Yesterday, the Federal Reserve raised the key interest rate by 0.25 percentage point, saying that six more hikes were ahead. Thus, the regulator began its fight against the highest inflation in the last 40 years. Of course, such actions may pose a threat to future economic growth. Nevertheless, inflation is the most essential problem at the moment.

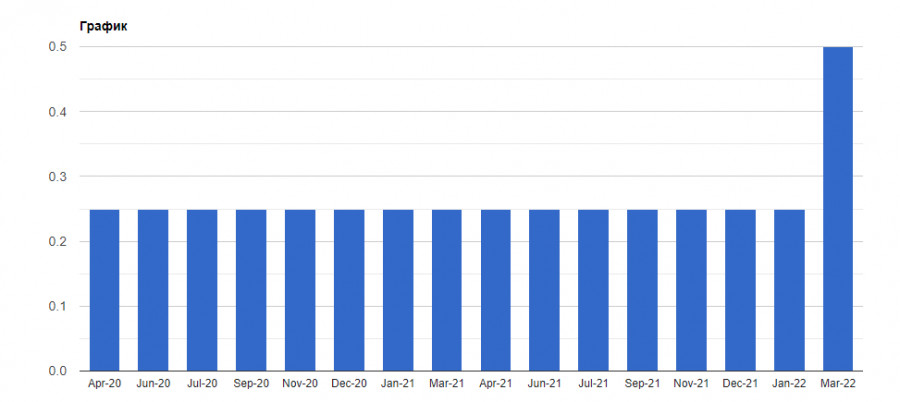

The Fed's representatives voted 8-1 for the key interest rate hike. During the last two years, the benchmark rate was at the zero level. This decision was taken to support the local economy amid the pandemic. Now, the monetary policy is on its way to a normal condition, when the interest rate is at 2.5%. However, St. Louis Fed President James Bullard disagreed with the increase.

The current rate hike is only the first from six that are planned for this year. The regulator supposes that a further rise in the benchmark rate will be reasonable amid the existing conditions. According to the forecast, by the end of 2022, the key interest rate should be at 1.9%. Although these predictions met traders' expectations, they exceeded the initial forecast. In 2023, the interest rate is expected to climb to 2.8%. In 2024, the rate will also remain at 2.8%.

In fact, the interest rate expectations for 2024 are very important. It is obvious that the Fed is not planning to push the interest rate above the neutral levels. That is why markets managed to avoid panic. The neutral level that does accelerate or slacken the economy is located at 2.5%. If inflation continues surging, it will be necessary to take more radical measures, which will negatively affect the stock market and boost the already overbought US dollar. However, some analysts suppose that after the record high recorded in February, inflation may slow down.

The Fed also emphasizes that the Ukrainian crisis is causing considerable economic difficulties. "The implications for the U.S. economy are highly uncertain, and we will be monitoring the situation closely," Powell said.

"The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain," he added. "Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook."

Notably, the Fed also intends to reduce its balance by $8.9 trillion. This could happen at the next meeting. Purchases of treasury bonds and mortgage-backed securities, which ended this month, were aimed at supporting the economy during the pandemic. That is why the cut of the balance sheet will help to fight against inflation.

The Fed has faced a serious problem. The fact is that loose measures may allow inflation to spiral out of control. In this case, the regulator will have to switch to extremely tight measures. On the other hand, a too aggressive approach may lead to recession. Judging by the current prices of food, utilities, and fuel, it is obvious that a jump recorded in February is not a ceiling.

All these factors are expected to slacken the US economy, pushing it to recession. If oil prices remain above $100, the prediction will come true very soon. The Fed's officials foresee inflation at 4.3%, that is higher than they initially expected. However, in 2024, the indicator may slide to 2.3%. Economic growth outlook for 2022 was cut to 2.8% from 5%. Forecasts for unemployment were insignificantly changed.

Technical analysis of EUR/USD

Bulls of the euro pushed the price above 1.1000 to 1.1060. As a result, demand for the euro is still high. Risk assets may continue gaining in value thanks to a looser geopolitical tension and calm reaction to the Fed's meeting results. If the single currency consolidates above 1.1060, it may continue climbing to 1.1120 and 1.1165. A decline in the asset will be met by a large number of long positions at 1.1020. The key interest rate is still at 1.0960.

Technical analysis of GBP/USD

Buyers of the pound sterling are focused on the resistance level of 1.3190. If the price breaks this level, it may soar to 1.3240 and 1.3275. However, the upward potential is capped by the upcoming BoE's meeting. The central bank is going to announce changes in its monetary policy. It is hardly possible to predict market reaction. That is why, traders are better to take the wait-and-see approach to avoid risks caused by high volatility and uncertainty. If the pair slides below 1.3120, it may face stronger pressure. In this case, it may fall deeper to 1.3080 and then to such lows as 1.3030 and 1.2970.