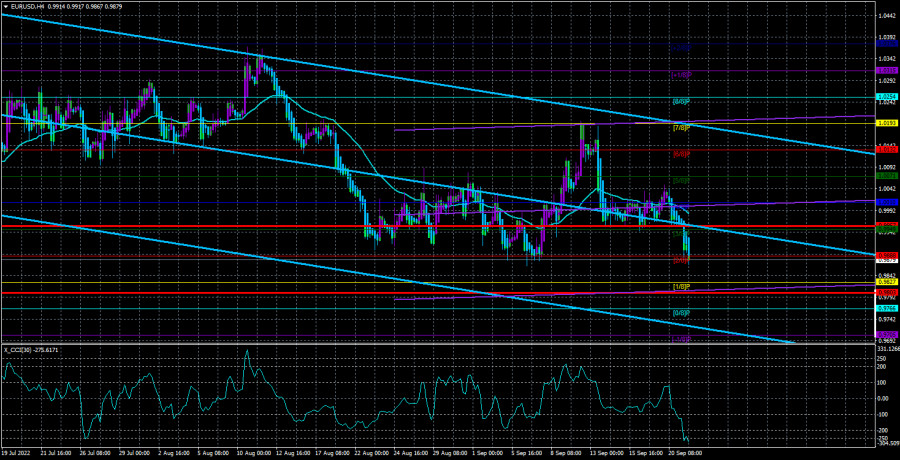

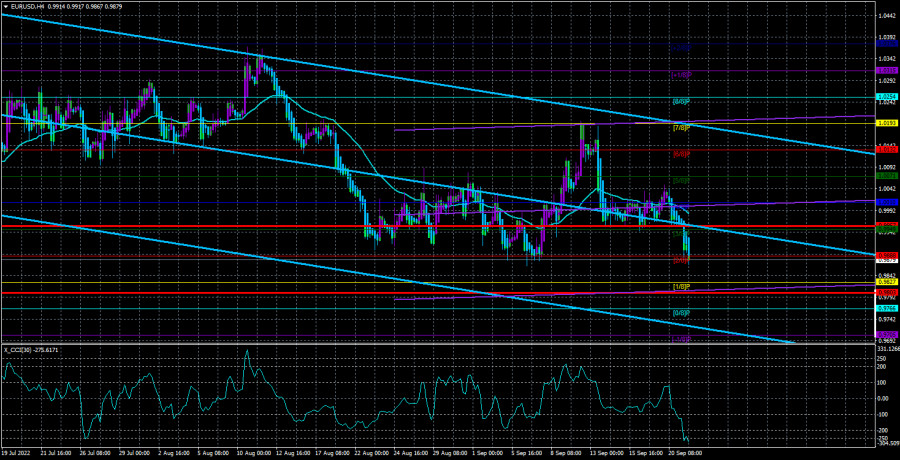

The EUR/USD currency pair immediately collapsed during the first half of Wednesday after trading flat on the lower TF for five days. We also remind you that we will continue highlighting the 0.9888–1.0072 side channel, where the pair spent most of the last month. Although the quotes could have already left it, this channel still cannot be ignored since the price left it on important and serious news and then returned to it. By tradition, we do not consider the results of the Fed meeting, which were summed up last night in this article. It is necessary to consider them clearly, realizing how the market reacted. After all, the reaction is important, not the results themselves. Since the meeting ended late in the evening, European traders did not have the opportunity to work it out (as well as Asian ones). Therefore, a strong movement based on this event may persist for 24 hours after announcing the results. Accordingly, we will sum up the results only tomorrow. In the meantime, it should be said that wherever the pair moves after the announcement of the meeting results, the fundamentally technical and fundamental picture will not change.

Everything is clear with the "technique" now: there is a global downward trend, and there is no single buy signal. From time to time, the market takes a pause, and at this time, the pair goes into a flat state. Everything is clear with the "foundation," too. The market still considers the difference between the ECB and Fed rates as one of the main reasons for further dollar purchases. Therefore, no matter how much the interest rate was raised last night, the difference between them will remain the same. At the same time, if it is clear in the United States how long the rate will rise, then in the European Union – no. Yes, Christine Lagarde said at the last meeting that the rate could continue to rise at all meetings in 2022, but who said that this would be enough to bring inflation back to 2%? Recall that Europe is on the verge of an energy crisis, and the geopolitical situation (which has re-activated its influence on the market) has only led to a fall in the euro currency.

The head of the ECB did not tell anything new to traders.

On Tuesday evening, Christine Lagarde gave a speech. Many traders were looking forward to it but, as it turned out, in vain. All the theses that Lagarde voiced were already known to the market for a long time, and the head of the ECB did not report anything new. She stated that: (1) the final rate should be compatible with the inflation target; (2) the ECB will not allow high inflation to affect the economic behavior of consumers; (3) the maximum value of the rate will depend on where inflation is fixed; and (4) high energy prices may negatively affect the volume of industrial production. We translate the language of Christine Lagarde into an ordinary, understandable language. The ECB will do everything possible to stop inflation, but this does not mean the operation will succeed. The ECB will call it successful in any case, but the losses to the economy could be significant. If gas prices continue to rise, industrial production may seriously decline, which will cause a deeper recession than expected. The ECB will react to inflation and, when it shows a significant slowdown, will slowly return the rate to lower levels.

In principle, the Fed adheres to the same monetary policy now. Therefore, you can turn to Powell's last speech if you have not heard Lagarde's speech. There you will see approximately the same thing. As for the "gas problem," there is no solution here since everything will depend on further price dynamics, the temperature outside the window this winter, and the number of gas reserves in European storage facilities. In general, Lagarde did not report anything that could support the euro, and it sank back to its new 20-year lows in the morning. As in the case of the pound sterling, we believe that the decline of the European currency will continue in the medium term.

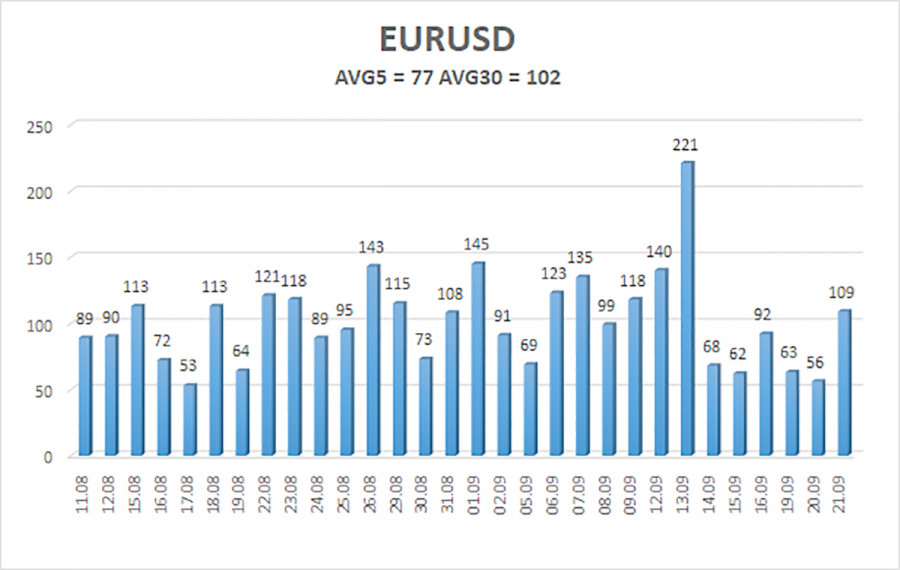

The average volatility of the euro/dollar currency pair over the last five trading days as of September 22 is 77 points and is characterized as "average." Thus, we expect the pair to move today between 0.9803 and 0.9957. The reversal of the Heiken Ashi indicator back up signals a round of upward movement.

Nearest support levels:

S1 – 0.9888

S2 – 0.9827

S3 – 0.9766

Nearest resistance levels:

R1 – 0.9949

R2 – 1.0010

R3 – 1.0071

Trading Recommendations:

The EUR/USD pair is trying to resume the global downtrend, but it turns out that it is still only inside the 0.9888-1.0072 side channel. Thus, you either need to wait for the flat to complete or trade for a rebound/overcome its boundaries with appropriate goals.

Explanations of the illustrations:

Linear regression channels – help to determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Based on current volatility indicators, volatility levels (red lines) are the likely price channel in which the pair will spend the next day.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.