The GBP/USD currency pair also failed to continue its downward movement on Tuesday, but it also remained below the moving average line for most of the day. The pound/dollar pair failed to overcome the important, strategic level of Murray "2/8" - 1.3000, from which the price has already bounced several times. And this level is now a 15-month low. Thus, the British currency is now on the edge of the abyss and is about to fall into it. The fact that this has not happened yet probably indicates that the bears are not very willing to continue selling the pair, since the current price levels are already very low. Thus, selling now, if you look at the current rate of the pair, is not the most potentially profitable activity. Nevertheless, what else to do with the pair if most of the factors speak in favor of a further fall in the British pound and the growth of the US dollar? Even if the Bank of England raises the rate one more time at the next meeting, it will be 1%. Already at the June meeting of the Fed, the rate may be brought up to 1.25%. And unlike the British rate, the American one is almost guaranteed to reach 2.5% by the end of the year.

That is, in the future, the United States will have a much more "hawkish" monetary policy. Further, the pound remains a risky currency, and the crisis in Eastern Europe has a much greater chance of affecting the country and the economy from this very Europe than in the United States, which is very far away. The British economy is in a much weaker state than the American one, as evidenced by the latest GDP reports. And the chances of a recession or stagflation in Britain or the EU are much greater than overseas. In addition, do not forget that there is a risk of drawing some other European countries into the conflict between Ukraine and Russia. The Kremlin somehow looks at all security issues in its way, so Poland, actively helping Ukraine, may well become Moscow's next target and be declared a "dangerous country for Russia's security." What can we say about Finland, which has a border with the Russian Federation more than 1000 km long and is going to join NATO this summer...

We are moving from France to Finland.

Yesterday, we wrote about the presidential elections in France, but this issue, according to most experts, can be considered closed, and Emmanuel Macron is the new old president. Much more interesting events will unfold in the near future around Finland and Sweden, which, according to unofficial information, are ready to apply for NATO membership this summer. And NATO is ready to approve these applications without delay. It should be noted that there has been talk of Finland joining NATO since the very beginning of the year. Finns, who have maintained neutrality in recent decades, have changed their point of view in the last few months. Now more than 84% of the inhabitants of this country see Russia as a threat to their security. And it is based on this consideration that the population of Finland is going to demand that its government join the alliance. In the Kremlin, Dmitry Peskov has already made a statement about this, saying that NATO is an organization that does not contribute to improving security in the European region, and warned Helsinki and Stockholm against this step. Military experts from the Russian Federation said that the Kremlin would have to "answer" to the Finns and Swedes if they join the military alliance, since in this case NATO military bases, which will house medium and long-range missiles, which theoretically can carry nuclear warheads, will be located just two hundred kilometers from St. Petersburg. Thus, there is no doubt that if this happens, then this summer we can witness a new "special operation". Moreover, most likely, Moscow will not wait for the moment when both countries will already join the Alliance, because in this case, a military clash will occur with NATO. Most likely, Moscow will begin to react much earlier, as in the case of Ukraine. Already yesterday there were reports that the transfer of equipment began in Russia on the border with Finland, in particular, mobile Bastion missile systems began to move. Finland has recently begun to seriously fear the invasion of Russia, as it was already in 1939 when the Soviet Union attacked. Bosnia and Herzegovina is also increasingly actively wooing NATO.

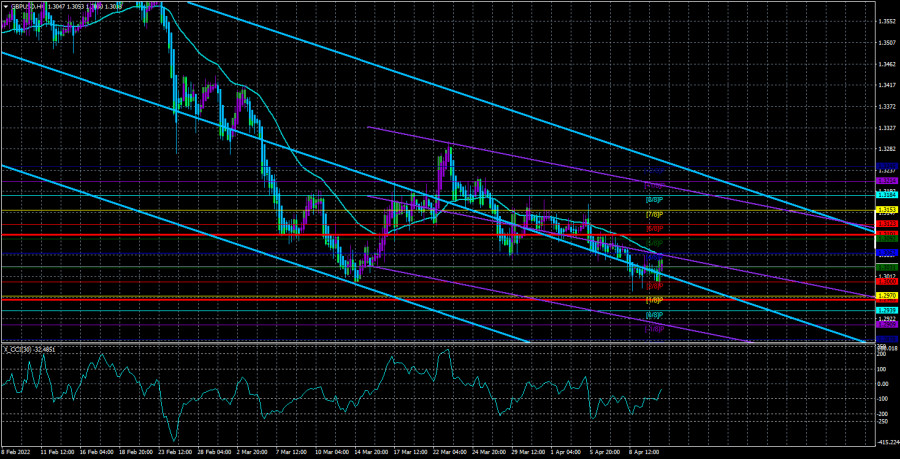

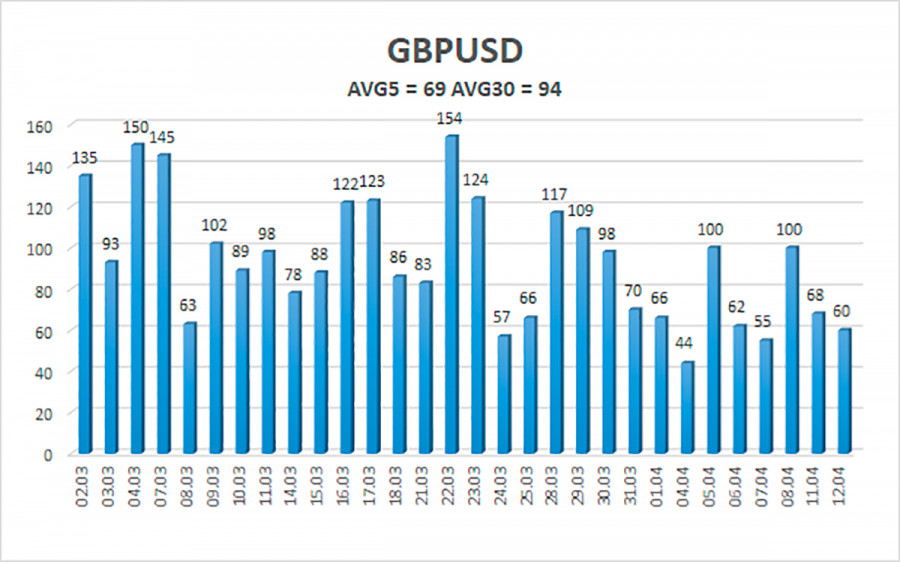

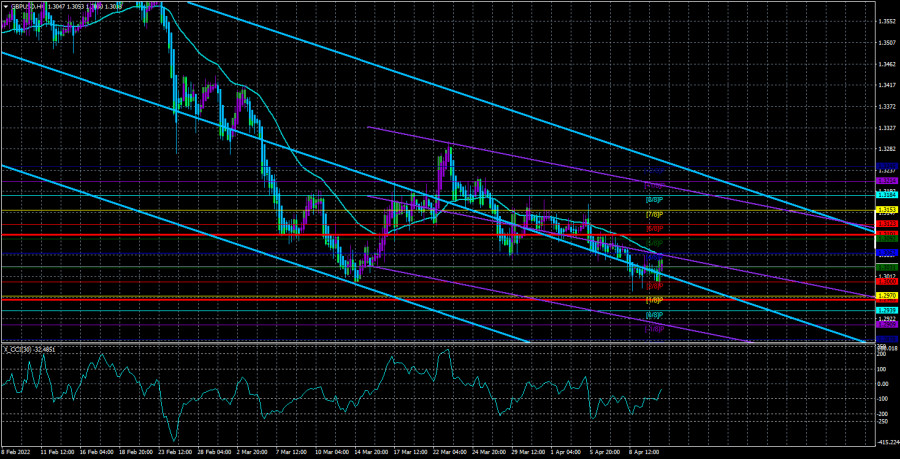

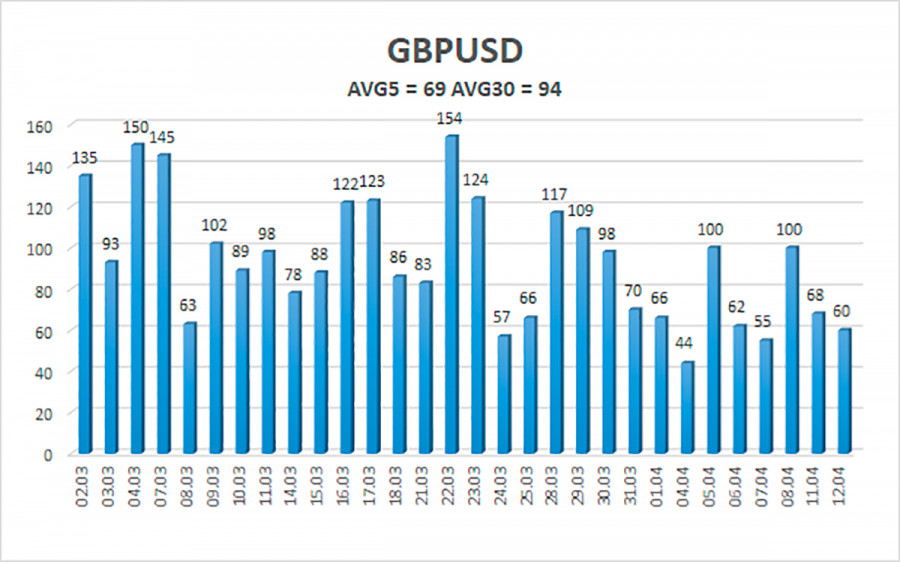

The average volatility of the GBP/USD pair is currently 69 points per day. For the pound/dollar pair, this value is "average". On Wednesday, April 13, thus, we expect movement inside the channel, limited by the levels of 1.2983 and 1.3101. The reversal of the Heiken Ashi indicator downwards signals a possible continuation of the downward movement, which has stalled near the 1.3000 level.

Nearest support levels:

S1 – 1.3000

S2 – 1.2970

S3 – 1.2939

Nearest resistance levels:

R1 – 1.3031

R2 – 1.3062

R3 – 1.3092

Trading recommendations:

The GBP/USD pair continues its downward movement in the 4-hour timeframe. Thus, at this time, sell orders with targets of 1.2970 and 1.2939 should be considered. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3123 and 1.3153. It should be recognized that traders have problems with overcoming the 30th level.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.