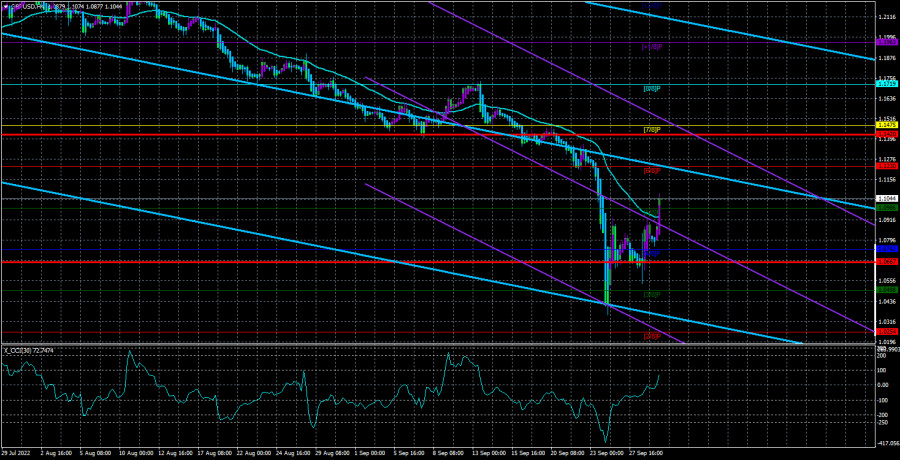

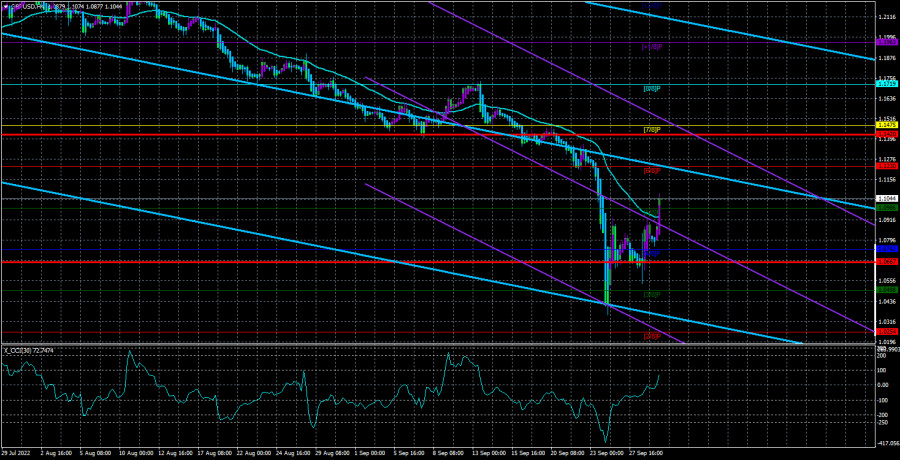

The GBP/USD currency pair adjusted during Thursday, being below the moving average line. It should be recalled that the pound collapsed to its absolute lows at the beginning of the week, and now it is frantically trying to recover at least a little. However, its growth prospects also look very vague. If there are a lot of problems in the European Union, then there are a lot of them in the UK by tradition. But first, the "technique." So far, there are a few reasons to assume the end of the downward trend. Yes, the pound has made a rather sharp departure from its absolute lows, but is such a pullback enough to interpret it as the beginning of a new trend? You first need to wait for a confident consolidation above the moving average and only then talk about the pound's prospects. Recall that there is an equally important 24-hour TF on which the pair must overcome the important Senkou Span B and Kijun-sen lines to count on tangible growth. Of course, the pound cannot fall forever, and sooner or later, this process will end, but we need to understand whether it can end now and whether we are not dealing with another "toothless" correction, as it has been repeatedly in 2022.

The fundamental background for the pair has not changed in recent weeks. We want to say that the betting situation has not changed in Britain or the USA. But there was much more gloomy news for the British pound than just a lag in rates from the Fed. It became known that the Bank of England is moving to an emergency purchase of long-term treasury bonds to stabilize financial markets. Liz Truss's first initiative to reduce the tax rates were sharply criticized. Experts believe this will lead to a global decline in the British economy, a huge budget deficit, and the need to introduce new economic stimulus programs that seem to contradict BA's desire to tighten monetary policy to combat high inflation. Signatures are already being collected to announce a vote of no confidence in the Truss, and Finance Minister Kwasi Kwarteng may resign. Experts also say that tax cuts will only hit the poor, and the rich will hardly notice it. Thus, Truss can put an anti-record after the pound if he receives a vote of no confidence less than a month after taking office. Many say that Truss' appointment was a mistake, although she looked the best of all the candidates. Should Boris Johnson have been expelled for sure?

Geopolitics + market panic = a new fall in the pound?

All other macroeconomic news can now be considered insignificant. Will the British economy face a recession? Who is surprised by this? Falling industrial production, high energy, and fuel prices? The whole world will face this. Weakness of the Bank of England's monetary approach? The regulator cannot raise the rate by 1% or 1.5% at each meeting. We would also note geopolitics and general market nervousness as factors that can devastate the pound.

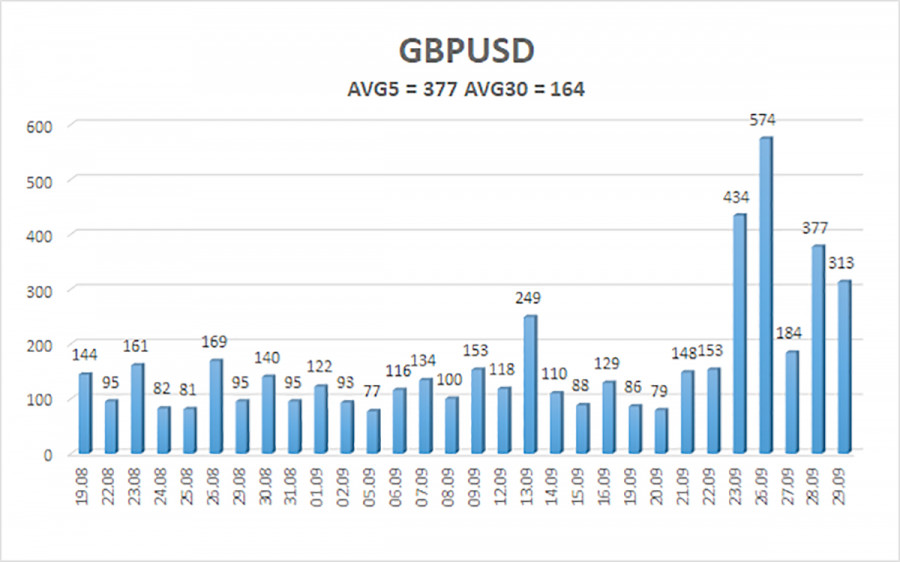

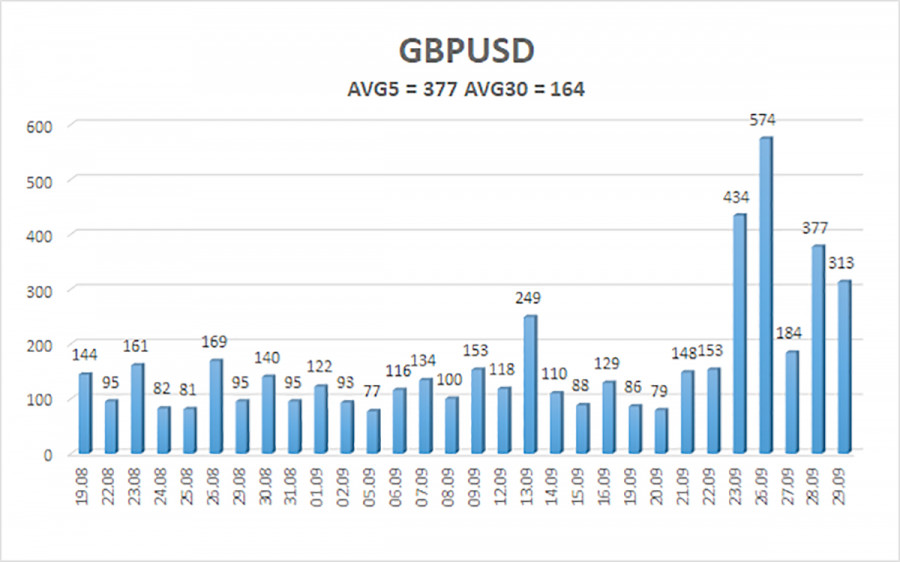

The illustration below clearly shows the current week's rates volatility records. The average volatility over the last four days is 373 points. This astronomical figure indicates a panic in the market. And panic is a thing that can move a couple in any direction with any force. In addition, geopolitics may worsen today if Vladimir Putin announces the annexation of parts of 4 Ukrainian regions to Russia. The market has not yet recovered from the news of mobilization in the Russian Federation, but now no one will have any doubts that the military conflict in Ukraine will flare up with renewed vigor. New sanctions will be imposed on Russia, negatively affecting the markets. There will be new bloody battles, and the use of nuclear weapons is not excluded. How should traders and investors feel in such a situation? Naturally, they can keep getting rid of risky assets and currencies, buying safe ones. We see that the US stock market continues to fall, the cryptocurrency market is at the "bottom," but it can form a new "bottom," and risky currencies continue to fall. Only the dollar is growing. Why shouldn't it continue growing if its growth factors only get stronger?

The average volatility of the GBP/USD pair over the last five trading days is 377 points. For the pound/dollar pair, this value is "very high." Therefore, on Friday, September 30, we expect movement inside the channel, limited by the levels of 1.0667 and 1.1420. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement.

Nearest support levels:

S1 – 1.0742

S2 – 1.0498

S3 – 1.0254

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1230

R3 – 1.1475

Trading Recommendations:

The GBP/USD pair is still being adjusted on the 4-hour timeframe. Therefore, at the moment, new sell orders with targets of 1.0667 and 1.0498 should be considered in case of a rebound from the moving average. Buy orders should be opened when fixed above the moving average with targets of 1.1230 and 1.1420.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.