On Wednesday, the GBP/USD currency pair resumed rising and managed to gain another 140–150 points. The UK inflation report, of course, served as the foundation for such a decision. The market reacted quite strongly and bought the pound virtually the entire day, although the actual value perfectly aligned with the prediction (10.5% in December). We have stated that a minor slowdown in inflation is likely to produce a rise in the British pound since it will force the Bank of England to hike interest rates more quickly than anticipated. The fact that it will be prepared for such a step is, however, far from certain. However, the market purchases the pound because it thinks there isn't and won't be any other option.

In reality, given that all technical indicators point upward, what else can we anticipate from the British pound at this point? There isn't a single sell signal. The pound has already climbed "some" 2,100 points from its 2022 lows. However, if all technical indicators are pointing upward and we base our trading primarily on them, what difference does it make if we also consider that their growth is overly rapid and unreasonable? The first rule of trading is to always trade in the direction of the trend. Because there are no sell indications, we continue to trade for a raise while keeping in mind that the current growth is as irrational as possible.

Additionally, the Bank of England's rate, which is currently 3.5%, should be mentioned. Let's assume it increases to 4% in two weeks. What will happen to inflation? It will fall by 0.5 percent. How can inflation respond to declining energy costs? Another negative 2–3%? In other words, for inflation to return to the target level within two to three years, the Bank of England needs to hike the rate to at least 5%, if not as high as 6%. They do not anticipate inflation to go below 3% this year, not even in the United States, where it has already decreased to 6.5%. What is there to say about the UK?

It will take time for inflation to return to 2%.

Morgan Stanley, an investment bank, has released a statement suggesting a potential future decline in inflation. The consumer price index may drop to 3% by the end of 2023, and 2% should be anticipated by the end of 2024, according to its analysts. As you can see, the inflation rise process is quick and simple, whereas the inflation fall process is difficult and drawn out. James Gorman, CEO of Morgan Stanley, thinks that a Fed rate cut this year is unlikely. Thus, the Fed's policy will continue to be "hawkish" for a very long time, something that market participants have forgotten lately. We think the dollar will bounce back, and just before the following sentence, let's not forget that we've been talking about a negative correction for nearly a month.

In a report released by Standard Chartered, analysts predict that the euro and the pound will soon start to adjust. The report claims that after rapid expansion, there is no consolidation. The euro has already increased by 9%, and the pound has surged much more. A further increase is not impossible, but it is improbable without adjustment. The Fed is anticipated to boost the benchmark rate by at least 0.75%, according to Standard Chartered. And the American currency must be supported by this fact. The Fed rate's anticipated peak value may change as a result of China's strong economic recovery, which may cause a reduction in the rate of inflation's decline. As you can see, the biggest banks and research firms are similarly perplexed by the sudden and severe decline in the value of the US dollar, and the Fed hasn't even given up on tightening monetary policy yet. In the present situation, however, all we can do is wait for the market to "wake up," at which point the price will at the very least stabilize below the moving average. Remember that a fixation below the moving average is a signal for a potential trend change, but more evidence is required.

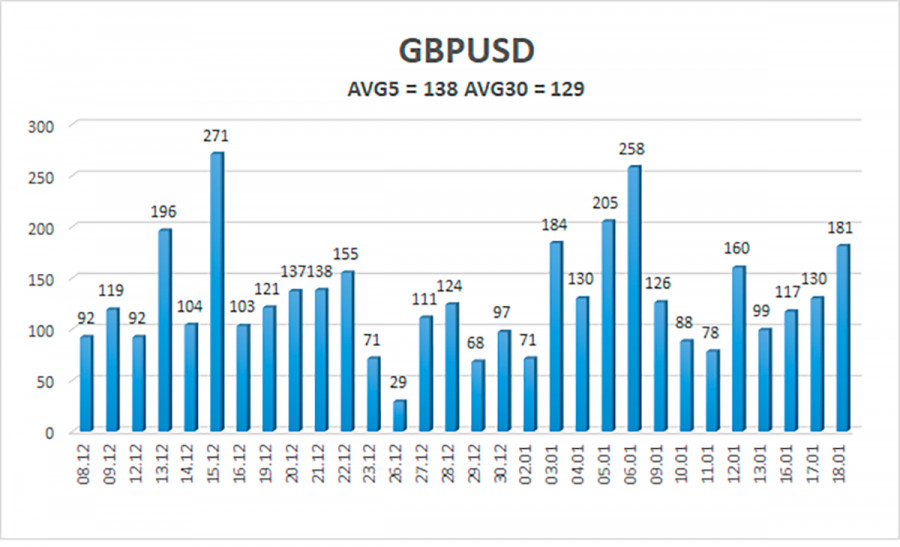

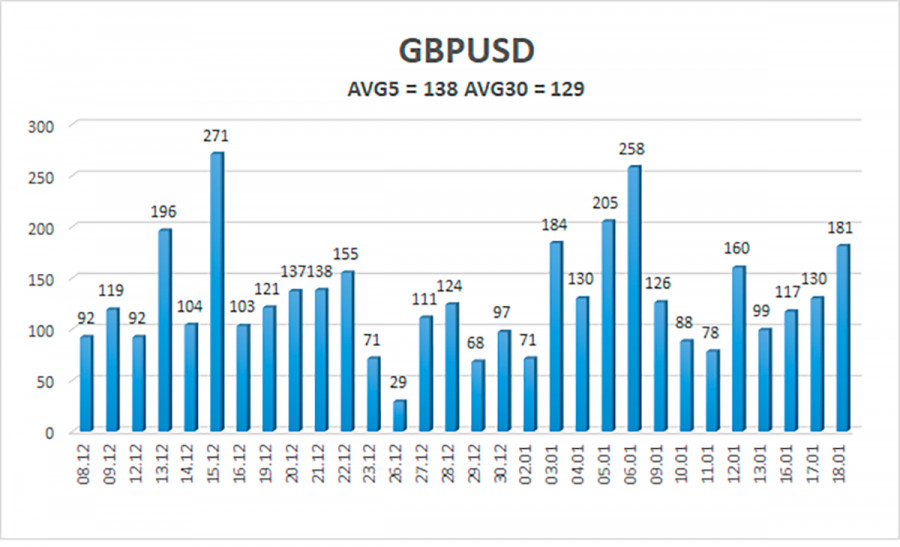

Over the previous five trading days, the GBP/USD pair has averaged 138 points of volatility. This figure is "high" for the dollar/pound exchange rate. So, on January 19, we anticipate that movement that is constrained by the levels of 1.2205 and 1.2481 will occur inside the channel. A new phase of the corrective movement is indicated by the Heiken Ashi indicator turning downward.

Nearest levels of support

S1 – 1.2329

S2 – 1.2207

S3 – 1.2085

Nearest levels of resistance

R1 – 1.2451

R2 – 1.2573

R3 – 1.2695

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is still rising. Therefore, until the Heiken Ashi indicator turns down, it is still possible to hold long positions with objectives of 1.2451 and 1.2481. If the price is set below the moving average, you can start opening short bets with a 1.2085 objective.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.