The EUR/USD currency pair on Thursday continued the upward correction for most of the day. The price had earlier settled above the moving average line for days, so the trend unexpectedly shifted to a downward one. Just yesterday, we pointed out that the rise of the European currency was completely illogical this week, yet the market has reverted to its old ways - ignoring all the news and reports that favor the dollar. For instance, on Wednesday, the market disregarded the strong ADP report on changes in private-sector employment and paid no attention to inflation in the European Union, which had already dropped to 2.4% year-on-year. Should we be reminded once again that the faster and stronger inflation falls, the closer the central bank gets to easing monetary policy? And the closer the bank gets to easing, the greater the pressure should be on the currency, as easing is always a negative factor for the national currency.

However, at present, the market has once again disregarded all these factors. I believe that what we are currently observing is simply a technical correction, after which a logical and predictable decline will resume. However, it remains the last day of this week, and macroeconomic statistics from across the ocean can provoke almost any market reaction. Let's consider the most likely scenarios for Friday.

The first scenario. Over the past two days, we have seen acceleration before another decline. The market understands that there is no reason to buy the euro currency now, and the ECB is likely to lower the key rate even faster than the Fed. Therefore, it artificially accelerated the pair upwards before new massive sales. Market makers may use current levels for more advantageous short positions. Therefore, today, any values of the Nonfarm Payrolls and unemployment reports will only provoke a rise in the dollar, as it has already fallen significantly this week.

The second scenario. Over the past two days, we have seen a similar rise in the euro currency, and the market intends to support it further. Then, any value of American labor market statistics and unemployment could provoke, at most, a slight strengthening of the dollar. If they turn out to be weaker than forecasts, then the market will have a new reason to buy the EUR/USD pair.

Both scenarios are unattractive, as both suggest similar movements. Therefore, on Friday, we call for caution because volatility may significantly increase, and there may be very little logic in the movements.

On the 24-hour TF (time frame), the price returned to the Ichimoku cloud but could not settle above the critical line yet. A rebound will likely follow with the resumption of the downward trend, which persists. However, overcoming the Kijun-sen line, which is located at the level of 1.0856, will indicate the continuation of the rise of the European currency. In this case, the downward trend may even be canceled. However, we still believe that the decline of the pair will resume. That is, the first of the above options will be implemented.

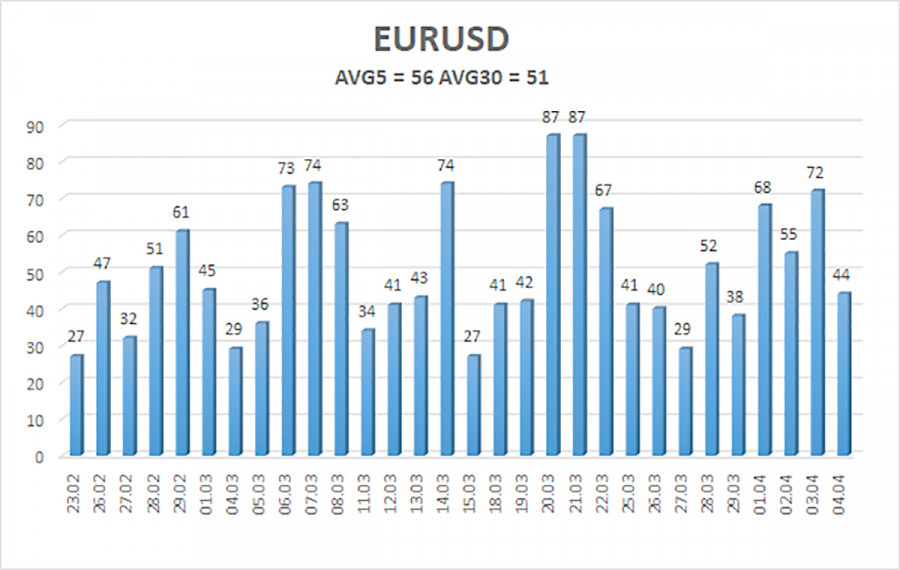

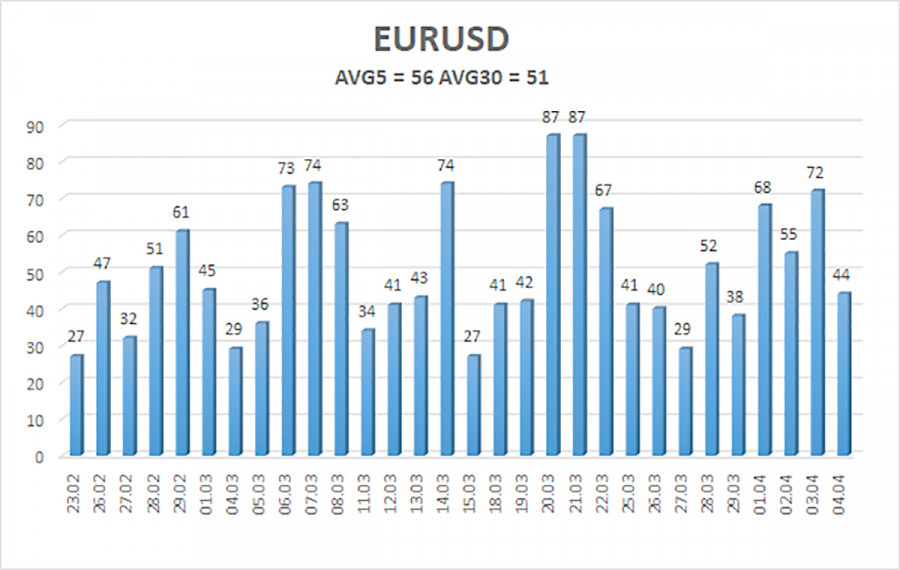

The average volatility of the euro/dollar currency pair over the past 5 trading days as of April 5th is 56 points and is characterized as "average." This week, volatility is higher than last week due to a large number of important publications in the US and the EU, but not significantly. We expect movement of the pair between the levels of 1.0806 and 1.0918 on Friday. The senior channel of linear regression is sideways, but the overall downward trend persists. The CCI indicator has not entered extreme areas recently.

Nearest support levels:

S1 – 1.0834

S2 – 1.0803

S3 – 1.0773

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0895

R3 – 1.0925

Trading recommendations:

The EUR/USD pair settled above the moving average line. However, the movement is clearly corrective, so it is necessary to wait for new sell signals with targets at 1.0742 and 1.0712. We expect a decline to the 7th level, and in the longer term, several months ahead - to the level of 1.0200. After a sufficiently long rise of the pair (which we consider a correction), we see no reason to consider long positions. Even with the price settling above the moving average. Volatility is not the lowest at the moment, but it leaves much to be desired.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should currently be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is approaching in the opposite direction.