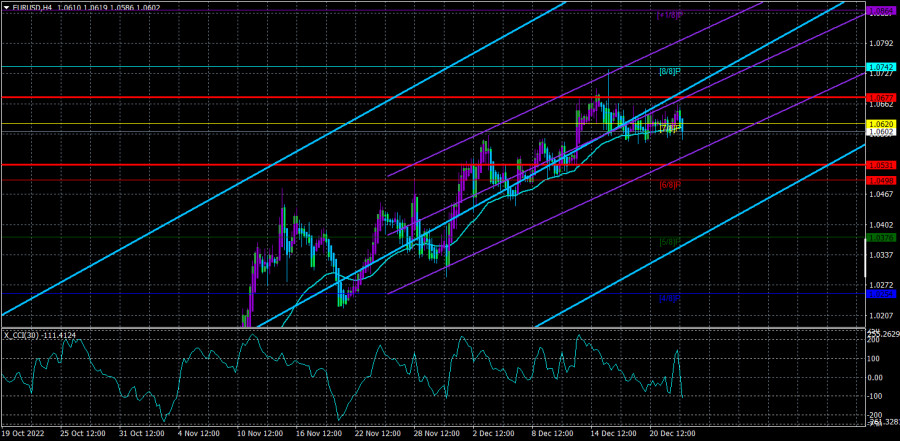

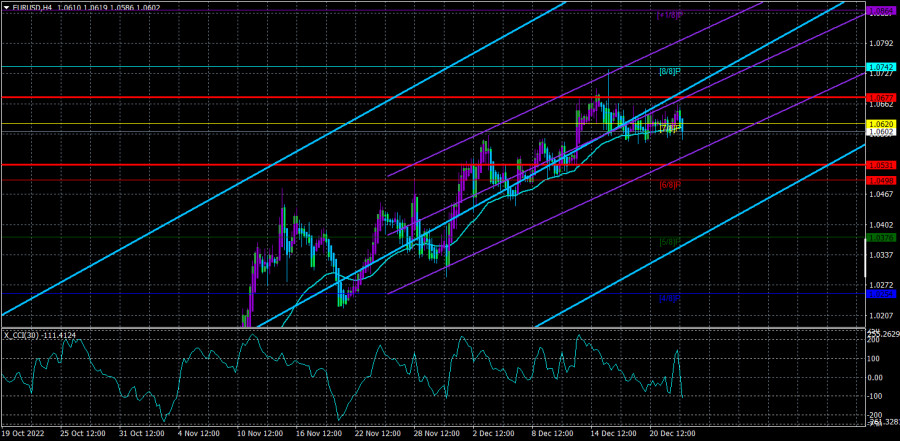

On Thursday, the EUR/USD currency pair kept its position above the moving average line while making gentle progress along it. Of course, the best way to describe the entire current movement is as totally flat and not as a movement along the moving average. Remember that the price cannot move sideways and along the moving average at the same time. The moving average line will eventually begin to point in the direction of the east, at which point the price will cross it ten times per day. As a result, the euro/dollar pair's market is currently completely flat. Volatility has decreased, as we have already stated, if not to the lowest values, then at least to quite low levels, such as those for 2022. Consequently, it is currently very challenging to trade a pair. Given that nothing noteworthy is occurring at the moment in either the world or the market, there may not be anything else to say about the technical situation. Everybody is gradually preparing for Christmas and the New Year. No significant publications, speeches, or statements have been made recently. There is nothing to analyze; all that is left to consider is how the upcoming year will go and how the pair will behave in January. However, in our opinion, the euro currency can now remain flat for a considerable amount of time.

Keep in mind that a flat is not uncommon in the foreign exchange market. And it isn't required to continue for a week or two. When a minimal number of new positions are created, the market is flat. Traders now merely see no reason to open the deals because they do not open, or they are waiting for a more favorable environment. In any case, there are no discounts, and there might not be any for several months. Of course, we hope that no such extreme scenarios will arise, but in reality, anything is possible. Naturally, the moving-overcoming signals have no relevance at this point. We must now either wait for the flat to be finished or try to trade within the side channel's borders on the lower TF.

In the third quarter, the American economy expanded.

The US GDP for the third quarter in the third and final assessment was this week's only significant report. In theory, we stated yesterday that we did not anticipate a response to this report. It might still be, given that the third quarter's actual value was 0.3% higher than expected. The result was a 3.2% increase in the American economy, which more than offset the losses from the first two. Therefore, it cannot be said that a recession in the United States has started as of the third quarter. Although the vast majority of economists predict a recession for the coming year, it is always preferable for it to begin later or for the fall to be as small as possible. The US economy appears to be doing well right now. As a result, we believe it is premature to discuss a recession. It might be very fleeting and shallow. The Fed has already increased its rate nearly to the desired level in the interim. Five months in a row have seen a decrease in inflation. The states have a great chance to exit the high inflationary period quickly and with minimal losses.

However, predicting how the EU's battle against inflation will turn out is still quite challenging. As you may recall, many experts question the ECB's ability to raise the rate "as long as it takes." This indicates that even if the battle lasts for years, the rate won't rise above the Fed rate. This is unfortunate for the value of the euro. It is impossible to predict the rate's potential value because ECB representatives are silent about the rate's eventual level.

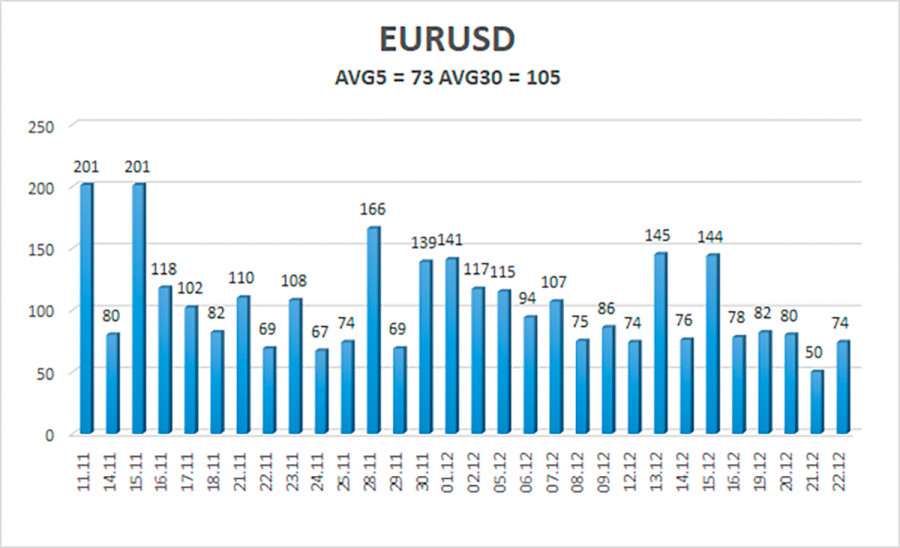

As of December 23, the euro/dollar currency pair's average volatility over the previous five trading days was 73 points, which is considered "average." So, on Friday, we anticipate the pair to fluctuate between 1.0531 and 1.0677 levels. The Heiken Ashi indicator's reversal means nothing because the pair is completely flat.

Nearest levels of support

S1 – 1.0498

S2 – 1.0376

S3 – 1.0254

Nearest levels of resistance

R1 – 1.0620

R2 – 1.0742

R3 – 1.0864

Trading Suggestions:

Although the EUR/USD pair has been flattening out for several days, it is still maintaining an upward trend. Trading can only be done on the lower TF inside the side channel because the 4-hour TF hardly ever moves.

Explanations for the illustrations:

Channels for linear regression help identify the current trend. The trend is currently strong if they are both moving in the same direction.

The short-term trend and the direction in which to trade right now are determined by the moving average line (settings 20.0, smoothed).

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.