The EUR/USD currency pair traded on Tuesday as though it were paying attention to our recommendations and forecasts. In recent days, we have frequently discussed how the price frequently reverses its direction of movement and surpasses the moving average line. The upward movement appeared to have started on Monday and might have continued, but on Tuesday the pair simply collapsed downward. Also, this is exactly what we anticipated given that we have recently been discussing the overbought European currency, its unwarranted increase in the second half of the year 2022, as well as the lack of growth factors. Yet, we think that Jerome Powell's statement was simply a trigger for the current strengthening of the US dollar that eventually occurred. In any event, Powell's "hawkish" statement accidentally caused the US dollar's decline when it was scheduled to start growing again. In the next few sections, we shall discuss the Fed chairman's speech, but for now, allow us to state the following.

In the medium term, a new wave of movement to the south may well begin with the current collapse of the European currency. The market has already demonstrated recently that it is not prepared to purchase the euro. The European currency experienced significant pressure even in those years when growth would have been reasonable or at least not at odds with the underlying conditions. Hence, a new fall was coming. Of course, the pair may simply follow the British pound's lead and remain flat, but given that it has already departed its side channel, it may instead continue to decline. So, both pairs, which frequently move in the same manner, have fantastic potential to advance in the direction that we recently anticipated.

The two once more rested on the Senkou Span B line on the 24-hour TF. If it is overcome, there is a greater possibility that quotes may decline more. In this instance, it may go all the way to the level of 1.0200. We think that such a move would be entirely appropriate, even from a fundamental perspective. The US rate will remain higher than the rate in the European Union for a considerable amount of time since the Fed continues to maintain a more hawkish stance than the ECB.

The Fed's chairman made a hint about a longer rate increase.

What specifically did the Fed chairman say to Congress, then? If readers recall or familiarize themselves with our most recent publications, they will be able to verify what we have repeatedly stated: the US rate will need to be raised considerably more than 5.25%, as many are currently anticipating. The basic calculation indicates that it will only take 1-2 more rises to bring inflation back to 2%. Nevertheless, the Fed intends to return to price stability as soon as feasible and will not prolong the pleasure for a long time. Even so, in the European Union or the UK, this scenario would take far longer. The rate should therefore keep rising in any event.

In addition, we noted that since energy prices have declined, which has an impact on the costs of practically all goods and services, inflation has slowed down over the past six months in many nations throughout the world. But, the decline in the price of oil and gas could not endure indefinitely, thus this positive inflationary factor eventually had to be leveled. And that's what occurred. The Fed also enjoys a strong economy, a low likelihood of a recession, a strong labor market, and record-low unemployment. As a result, the Central Bank not only has the capability but also the motivation to actively fight rising inflation.

Jerome Powell essentially acknowledged that on Tuesday in front of Congress. He predicted that the struggle against inflation would be long and uneven, and that interest rates would have to be raised much more than previously anticipated. There was a chance that inflation would stall in February or March because it barely slowed down in January. The likelihood of a 0.5% rate hike in March has now increased to roughly 50%, although traders were not even seriously considering this possibility a week ago. According to Powell, the regulator is prepared to speed up the tightening of monetary policy once again if necessary. To be honest, we did not expect such a dramatic reaction to Powell's speech, but we must say that the Fed chairman was exceptionally open and truthful this time. His speech could not help but strengthen the dollar, though it could have been lower, as only such a situation could have been foreseen recently. And given the recent figures on the nonfarm sector and inflation, what else might we anticipate?

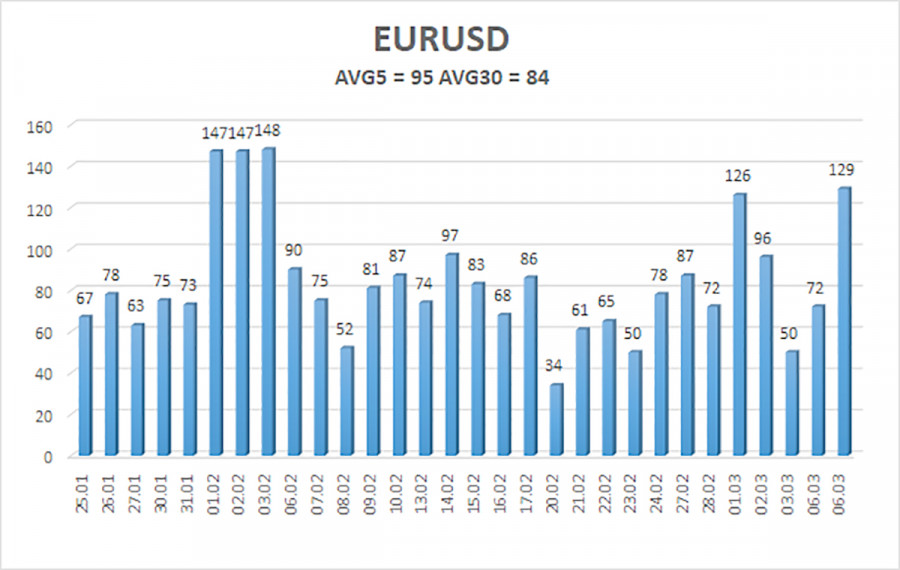

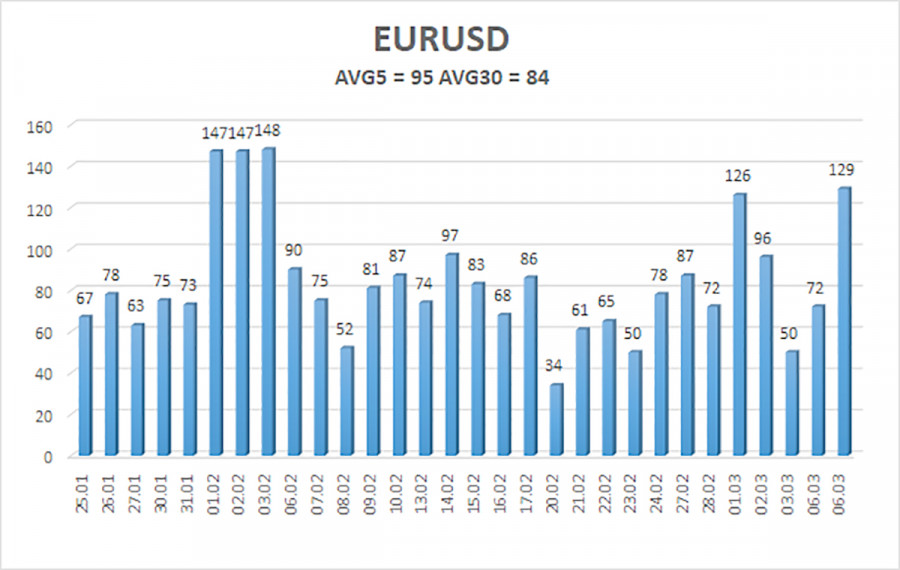

As of March 8, the euro/dollar currency pair's average volatility over the previous five trading days was 95 points, which is considered "high." Therefore, we anticipate that the pair will move on Wednesday between the levels of 1.0470 and 1.0660. A new phase of upward movement will be signaled by the Heiken Ashi indicator turning back to the top.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0964

Trade Suggestions:

The moving average line has been reclaimed below by the EUR/USD pair's consolidation. Unless the Heiken Ashi indication turns up, you can continue to hold short positions with targets of 1.0498 and 1.0470. If the price is fixed above the moving average line with a target of 1.0742, long positions can be opened.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the direction in which to trade right now are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.