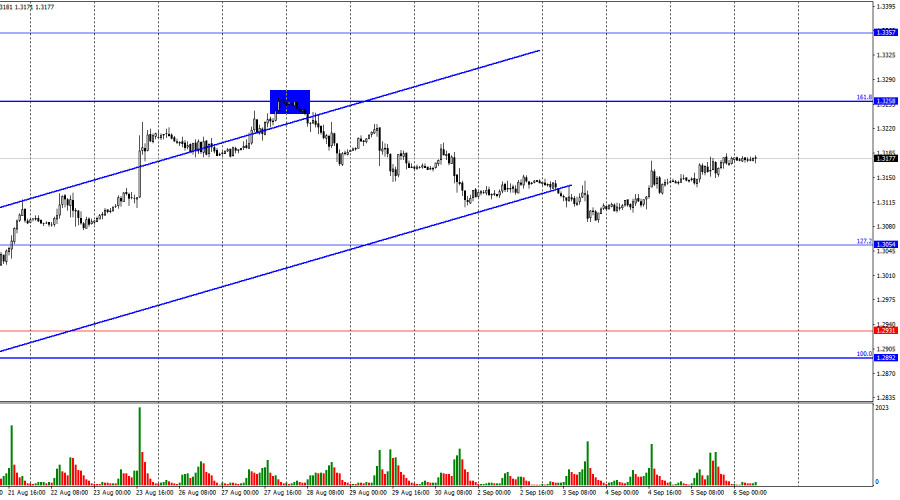

On the hourly chart, the GBP/USD pair continued to rise on Thursday towards the 161.8% retracement level at 1.3258. This target is quite distant, and there are currently no levels near the current price on the hourly chart. Therefore, trading signals on this chart are unlikely to form today.

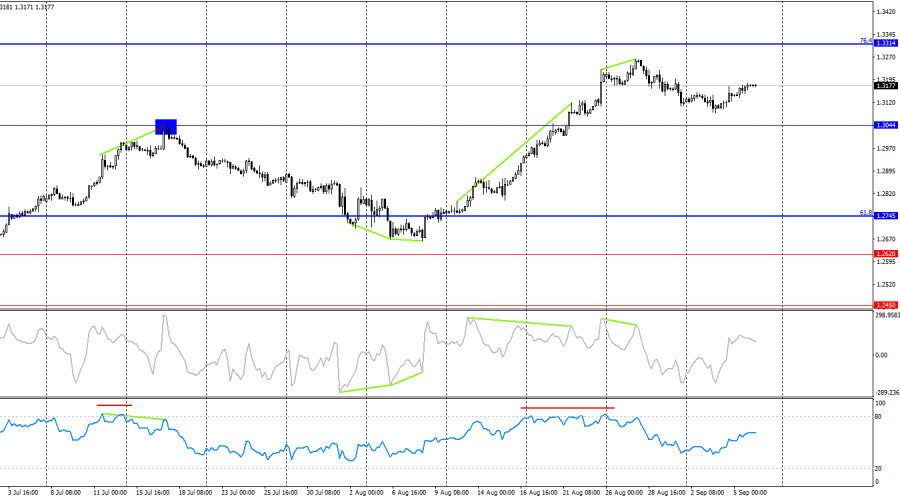

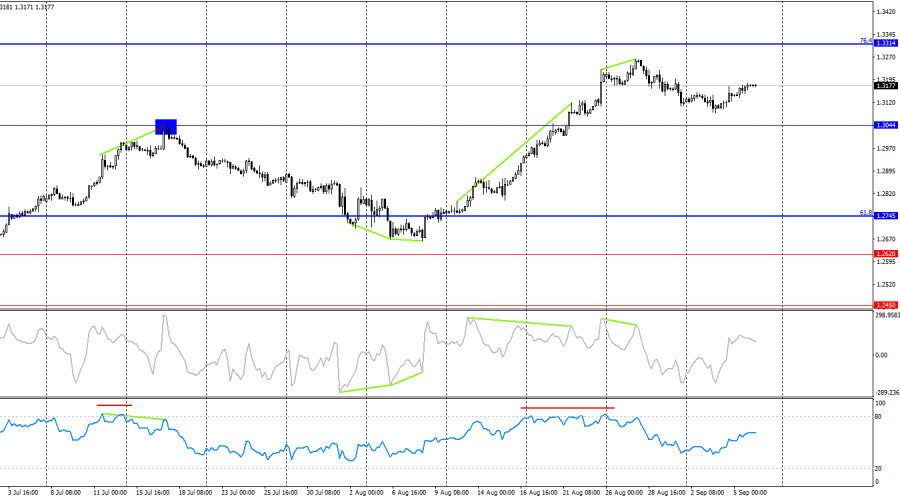

The wave structure is clear. The last completed downward wave failed to break the low of the previous wave, while the last upward wave managed to break the peak of the previous wave. Thus, we are currently dealing with a clear bullish trend, but the waves are so large that a trend reversal could be detected with a significant delay. There appear to be no smaller wave patterns that could signal a trend break.

The news background on Thursday once again provided no support for the dollar. The ADP report came in much weaker than traders had expected, and the ISM Services PMI only kept the bull traders from making even more purchases. I would also note the rather low trading activity this week, which once again proves the obvious fact – all previously released reports mean little to traders ahead of the Nonfarm Payrolls and unemployment rate reports. These data will be released later today and will determine the fate of the dollar. In my opinion, these reports don't necessarily have to be weak. It's important to remember that the ADP report does not guarantee a similar result for Nonfarm Payrolls. Therefore, the payrolls today could easily come in above 145–160 thousand. The unemployment rate is trickier, as the market expects a drop from 4.3% to 4.2%. I'm not sure how realistic such expectations are. I believe that the likelihood of the dollar falling today is higher than the likelihood of it rising. However, everything will depend on the US reports. For the market, these reports are crucial in determining the potential actions of the Federal Reserve at the next meeting.

On the 4-hour chart, the pair has moved above the 1.3044 level. However, the CCI indicator has been warning of a bearish divergence for more than a week, and the RSI indicator has been in overbought territory for a week, which doesn't happen often. Therefore, a reversal in favor of the U.S. dollar occurred, and the pair has started falling towards the 1.3044 level. A rebound from this level could lead to expectations of a renewed rise towards the 76.4% retracement level at 1.3314.

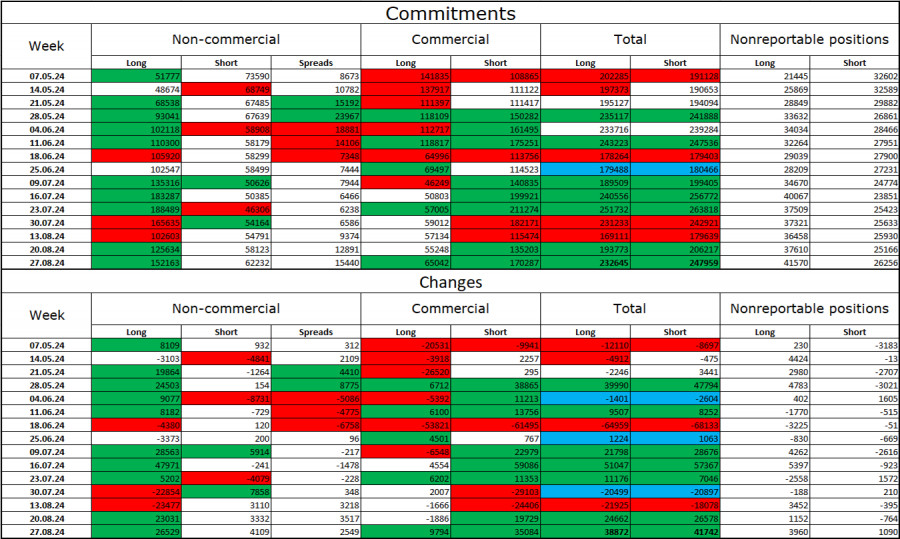

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became much more bullish in the last reporting week. The number of long positions held by speculators increased by 26,529, while the number of short positions increased by only 4,109. The bulls still hold a significant advantage. The gap between the number of long and short positions is almost 90 thousand: 152 thousand compared to 62 thousand.

In my view, the British pound still has the potential to fall, but the COT reports suggest otherwise for now. Over the past 3 months, the number of long positions has increased from 51 thousand to 152 thousand, while the number of short positions has decreased from 74 thousand to 62 thousand. I believe that over time, professional players will start reducing their long positions or increasing their short positions, as all possible factors for buying the British pound have already been priced in. However, it's worth remembering that this is just speculation. Chart analysis suggests a likely fall in the near future. However, for now, the bullish trend remains undeniable.

News calendar for the US and UK:

US – Change in Nonfarm Payrolls (12:30 UTC).US – Unemployment rate (12:30 UTC).US – Change in average hourly earnings (12:30 UTC).

On Friday, the economic events calendar includes three important reports, all of which will be released at the same time. The impact of the news background on market sentiment could be very strong today.

Forecast for GBP/USD and trading advice:

Selling the pair was possible after a rebound from the 1.3258 level on the hourly chart, with a target of 1.3054. These trades can still be kept open. I wouldn't rush into buying until the 1.3054 level is reached – there are no signals at the moment. The news background will strongly influence the pair's movement today.

The Fibonacci levels are constructed from 1.2892 to 1.2298 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.