During the past few weeks, the GBP/USD currency pair has been in "swing" mode. On the 4-hour TF, this is very evident, and on the 24-hour TF, we have a flat in a channel that is 500 points wide. As a result, the technical picture as it stands now is not the best for trading. Although there were no fundamental or macroeconomic foundations for either the dollar or the pound sterling, yesterday ended up being another failure for the pound sterling. Nonetheless, we cautioned that the pair might move rather actively in the side channel even in the absence of reports and events. The pair fell to a level of 1.1932 during the day, which is regarded as the lower limit of the side channel on the 4-hour TF. Now the pair must confidently pass through this level if traders are to anticipate further declines in the quotes. A further decline in quotes may be limited by the fact that on the 24-hour TF, the side channel's border passes a bit lower, at the level of 1.1841.

The pair left the Ichimoku cloud on the 24-hour TF yesterday, but as previously stated, the decline in quotes can only continue if the level of 1.1841 is overcome. As a result, this victory has no meaning. In the very long term, the pound continues to be unchanged. It appears as a "swing" on a 4-hour TF. But keep in mind that the pair still tends to drop further because the price is taking its time returning to the channel's upper limit. At the moment, there are no solid foundations for the pound's growth. In recent months, it has increased by more than 2,000 points, while just 500 points have been lost or gained. As a result, we still support continuing the downward trend. A lot now depends on the Bank of England, among other things, and a lot of contradictory information keeps coming from behind.

The Bank of England's governor has not changed his rhetoric.

The next performance by Andrew Bailey took place this week, despite not even being mentioned in the news calendars. It should be emphasized that while Mr. Bailey rarely conducts interviews or delivers speeches, each of them is given more attention. Even less frequently, Mr. Bailey speaks out in a loud manner. There was no exception the day before yesterday. No one will sacrifice the economy, as the Bank of England chairman made clear to the market. And this can only indicate that the regulator is on the verge of another slowdown in the rate of tightening monetary policy. It's hard to say with certainty how many rate increases traders already factored in when purchasing the pound between September and December 2022. At that time, the pound was quickly increasing, plainly anticipating a future tightening of monetary policy. After all, it was only last fall when US inflation started to decline and rumors of a slowdown in the Fed's crucial rate hikes first emerged. This is where the pattern changed because the Bank of England was late in responding to the Fed.

Right now, the situation is the exact opposite. First off, the pound has reacted pretty sharply to the two-year downward trend. Second, the market has legitimate concerns about the British regulator's willingness to continue tightening after it has already increased the key rate 10 times. All of this suggests that a downward correction is already necessary.

For all currencies, the rate problem is still present and quite complicated. The fact is that nobody knows what the rate increase in the UK or the EU will be at its highest point. Both central banks have adopted the most covert stance and are keeping the impending tightening a secret. As a result, estimating peak rates is quite challenging. And the answer to this question determines how both of the major currency pairs behave. Nevertheless, since the market itself lacks an answer to this query, it must rely on the information at hand to make decisions. And there isn't much of it right now. Everything now just comes down to whether the market believes that the ECB and BA will be willing to tighten policy as far as is necessary. We don't think so. Yet, there is confidence in the Fed, so we will continue to support the dollar's rise in the near term. When all central banks meet regularly in the middle of March, perhaps the situation will slightly improve. There can be some surprises or crucial remarks. Yet, it is now simply impossible to draw any further conclusions.

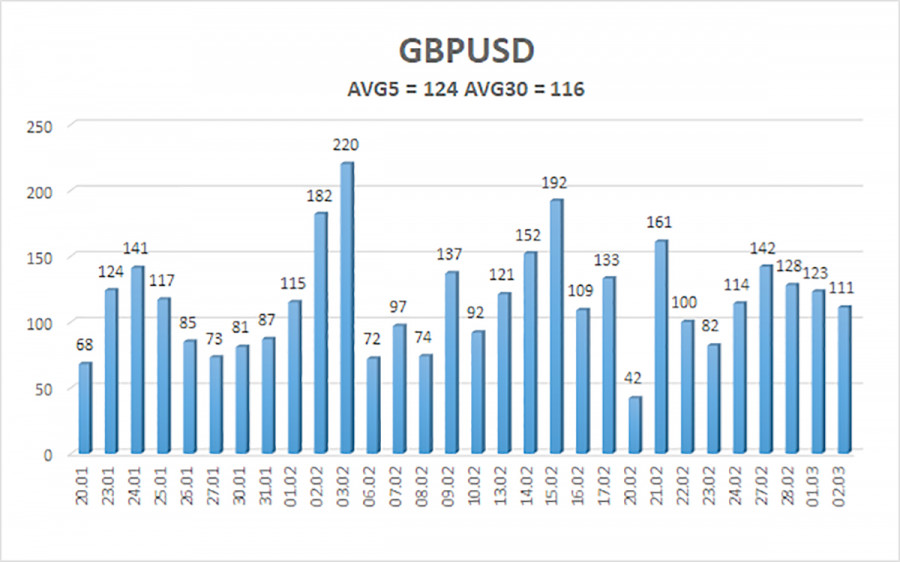

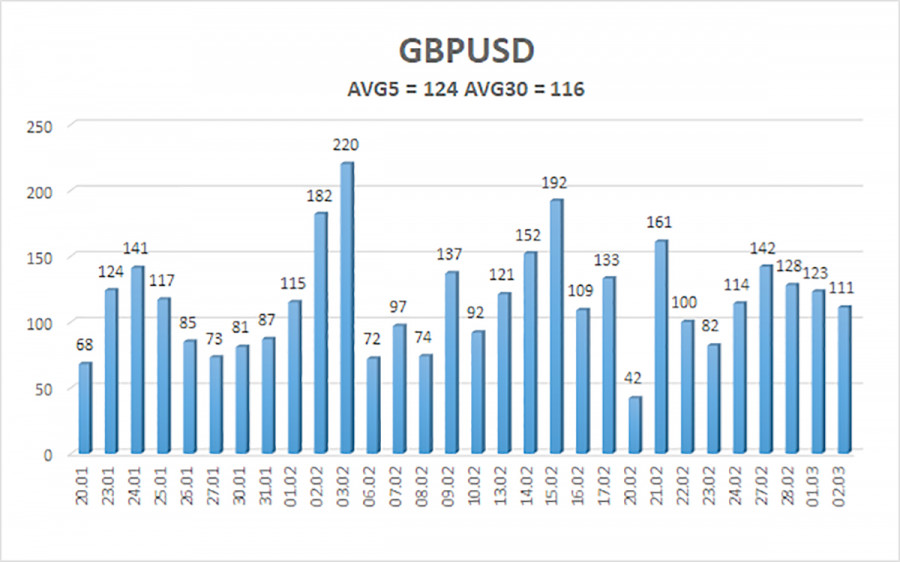

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 124 points. This value is "high" for the dollar/pound exchange rate. So, we anticipate movement inside the channel on Friday, March 3, with movement being limited by levels of 1.1815 and 1.2063. A new upward round of movement within the "swing" is indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.1932

S2 – 1.1902

Nearest levels of resistance

R1 – 1.1963

R2 – 1.1993

R3 – 1.2024

Trade Suggestions:

In the 4-hour timeframe, the GBP/USD pair once again stabilized under the moving average. The pair is currently in a "swing" movement, which allows you to trade on a recovery from the levels of 1.1932 and 1.2115. Alternately, trade on the lower TF, where it is simpler to spot moves using shorter-term and more precise signals. Although there is a chance of going beyond 1.1932, the following negative impulse can already be weak.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

The short-term trend and the current trading direction are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.