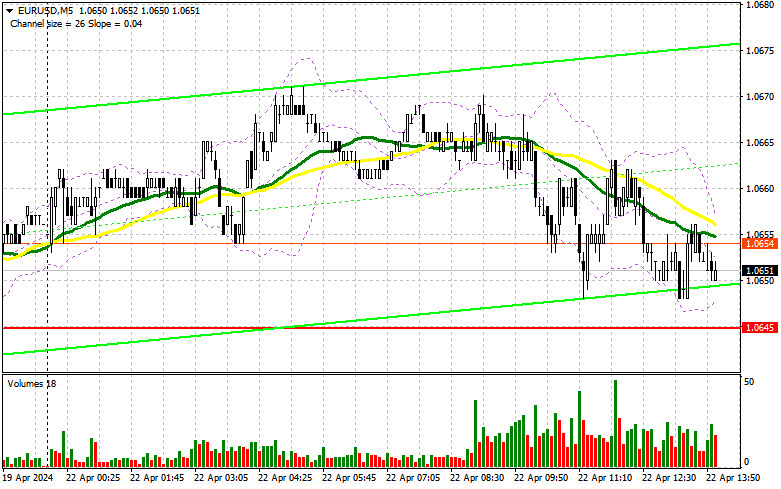

In my morning forecast, I drew attention to the level of 1.0645 and planned to make decisions regarding market entry based on it. Let's look at the 5-minute chart and figure out what happened there. There was a decline, but a false breakout did not occur because the pair didn't test this level by a couple of points. The technical picture remained unchanged for the second half of the day.

For opening long positions on EUR/USD, the following is required:

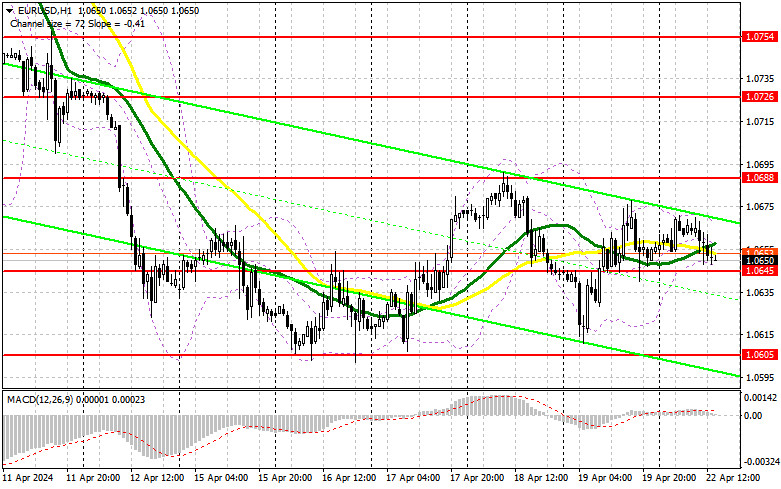

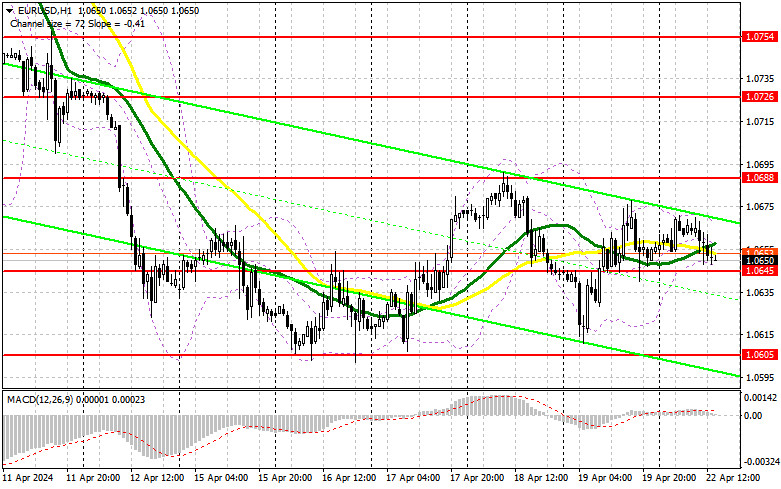

Due to the lack of important statistics for the eurozone and low volatility, suitable entry points into the market were not found. The second half of the day promises to be the same, as there are no scheduled US data releases, and the economic calendar is empty. There are also no speeches by Federal Reserve representatives, which will certainly affect traders' actions without new guidelines. As for intraday trading, I intend to rely on the morning plan. A false breakout formation around 1.10645 would be suitable for purchases, expecting another attempt to rise to 1.0688, which failed in the first half of the day. A breakout and update above this range will strengthen the pair with a chance to surge to 1.0726. The ultimate target will be a maximum of 1.0754, where I will take profit. In the case of a decline in EUR/USD and lack of activity around 1.0645, where the moving averages favoring buyers are slightly above, pressure on the euro within the bearish trend will return. In such a case, I will enter the market only after a false breakout formation around the next support at 1.0605 - the monthly low. I plan to open long positions immediately on a rebound from 1.0569 with a target of a 30-35 point upward correction within the day.

For opening short positions on EUR/USD, the following is required:

Despite the lack of activity around 1.0645, euro sellers still have a good chance of further decline. For this, it would be nice for them to regain control over 1.0645. Still, a false breakout formation around the resistance at 1.0688 would also be a perfect scenario for entering short positions. A breakout and consolidation below 1.0645 and a reverse test from bottom to top will provide another selling point with the pair's movement towards 1.0605, returning the bearish trend. There, I expect more active involvement of large buyers. The ultimate target will be a minimum of 1.0569, where I will take profit. In case of upward movement of EUR/USD in the second half of the day, and also in the absence of bears at 1.0688, which is unlikely, bulls will try to continue the correction. In such a scenario, I will postpone sales until testing the next resistance at 1.0726. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0754 with a 30-35 point downward correction target.

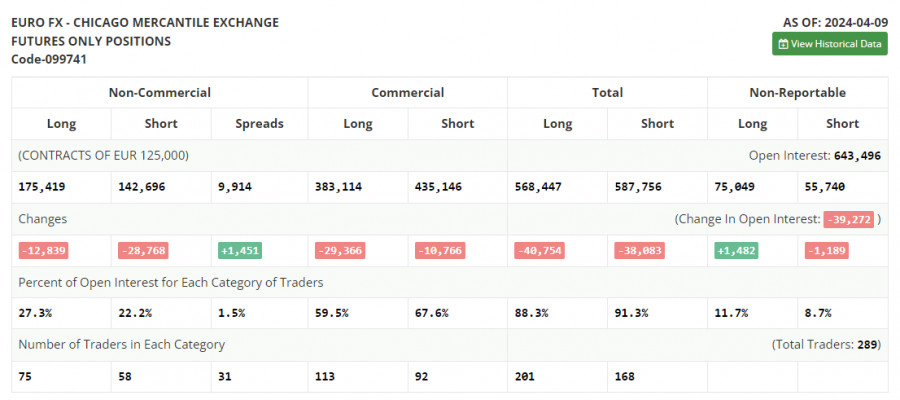

In the COT report (Commitment of Traders) for April 9, there was a reduction in both long and short positions. The European Central Bank meeting, the soft tone of policymakers, and the significant drop in the euro that followed indicate the problems that risk asset buyers are facing and will continue to face. Considering that the position of the Federal Reserve will remain tight for a longer period, there is no expectation of a return of demand for the euro. For this reason, I rely on further development of the bullish trend for the US dollar and a decline in the euro. The COT report indicates that non-commercial long positions fell by 12,839 to 175,419, while non-commercial short positions decreased by 28,768 to 142,696. As a result, the spread between long and short positions increased by 1,451.

Indicator Signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating a sideways market.

Note: The period and prices of moving averages considered by the author are on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0645, will act as support.

Description of Indicators:

- Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

- Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

- Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open positions of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between non-commercial traders' short and long positions.