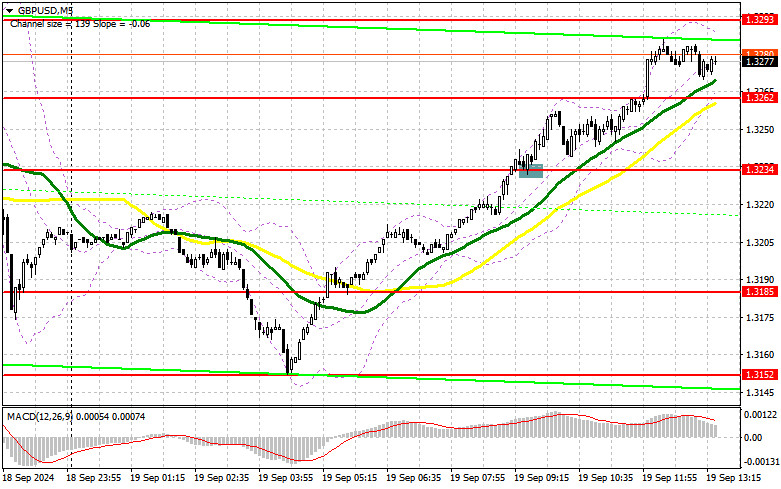

In my morning forecast, I highlighted the level of 1.3234 and planned to make market entry decisions based on it. Let us review the 5-minute chart to analyze what happened. A breakout followed by a retest of 1.3234 led to a buying opportunity, pushing the pound up by more than 50 points. I have now revised the technical picture for the second half of the day.

For opening long positions on GBP/USD:

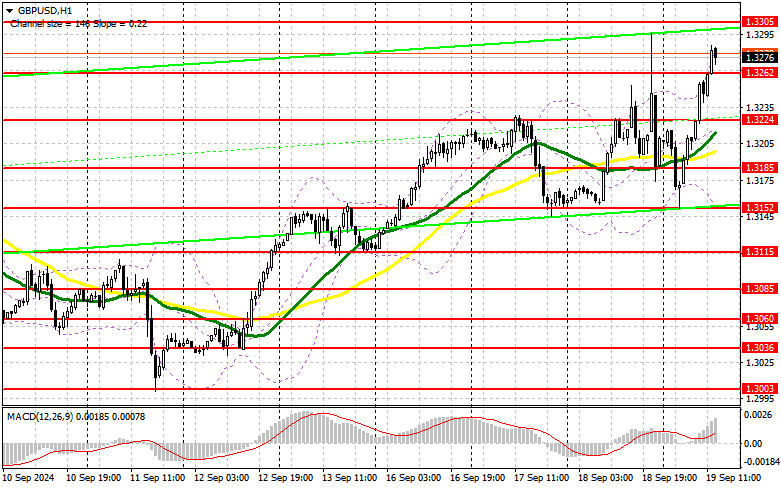

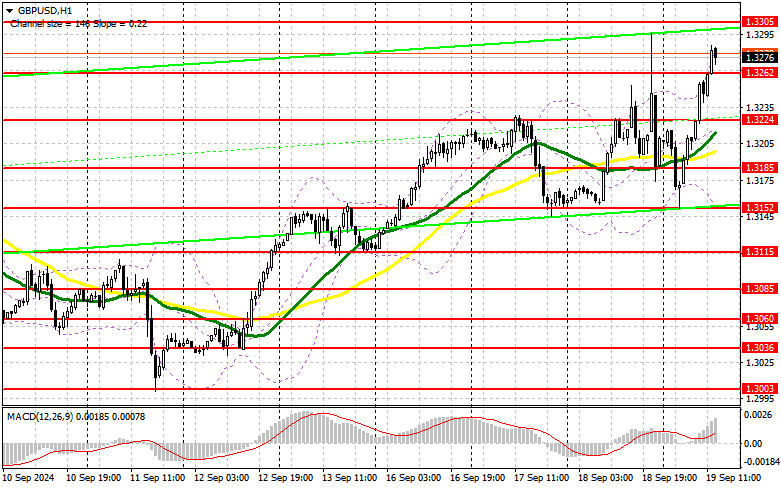

We discussed the Bank of England meeting in detail in the morning forecast, so there is no need to repeat that. After the market reacts to the regulator's decision, attention will shift to U.S. data, including weekly jobless claims, the Philadelphia Fed manufacturing index, the current account balance, and existing home sales. Only very strong U.S. data will be able to break the bullish market that emerged after the Federal Reserve's meeting yesterday. In the case of a negative reaction to the Bank of England's decision, a false breakout around the new support level of 1.3262 will offer a good chance for a continued upward move, with the pair recovering to 1.3305. A breakout followed by a top-down retest of this range will strengthen the chances of an upward trend, triggering stop-losses from sellers and offering a strong entry point for long positions, with the potential to reach 1.3349. The final target will be around 1.3390, where I plan to take profit.

If GBP/USD declines and no bullish activity occurs at 1.3262 in the second half of the day, the pair will face increased pressure, leading to a drop and a retest of the next support at 1.3224, where the moving averages, supporting buyers, are located. A false breakout at this level will be the only suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.3185, targeting a 30-35 point intraday correction.

For opening short positions on GBP/USD:

Sellers are waiting for the results of the Bank of England meeting. A dovish stance from the Bank of England will help the bears succeed in defending the 1.3305 level, where a false breakout will provide an ideal entry point for shorting the pound. The target will be the support at 1.3262, which is unlikely to see an intense battle. Therefore, a breakout followed by a bottom-up retest of this range, similar to the example discussed above, will deal a blow to buyers' positions, triggering stop-losses and opening the way to 1.3224. The final target will be around 1.3185, where I plan to take profit.

If GBP/USD rises and no bearish activity occurs at 1.3305 in the second half of the day, buyers will continue pushing the pound higher. In that case, sellers will be forced to pull back to the resistance at 1.3349. I'll only sell there on a false breakout. If no downward movement occurs at that level, I'll look for short positions near 1.3390, targeting for a 30-35 point intraday correction.

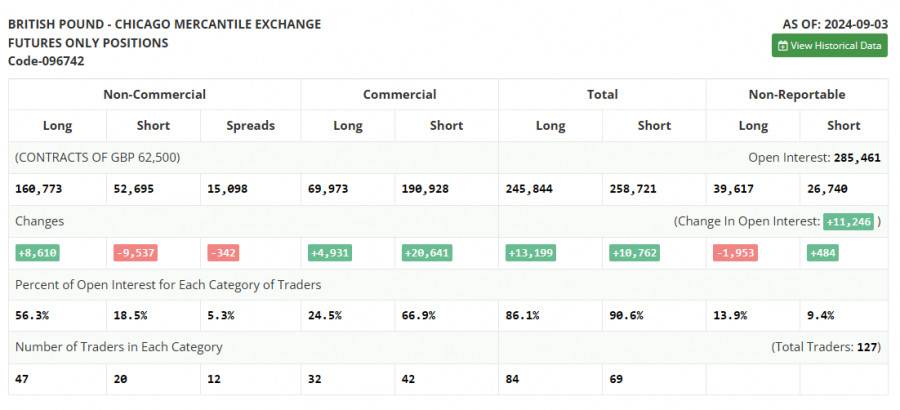

In the COT (Commitment of Traders) report for September 3, there was an increase in long positions and a reduction in short positions. Despite the pair's correction, traders are confident that the rate cuts in the U.S. are a much more significant event than similar actions from the Bank of England. The market is likely pricing in the future reduction of borrowing costs in the UK, and demand for the pound will inevitably return soon, as the medium-term uptrend remains intact. The ratio of long to short positions, which is three times greater, speaks for itself. The latest COT report showed that long non-commercial positions increased by 8,610, reaching 160,773, while short non-commercial positions decreased by 9,537, to 52,695. As a result, the gap between long and short positions narrowed by 342.

Indicator Signals:

Moving Averages:

Trading is above the 30- and 50-day moving averages, indicating further growth for the pair.

Note: The author uses an H1 hourly chart, which may differ from the classic D1 daily chart moving averages.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3152 will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. 50-period, marked in yellow on the chart.

- Moving Average (MA): 30-period, marked in green on the chart.

- MACD Indicator: Uses a 12-period fast EMA, a 26-period slow EMA, and a 9-period SMA.

- Bollinger Bands: A 20-period Bollinger Band is used to identify price volatility and potential support and resistance levels.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes.

- Non-commercial long positions: The total number of long positions held by non-commercial traders.

- Non-commercial short positions: The total number of short positions held by non-commercial traders.

- Non-commercial net position: The difference between short and long positions of non-commercial traders.