The GBP/USD currency pair traded very weakly again on Tuesday, but we did see a slight decline nevertheless. It seems that the market is afraid. Afraid to admit their own mistake, afraid to make decisions. After all, if we start to buy the dollar logically now, then it turns out that many previous actions were wrong. For example, a major market maker bought pounds hoping for a 6-7 rate cut by the Fed in 2024. Now it is obvious that even three rate cuts are quite an optimistic scenario. It turns out that the pound should be sold, and the dollar should be bought. But long positions on the GBP/USD pair remain in force because major market participants simply refuse to close them. Moreover, recent COT reports show that the market is increasing its purchases of the pound. One might ask: based on what?

And the answer will not seem attractive to many. Once again, we can only say the following: the market is not obligated to trade on the fundamental and macroeconomic background. For many years, the British currency has been depreciating logically. First, there was Brexit, then the pandemic (which the British government handled worse than others), the UK officially leaving the EU (which has already resulted in a shortfall of £160 billion), then the arrival of Liz Truss in power, and finally, stronger inflation growth than in other countries. Therefore, the depreciation of the pound over the past 10–15 years is logical.

As we can see, the market can operate following the fundamentals, but unfortunately, now is a different period. The pound has either been rising or has been flat for half a year. And it cannot be said that during this time there were no events that could have supported the US dollar. Expectations regarding Fed rates are becoming tougher day by day. If this is not a factor in the rise of the American currency, then what is? And what is the growth factor for the British currency? Recession in the United Kingdom?

Tonight, the most important event will be the announcement of new forecasts from the Fed on rates for 2024. The so-called "dot-plot" schedule. The last forecast was published at the end of last year, and it indicated three rate cuts (based on which the market was expecting 6 or 7 rate cuts). Now, many experts not directly related to the market believe that the "dot-plot" schedule will show only two 0.25% rate cuts this year. Thus, we will get a new factor for the rise of the US dollar, as the regulator will soften monetary policy much less than expected earlier.

Thus, by all parameters, the dollar should rise, not sluggishly hover around its semi-annual lows. But the market can interpret any information against it now. From a technical point of view, the pair remains below the moving average, so further decline is more promising and logical in any case.

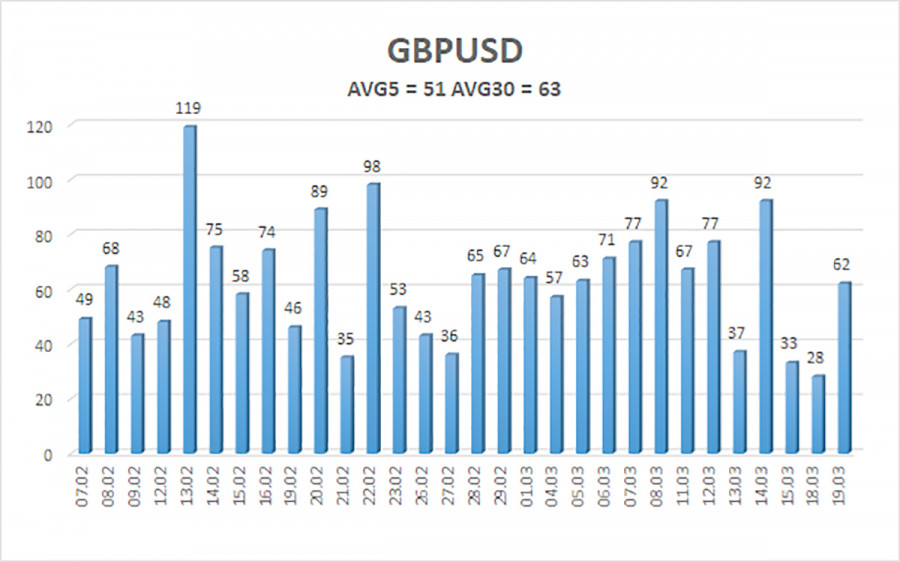

The average volatility of the GBP/USD pair over the past 5 trading days is 51 points. For the pound/dollar pair, this value is "low." Thus, on Wednesday, March 20th, we expect movement within the range delimited by the levels of 1.2671 and 1.2773. The senior linear regression channel is still sideways, so there are no questions about the current trend. The CCI indicator has not entered oversold territory recently, nor has it entered overbought territory. The market is currently trading not very logically, but traders have the right to expect a new significant downward movement.

Nearest support levels:

S1 – 1.2695

S2 – 1.2665

S3 – 1.2634

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2787

R3 – 1.2817

Trading recommendations:

The GBP/USD currency pair broke out of the flat and attempted to resume the upward trend. But we still expect a resumption of movement to the south, with targets at 1.2543 and 1.2512. The market still extremely reluctantly buys the dollar and sells the pound, completely ignoring the fundamental and macroeconomic background. This week, it can easily interpret received information in favor of the pound, even if it is in favor of the dollar. Long positions can formally be considered when the price is above the moving average, but we only support selling the pair.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is strong.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.