The new week began with a decline for the GBP/USD currency pair. This drop does not even appear to be a correction thus far. Any "big," though, always begins with something "small." Recall that for the next week and a half, we anticipate a strong downward correction. While the market has been continuously seeking out new reasons to purchase the pound sterling, unlike the European currency, the pound had good reasons to increase in value. For instance, it was significant that Nicola Sturgeon's request for the right to hold an independence referendum was denied by the Supreme Court of Great Britain. The market also acknowledged for the first time that the Bank of England is actively tightening monetary policy. The resignation of Liz Truss as prime minister and the inauguration of Rishi Sunak may also be advantageous for the pound. Well, it's hard to forget that the initiative to cut taxes was rejected. Taxes will now be increased and spending will be cut, but the economy will benefit from this. The reduction of subsidies and increases in taxes will cause financial difficulties for average Britons, but it is better for the economy if the national debt does not increase by 50 billion pounds. If not more.

So, in recent weeks and months, there have been good reasons to buy the pound, but eventually, everything comes to an end. We are currently only discussing correction; however, none of us are aware of the future. We are unable to predict how much the Bank of England will increase the rate. Perhaps it will even go above the Fed rate, in which case the pound will have new justification for an increase of 500–600 points. The possibility of a new escalation in the conflict in Ukraine or between the West and the Russian Federation will raise demand for the dollar, as it did frequently in 2022. We want to emphasize that making forecasts for more than a few weeks out is currently simply impractical. We anticipate that the pair will still start a downward trend correction that could last a few weeks. What will happen next will be heavily influenced by the decisions made by central banks at their most recent meeting this year, as well as inflation data.

Is Jerome Powell able to defend the dollar?

In general, we don't anticipate Jerome Powell to make any revelations or alter the tone of his rhetoric. We already believe that there are valid reasons to repurchase the dollar from the market because several Fed policymakers have stated that the rate may rise faster and for a longer period than initially anticipated. It's excellent that Jerome Powell most likely shares this viewpoint. Any positive news for the US dollar could act as a "trigger" because, in our opinion, it has already been oversold in some respects. Powell's assertion and confirmation that inflation can remain high for a long time imply the need to exert pressure on it with the aid of monetary policy tools for a long period, and this could serve as the foundation for the US currency's appreciation. Strong labor market data can reassure investors that a recession is not imminent for the US economy. And it is weak if it threatens. The US dollar may benefit from this as well. As a result, we are leaning more and more toward the possibility that both major pairs will start to fall soon.

We also want to point out that any fundamental hypothesis is just that—a hypothesis. They shouldn't be worked out without specific technical signals. We frequently discuss tools like bitcoin and concentrate on the fact that many "crypto experts" simply never stop mentioning the exorbitant heights of the value of the original cryptocurrency. But if these predictions come true in a few years and bitcoin itself falls to a point where it is no longer valuable, who would be interested in them? Currency pairs are the same way. Not in a few months, but in the near future, how they move is crucial. Thus, overcoming the moving will make it possible to descend. We anticipate a 500-600 point total decline from the maximum of 1.2153. The pound has been known to fluctuate by that much in recent months.

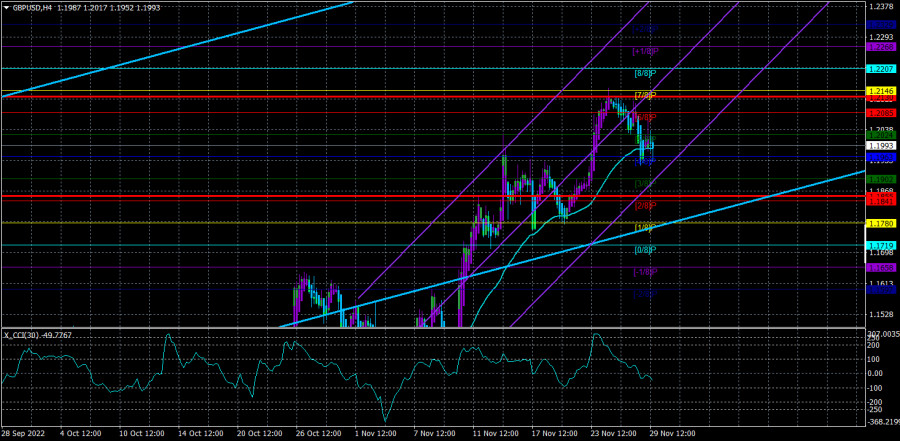

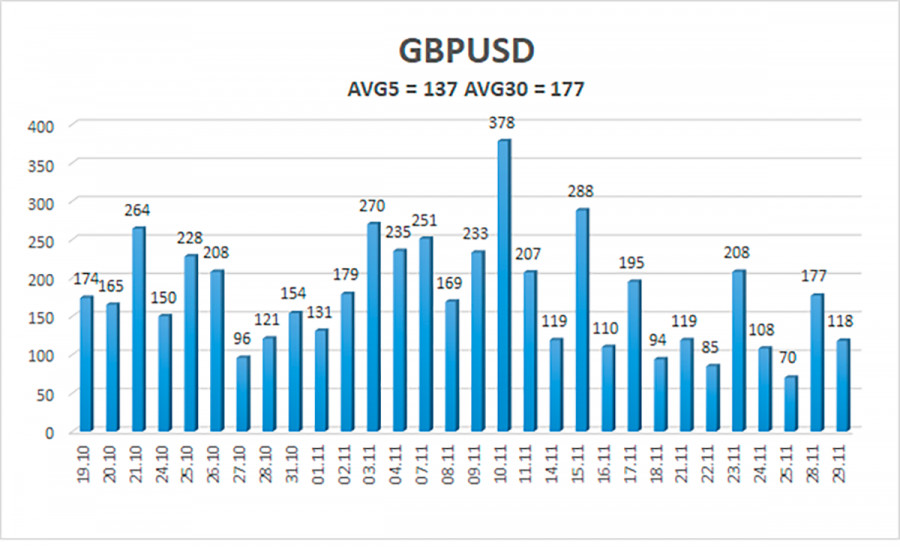

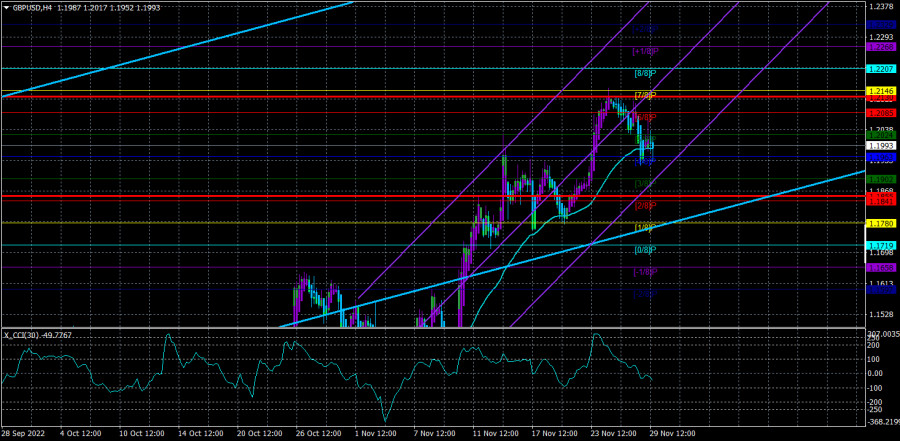

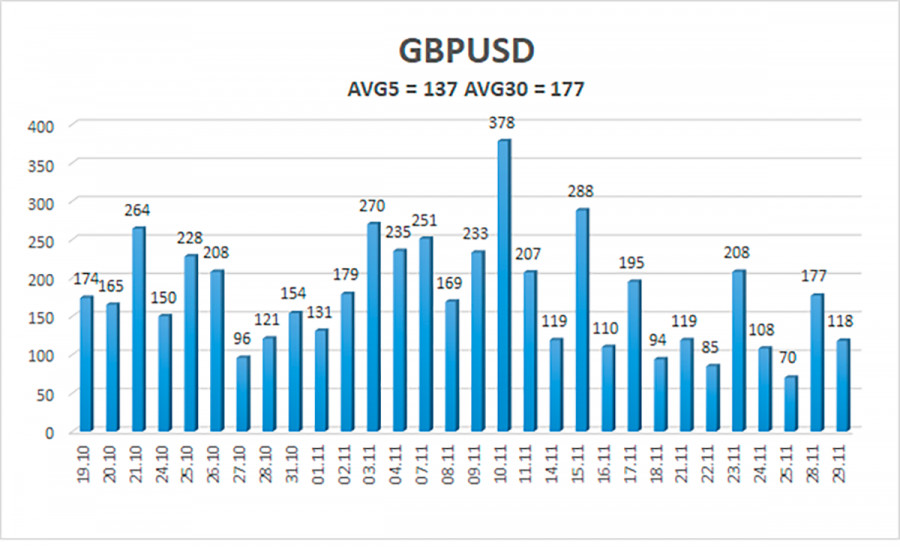

Over the previous five trading days, the GBP/USD pair has averaged 137 points of volatility. This value is "high" for the dollar/pound exchange rate. Thus, on Wednesday, November 30, we anticipate movement that is constrained by the levels of 1.1855 and 1.2130 to occur inside the channel. The Heiken Ashi indicator's upward reversal indicates that the upward movement has resumed.

Nearest levels of support

S1 – 1.1963

S2 – 1.1902

S3 – 1.1841

Nearest levels of resistance

R1 – 1.2024

R2 – 1.2085

R3 – 1.2146

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is still corrected. In light of this, new buy orders with targets of 1.2130 and 1.2146 should currently be taken into account in the event of an upward turn in the Heiken Ashi indicator or a recovery in the price from a move. With targets of 1.1902 and 1.1855, open sell orders should be fixed below the moving average.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.