The EUR/USD currency pair showed volatility equal to 33 points on Friday. This is how our article on the euro/dollar began. The British pound showed volatility of 29 points on the same day. Is there anything else to say about the movements and trades on Friday? 29 points for the British currency is not a movement, it is the usual market noise that can often be observed in the Asian trading session. Thus, the pair completed last week near the moving average, which is directed sideways. Perhaps this is the beginning of a flat, but we believe that these are the technical consequences of what happened to the pair on Wednesday and Thursday. Recall that for no apparent reason on Wednesday, the pound sterling rose by 170 points in less than a day. The next day, it fell by 120 points. And on Friday, it just stood there. It is still very difficult to say how these movements were justified. If for the euro/dollar pair, which showed similar movements, there was at least an ephemeral basis in the form of an ECB meeting, then there was nothing like that for the pound sterling.

Thus, we believe that after another rebound from the level of 1.3000 (1.2980), Take Profit orders from bears and pending buy orders from bulls were triggered, which led to the pair's growth. Purely technical growth. However, it ended very quickly and at the moment the quotes are located very close to their 15-month lows. The downward trend continues, as both linear regression channels are still directed downward. Although the Bank of England has already raised the key rate three times, the British pound is not particularly optimistic about this. It seems that the geopolitical picture of the world and Europe now worries traders much more than BA's monetary policy. And in any case, the Fed's monetary policy is potentially much stronger. It's just that the Fed is a little late from the BA with a rate increase. However, it can catch up over the next two months.

British Pound: "the dead with braids are standing, and silence."

The calendar of macroeconomic events in the UK this week is almost empty. Only on Friday, reports on retail sales, as well as on business activity in the service and manufacturing sectors will be published in the UK. No drastic changes in these indicators are expected, so the maximum that can be expected from them is a market reaction of 10-20 points. Although the British economy is not in such a deplorable state as the European one, it is very far from the American one, which means that the US dollar has a macroeconomic advantage. There will also be a speech by BA Chairman Andr ew Bailey late on Friday. However, he has hardly spoken about monetary policy in recent weeks, and in any case, his speech will take place when traders are already leaving the market on the eve of the weekend.

The next batch of speeches by Fed representatives will take place in the States this week. In particular, James Bullard, Mary Daly, Charles Evans, and Jerome Powell will voice their opinions on monetary policy and economics. Of course, Powell's speech on Thursday can be considered the most important event of the week, as the head of the Fed can make it clear to the markets whether the organization is ready for two rate hikes of 0.5% in May and June, as well as to reduce the balance sheet by $ 95 billion monthly, starting in June. This information is very important. From the macroeconomic reports, we can single out applications for unemployment benefits on Thursday and business activity indices in the service and manufacturing sectors on Friday. It is unlikely that this data will even be of interest to traders, not to mention their development. Thus, this week's key events will be the speeches of Powell, Bailey, and Lagarde. It is on them that you should focus your attention. In general, the week promises to be very boring, unless "geopolitics" intervenes.

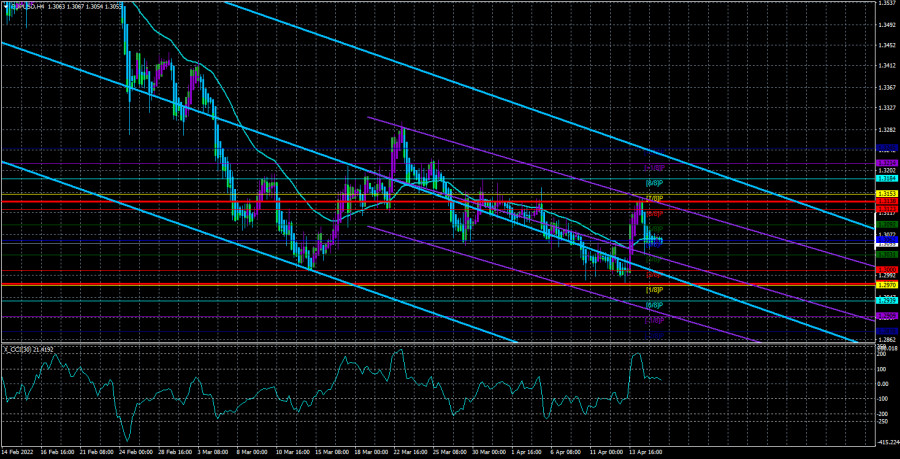

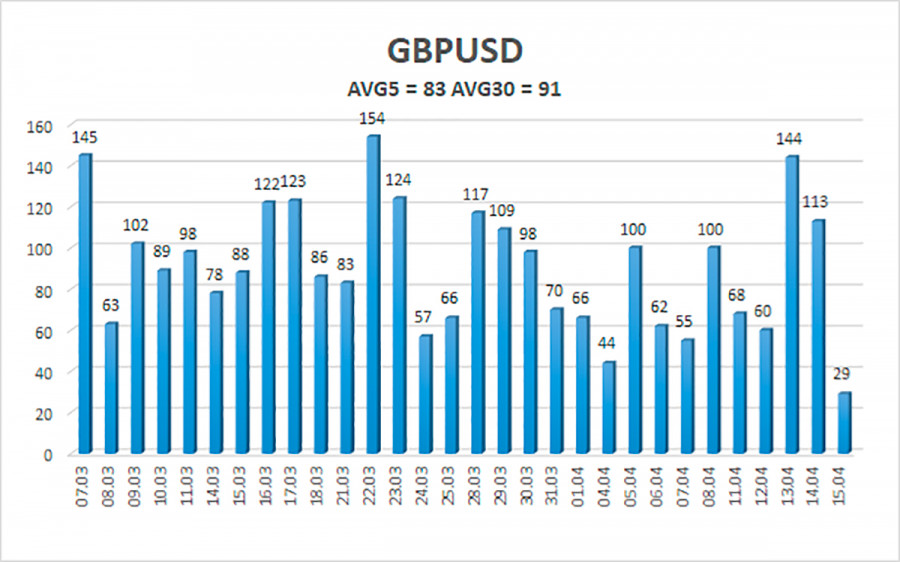

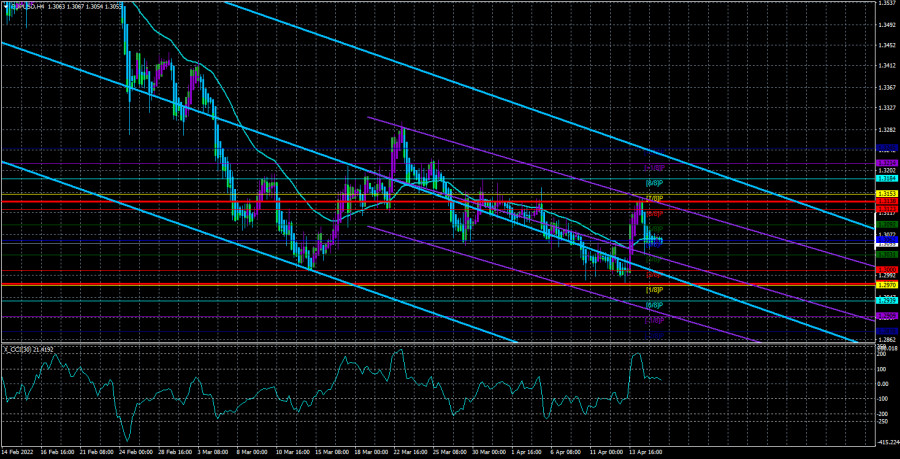

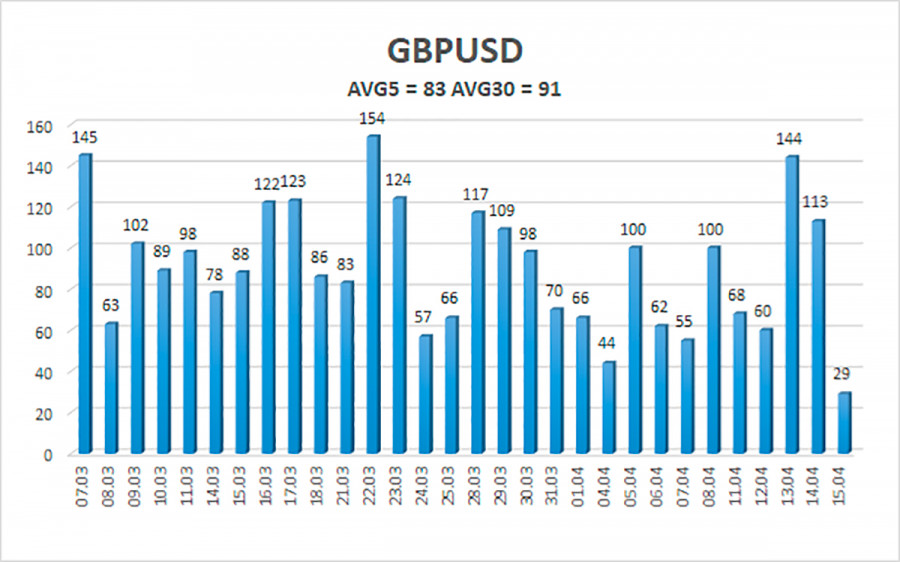

The average volatility of the GBP/USD pair is currently 83 points per day. For the pound/dollar pair, this value is "average". On Monday, April 18, therefore, we expect movement inside the channel, limited by the levels of 1.2974 and 1.3138. A reversal of the Heiken Ashi indicator upwards will signal a possible resumption of the upward movement if the price remains above the moving average.

Nearest support levels:

S1 – 1.3031

S2 – 1.3000

S3 – 1.2970

Nearest resistance levels:

R1 – 1.3062

R2 – 1.3092

R3 – 1.3123

Trading recommendations:

The GBP/USD pair is trying to start an upward trend in a 4-hour timeframe. Thus, at this time, buy orders with targets of 1.3123 and 1.3138 should be considered if the price remains above the moving average. It will be possible to consider short positions if the price is fixed below the moving average line with targets of 1.3000 and 1.2980. The pair has problems with overcoming the 30th level.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.