 and 1.3368. The upper linear regression channel is directed upwards, signaling the continuation of the uptrend. The CCI indicator has formed four bearish divergences and now even a fifth one, which suggests a significant decline, but we have yet to see it materialize.

Nearest Support Levels:

- S1 – 1.3245

- S2 – 1.3184

- S3 – 1.3123

Nearest Resistance Levels:

- R1 – 1.3306

- R2 – 1.3367

- R3 – 1.3428

Trading Recommendations:

The GBP/USD pair has made its first step toward a downward trend, but it remains the only one so far. We are not considering long positions at this time, as we believe that all the growth factors for the British currency (of which there have not been many) have already been priced in by the market multiple times. However, it's hard to deny that the pound could continue to rise due to momentum. Therefore, if you're trading based on "pure" technicals, long positions are possible with targets at 1.3367 and 1.3428 if the price stays above the moving average. Short positions can be considered with targets at 1.2939 and 1.2878 if the price consolidates below the moving average.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are pointed in the same direction, this indicates a strong trend.

Moving Average Line (settings 20,0, smoothed): defines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entry into the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction is approaching.