The GBP/USD currency pair was actively traded on Thursday and Friday. We cannot say that the market's volatility was off the charts, but it was undoubtedly jittery, which led to multiple-directional movements. The resignation of Boris Johnson, whom both the opposition and the conservatives attempted to remove from his position, became public knowledge on Thursday. The market cannot remain indifferent to the resignation of the prime minister. A change in government has no direct impact on the economy, but indirect effects can be significant - new leader, a new path of development, new business practices, and new programs. It is too early to discuss any of this, as it is still unclear who will become the new leader of the Conservative Party and, by extension, the Prime Minister. Despite these events, the British pound slightly increased, indicating that traders viewed Boris's departure favorably.

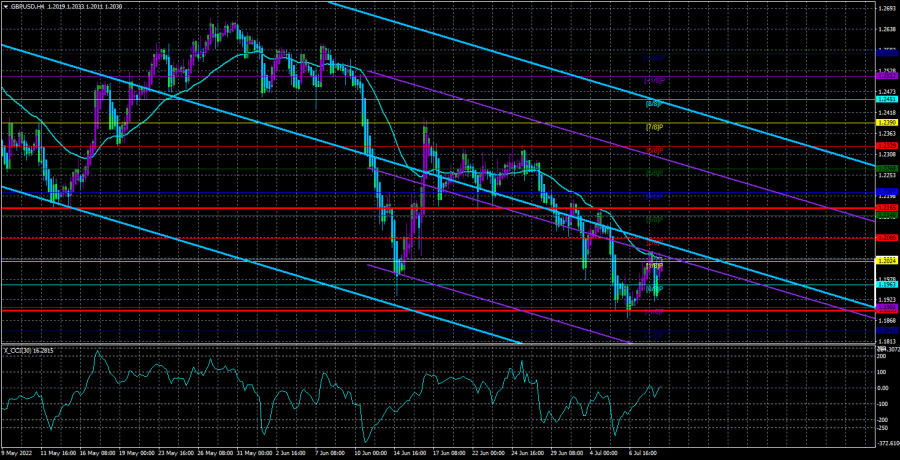

However, the British pound has changed very little over the past week. There are numerous causes for the continued decline of the pound. Both channels of linear regression continue to point downward. Occasionally, the pair overcomes the moving average with great difficulty, but all attempts by bulls to establish an upward trend fail very quickly. The Bank of England is doing everything possible on its own to halt the rise of inflation, but its efforts have yet to bear fruit. Even traders do not react significantly to the increase in the key rate, as the pound continues to decline over the medium term. However, geopolitics remains extremely challenging for the United Kingdom. Although the United Kingdom is somewhat further from the war zone than the European Union, its economy is highly dependent on the European economy. And gas and oil prices, as well as sanctions against Russia, have the same impact on the United Kingdom and the European Union.

Boris Johnson has followed in the footsteps of Donald Trump.

A year or two ago, we frequently compared then-current US President Donald Trump with Boris Johnson. Both charismatic leaders shared striking similarities regarding their behavior, working methods, and public discourse. Recall that in the most recent presidential election, Americans voted for Trump or anyone other than Trump. From our perspective, Joe Biden only won the election because Donald Trump amassed an army of his political and public opponents. Every day, he made false statements. It had already reached the point where credible analytical agencies counted the number of times Trump had lied. The daily maximum was fifteen false statements. Even social networks at the end of Trump's cadence have recently begun blocking him, which is unusual.As it turned out, Boris Johnson did not stray far from his American colleague and even failed to retain his position until the end of his term. Johnson may not have lied as frequently or brazenly as Trump, but public statements in Britain are held to a much higher standard. At least twice, Johnson made blatantly false statements that the entire nation could appreciate. Initially, he lied about not attending "coronavirus" parties. Then he claimed they were not parties but work meetings, and then he only attended for a half-hour and did not know it was illegal.

Moreover, due to the "lockdown," ordinary Britons were prohibited from visiting their relatives. It was revealed last week that Johnson had appointed Steve Pincher, the Conservative Party's deputy "disciplinarian," who was once investigated for harassing male party members while intoxicated. If Johnson truly did not know about this, he could still salvage his political career. However, witnesses quickly demonstrated that Johnson was fully aware of Pinscher's exploits, which was the final straw.

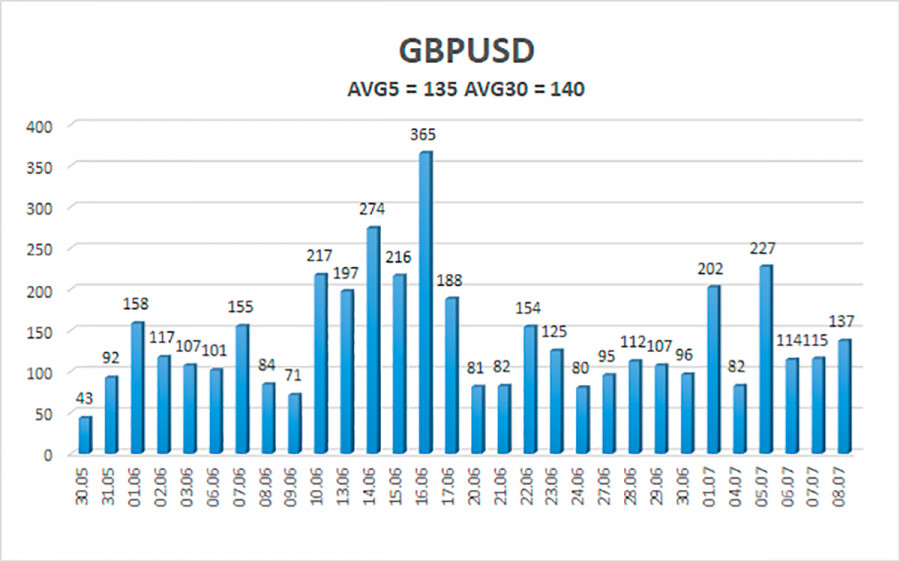

The average five-day volatility of the GBP/USD pair is 135 points. This value for the pound/dollar pair is "high." On Monday, July 11, we anticipate movement within the channel, bounded by 1.1895 and 1.2165. The downward reversal of the Heiken Ashi indicator signifies the continuation of the decline.

Nearest support levels:

S1 – 1.1963

S2 – 1.1902

S3 – 1.1841

Nearest resistance levels:

R1 – 1.2024

R2 – 1.2085

R3 – 1.2146

On the 4-hour timeframe, the GBP/USD pair has initiated a new correction. Therefore, new short positions with targets of 1.1963 and 1.1902 should be considered if the Heiken Ashi indicator reverses to the downside. When the price is above the moving average, open buy orders with targets of 1.2085 and 1.2146.

Explanations for the figures:

Channels of linear regression – aid in determining the current trend. The trend is currently strong if both are moving in the same direction.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the likely price channel the pair will trade within for the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or overbought area (above +250)- indicates a trend reversal.