The EUR/USD currency pair again failed to show anything interesting during the second trading day of the week. At first, the pair's quotes fell back below the moving average line, then they tried to return to the area above the moving average, but in the end, they remained near this line. Thus, so far everything is moving smoothly to the flat. Volatility has already decreased very much on Monday, and on Tuesday it did not increase to the values of the last or the week before last. On the one hand, this is logical, since a pair cannot pass 100-120 points every day when its normal value is 60-70 points. On the other hand, what happened this week that the desire of traders to actively trade abruptly disappeared? For example, the pound sterling passed more than 150 points in a day yesterday, although before that it was trading less actively.

We are currently observing such processes in the foreign exchange market that it is impossible to predict in advance. It is quite possible that the number of buyers of the British currency has increased sharply this week, and the number of buyers of the euro currency has sharply decreased. However, how could such a market behavior be assumed? No way. Thus, it remains only, as before, to analyze the technical picture, taking into account the volatility indicator as an indicator of market activity at a given time. Separately, I would like to note that the euro currency may resume its fall against the dollar, although the pound sterling flew up yesterday. The CCI indicator entered the overbought area at the end of last week (above 250), and this is a strong signal for sales. Thus, we are now inclined to the option that the fall of the euro will be resumed.

Jerome Powell and Christine Lagarde continue to speak different languages.

On Monday, Powell and Lagarde gave speeches. We did not consider them in detail in our previous articles, as there was no market reaction to them on Monday. It did not follow on Tuesday, but it should be recognized that their comments were very important and perfectly reflect how their central banks will act in 2022. Recall that earlier the situation was as follows. The Fed is fully prepared for a whole cycle of rate hikes, but in March, it can be said, disappointed traders, as it tightened monetary policy by only 0.25%. The market does not doubt that the rate will be increased 5-6 times during 2022. However, the night before last Jerome Powell said that the Fed could raise the rate by 0.50% several times, "if the situation requires it." This means that the Fed can bring the key rate to 2.5% by the end of the year. And this is already a neutral level, after which the effectiveness of each subsequent increase will be much higher. And the effectiveness is now expressed in how much it will be possible to lower the consumer price index. It is still too early to count the chickens, since it has not been a week since the first rate hike, and the curtailment of the QE program has not affected inflation in any way.

But the ECB and its head Christine Lagarde once again made it clear to the markets that they and America are at different poles of the planet. Lagarde clearly stated that the ECB is not going to follow the Fed because the state of their economies is completely different at the moment. Consequently, there is no question of any rate increase in 2022. Nevertheless, the European economy also has a problem of high inflation, but they will not fight it, but will only hope that it will begin to slow down by itself. Thus, we believe that the gap between the approaches to monetary changes between the Fed and the ECB is only increasing. And if so, then the European currency can continue to experience serious pressure on itself, while the dollar can count on further growth. Plus, do not forget that the Ukrainian-Russian conflict is not resolved in any way and months may pass before the signing of a peace treaty. All this time, increased demand may persist for the US currency.

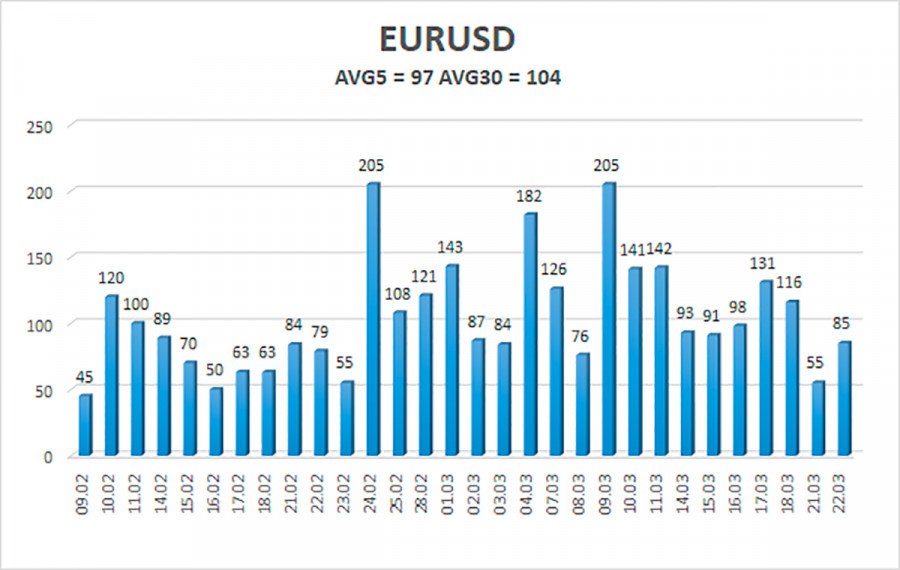

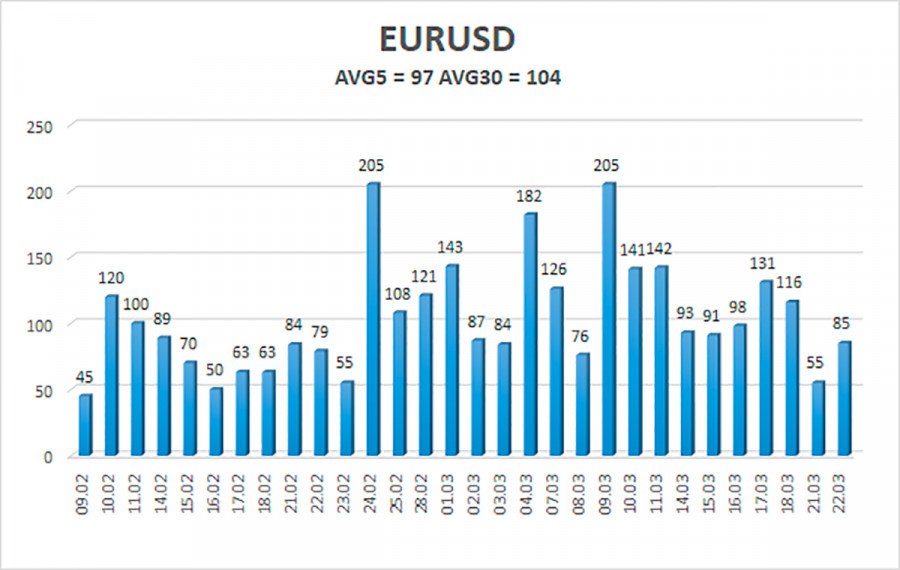

The volatility of the euro/dollar currency pair as of March 23 is 97 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0923 and 1.1118. A reversal of the Heiken Ashi indicator upwards will signal a new round of upward movement.

Nearest support levels:

S1 – 1.0986

S2 – 1.0864

S3 – 1.0742

Nearest resistance levels:

R1 – 1.1108

R2 – 1.1230

R3 – 1.1353

Trading recommendations:

The EUR/USD pair continues to be located near the moving average. Thus, new long positions with targets of 1.1108 and 1.1118 should now be considered if the price continues to be located above it. Short positions should be opened no earlier than the price-fixing below the moving average line with targets of 1.0923 and 1.0864.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.