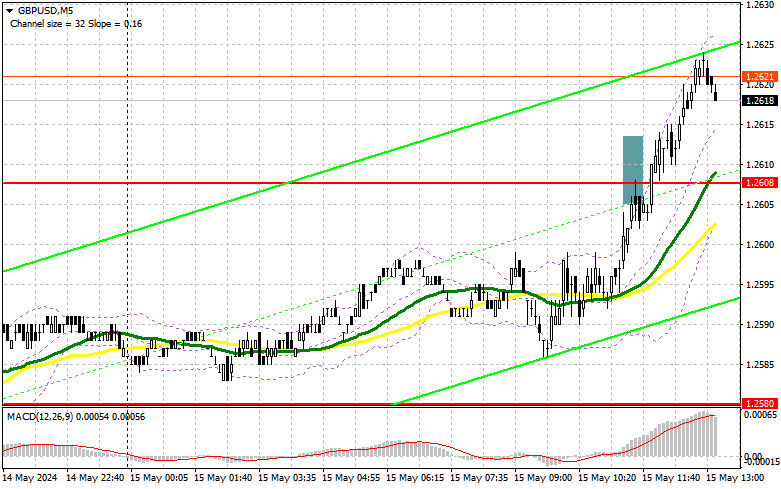

In my morning forecast, I drew attention to the level of 1.2608 and planned to base decisions on it for market entry. Let's look at the 5-minute chart and analyze what happened there. The rise and the formation of a false breakout signaled a sell-off; however, the drop never occurred, resulting in loss realization. The technical picture was revised for the second half of the day.

To open long positions on GBP/USD, the following is required:

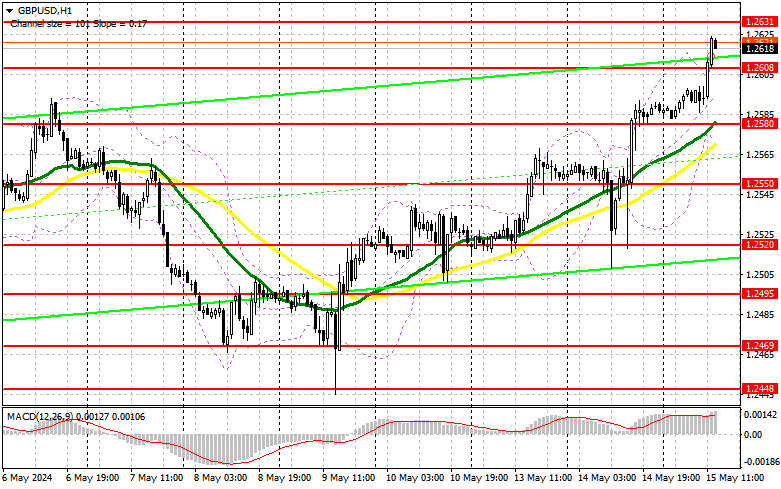

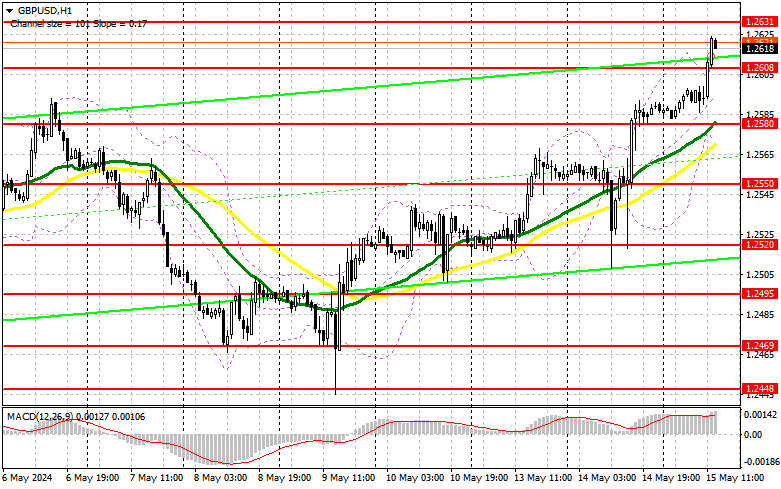

Predictably, the absence of data from the UK prompted new purchases of the pound and breaking through 1.2608 led to stop orders being triggered and a larger increase in the pair. Now, all attention will be focused on the figures for the US Consumer Price Index and Retail Sales Volume Change. Inflation growth will trigger a decline in the pound – especially if bulls fail to reach the monthly high. Weakening inflation and price decreases will lead to a new wave of strengthening for GBP/USD beyond the monthly high. In the current situation, I plan to buy the pound only after defending the support at 1.2608, which served as resistance in the morning. A drop and a false breakout there will provide an entry point for long positions, capable of pushing the pound towards 1.2631, which we narrowly missed in the first half of the day. Only a breakout and a test from top to bottom of this range against weak US data present a chance for GBP/USD to rise with an update to 1.2667. If it breaks above this range, we can expect a surge to 1.2703, where I will take profit. In the scenario of a GBP/USD decline and the absence of buyers at 1.2608 in the second half of the day after strong US data, pressure on the pound will return, leading to a downward movement towards 1.2580 – the day's minimum. Forming a false breakout will be a suitable option for market entry. I recommend opening long positions on GBP/USD immediately on a rebound from 1.2550 with a target of a 30-35 point correction within the day.

To open short positions on GBP/USD, the following is required:

If US data indicate the need for the Fed to maintain a tough stance, forming a false breakout around 1.2631 will provide an excellent entry point for short positions, targeting a drop in GBP/USD to around 1.2608. However, a breakout and a reverse test from the bottom to the top of this range will intensify pressure on the pair, giving bears an advantage and another selling point targeting an update to 1.2580, where the moving averages are located, playing in favor of bulls. A real battle will unfold around this level. The ultimate target will be the minimum of 1.2520, which will nullify all the efforts of buyers this week. I will take profit there. In the scenario of GBP/USD rise and the absence of bears at 1.2631 in the second half of the day, which is more likely, bulls will have the opportunity to continue the upward trend and update the level of 1.2667. I will also open short positions there only on a false breakout. If there is no activity there either, I suggest opening short positions on GBP/USD from 1.2703 with the expectation of a pair rebound downward by 30-35 points within the day.

In the COT report (Commitment of Traders) for May 7, there was an increase in both long and short positions. Pound buyers outnumbered sellers, all thanks to the Bank of England meeting. The regulator did everything to prepare the markets for future interest rate cuts this summer. Although this was expected to weaken the pound, traders responded with a rise in the current situation of economic problems. The latest GDP and inflation data allow the Bank of England to start easing policy, which will benefit consumers and businesses, leading to medium-term strengthening of the pound. The latest COT report states that long non-commercial positions increased by 8,108 to 51,777, while short non-commercial positions jumped by 932 to 73,590. As a result, the spread between long and short positions increased by 312.

Indicator signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating further pound growth.

Note: The author considers the period and prices of moving averages on the hourly chart H1, which differs from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of decline, the lower boundary of the indicator, around 1.2580, will act as support.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between short and long positions of non-commercial traders.