The GBP/USD currency pair was trading near the moving average line on Thursday and could not decide on the direction of movement all day. It is understandable: there was not a single really important macroeconomic or fundamental event during the day. The report on UK GDP already in the third or fourth assessment for the 4th quarter can hardly be considered strong. Although its value exceeded the forecast values, one would expect at least a slight strengthening of the British currency. But it didn't happen. In the States, the macroeconomic picture was even more boring. A few minor reports, which even theoretically had no chance to influence the pair's movement. Thus, the pound/dollar pair continues to remain near the moving average and can move in any direction.

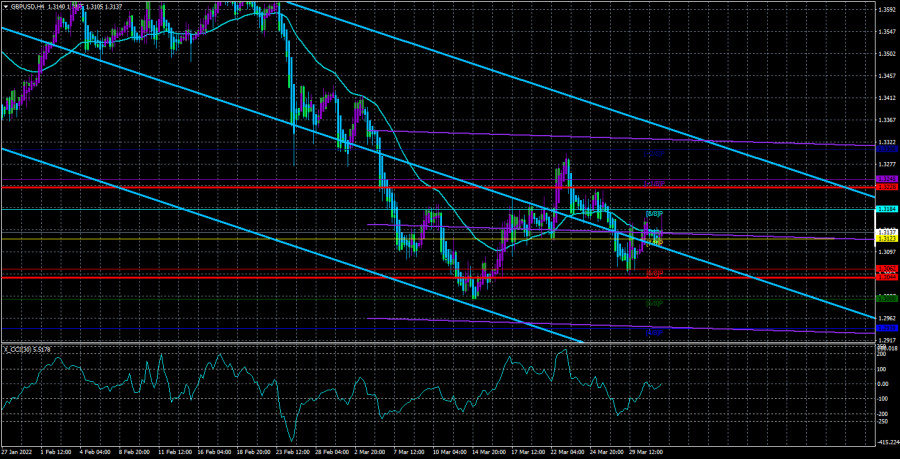

Technically, the correction that we have been seeing since March 15 may get another round, and the British currency in this case has a chance of a repeated increase to the Murray level of "+1/8" - 1.3306. At the same time, this round of correction may be completed on March 23. Of course, it is very convenient to trade a pair relative to the moving average, but we do not always see such a movement as in the period from February 23 to March 15. If we try to consider all available factors, then the pound sterling should also continue to fall against the dollar, however, probably to a lesser extent than the euro currency. Recall that the factor of a three-fold increase in the key rate by the Bank of England is very strong support for the British pound. And if it were not for this tightening of monetary policy, likely, we would now see the pound much lower. And if the Bank of England continues to raise rates at the same pace as the Fed, this could keep the pound afloat. Otherwise, the British currency will decline against the dollar one way or another.

Of course, we should not lose sight of the geopolitical factor. If, for example, the military operation is fully completed tomorrow and Russian troops leave Ukraine, it is natural that all risky currencies will immediately receive strong market support. If this conflict drags on for several more weeks/months/years, then this will put background pressure on the euro and the pound. Recall that the economies of the UK and the EU depend to some extent on Ukraine and Russia. We have said many times before that in the modern world all countries are tied to each other. And Ukraine is the second-largest country in Europe. Russia is the first in size in the world. In addition, Ukraine supplies half of Europe with food, and the Russian Federation supplies the whole of Europe with oil, gas, and raw materials.

British intelligence reports a possible escalation of the military conflict in the coming days.

While the whole world has already managed to celebrate a possible truce between Russia and Ukraine (although there were no reasons for this), American intelligence reports these days that it is not observing the withdrawal of Russian troops from Kyiv or Chernihiv. Yesterday, British intelligence confirmed this information, adding that there is only a withdrawal of some parts of the Russian army, which may be a simple replacement of the rank and file. The Russian military holds positions in the west of Kyiv and London believes that a new round of this conflict may begin in the coming days. London believes that the Kremlin has not abandoned the idea of "taking Kyiv", and if this does not work, then the tension near Kyiv and its regular bombing may force the Ukrainian delegation to be more accommodating in negotiations. Thus, as we said, there is no real reason to expect that this conflict will end in the near future. The pound sterling, by the way, did not even have time to show a noticeable increase on the news from Turkey on Tuesday. All it was enough for was an increase in the moving average line. Therefore, based on all factors, we believe that the fall of the pair is still more likely in the near future.

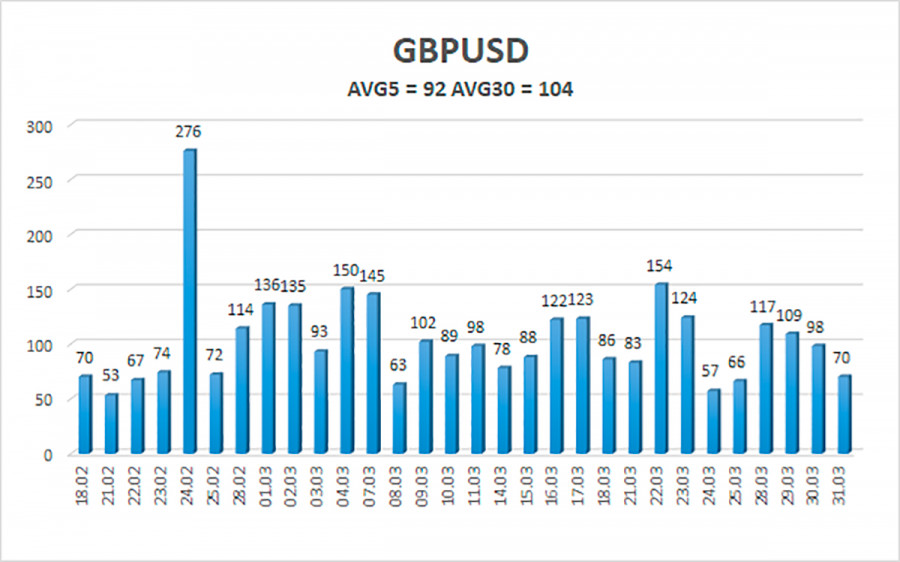

The average volatility of the GBP/USD pair is currently 92 points per day. For the pound/dollar pair, this value is "average". On Friday, April 1, thus, we expect movement inside the channel, limited by the levels of 1.3044 and 1.3228. A reversal of the Heiken Ashi indicator upwards will signal the resumption of the upward movement with a possible consolidation above the moving average.

Nearest support levels:

S1 – 1.3123

S2 – 1.3062

S3 – 1.3000

Nearest resistance levels:

R1 – 1.3184

R2 – 1.3245

R3 – 1.3306

Trading recommendations:

The GBP/USD pair has started a new round of upward movement in the 4-hour timeframe. Thus, at this time, sell orders with targets of 1.3062 and 1.3000 should be considered if the pair remains below the moving average. It will be possible to consider long positions no earlier than fixing the price above the moving average line with targets of 1.3228 and 1.3245.

Explanations of the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.