The EUR/USD currency pair performed two scenarios at once on Monday. We said that a correction may begin on Monday since the macroeconomic background will be absent on this day. However, the pair first managed to fall even more (the fall began at night) and only then began the correction. To be honest, at the moment, this meager correction looks like bullying. However, the latter is practically not on the market now. Although even this judgment is not entirely true. Recall that according to COT reports, the "bullish" mood among the major players is intensifying. It turns out to be an absolute paradox, which, however, we have already observed earlier. On the one hand, professional traders continue to open long contracts for the euro, and on the other hand, the euro is falling. We have already seen something similar in 2020-2021, when the US currency was falling, ignoring any data from COT reports. Then the Fed pumped money into the American economy (simply printed it), so no matter what traders did, the dollar was still getting cheaper as the money supply grew.

Now we see what the QE program has resulted in. Inflation is off the scale because 7.5% for the States is a lot. How to stop inflation is completely unclear. There is economic growth, but if rates are raised at each meeting, it will slow down and the question arises to what extent the Fed will be able to raise rates and whether this increase will be enough to bring inflation back to the target value. Moreover, it should be remembered that Jerome Powell and Christine Lagarde have repeatedly stated over the past few months that inflation will sooner or later begin to slow down by itself. Naturally, they implied that oil and gas prices would stop rising and supply chains would recover. It is now clear that these forecasts of Lagarde and Powell are simply worth nothing, because oil almost every day updates its cost maximums (as well as gas), and even greater difficulties may arise with supply chains because Russia is now, in fact, isolated from the whole world. In general, the year 2022 brought even more problems to the economy, although it has just begun, and now, probably, many would agree to the continuation of the pandemic, which everyone somehow very quickly forgot about, in exchange for the removal of geopolitical tensions in Eastern Europe.

What should traders expect this week?

In short, nothing good. In terms of macroeconomic statistics and fundamental background, there will not be a single more or less significant event in the European Union. There will only be an ECB meeting and a subsequent speech at a press conference by Christine Lagarde. But even this, of course, is a "high-profile event" we do not consider important. What could theoretically happen? It's nothing. Christine Lagarde and her colleagues have repeatedly stated that the rate will not be raised in 2022. That's all, it can diverge. The PEPP program, which was supposed to end in March, is no longer of interest to anyone. The APP program will have to be in effect for the entire current year, but now the European Union and the ECB have so many geopolitical problems that it's kind of a shame to even talk about any quantitative stimulus programs there. The only thing that can attract attention is the change in the rhetoric of ECB head Lagarde. But what reason do we have to expect her rhetoric to change to a more "hawkish" one? We believe that none. This issue should be based on the state of the European economy. Recall that in the 4th quarter of 2021, GDP grew by 0.3%. It's practically nothing. With such economic growth, raising the rate is practically suicide. Inflation continues to rise, but there is simply nothing to fight it with if you do not raise the rate. In the end, it all boils down to the fact that either there will be some kind of surprise (probability 5%), or there will be nothing interesting at all (probability 95%). Thus, geopolitics will be in the first place this week.

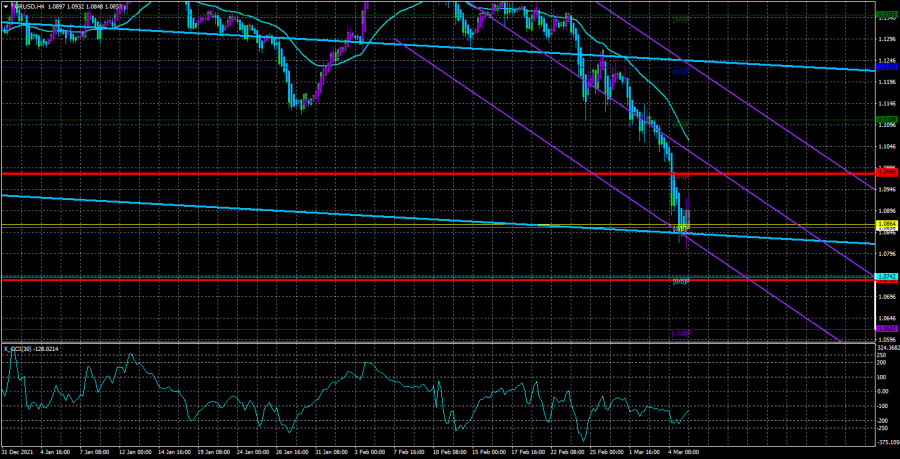

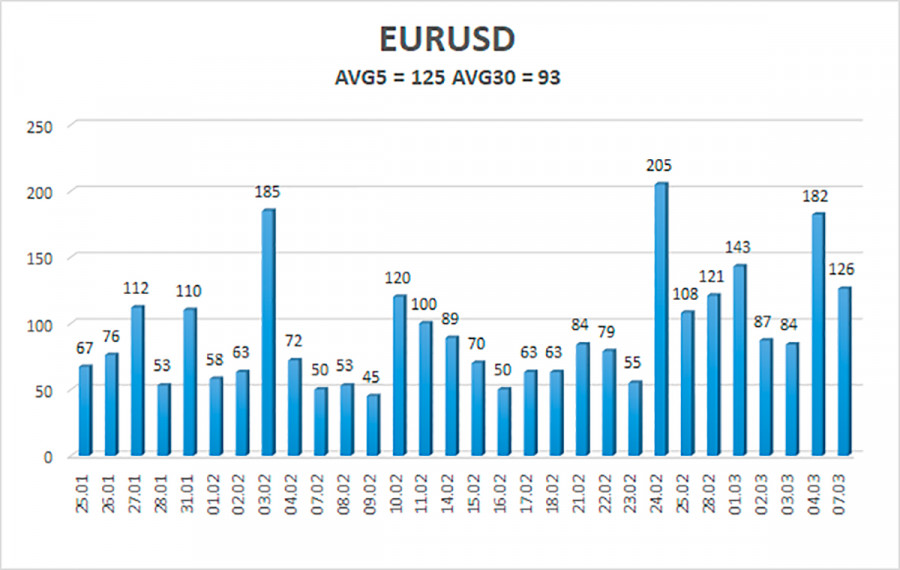

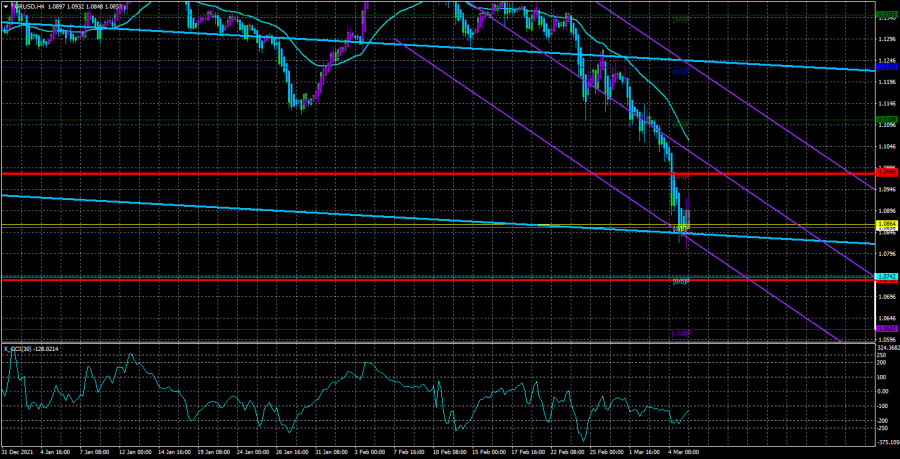

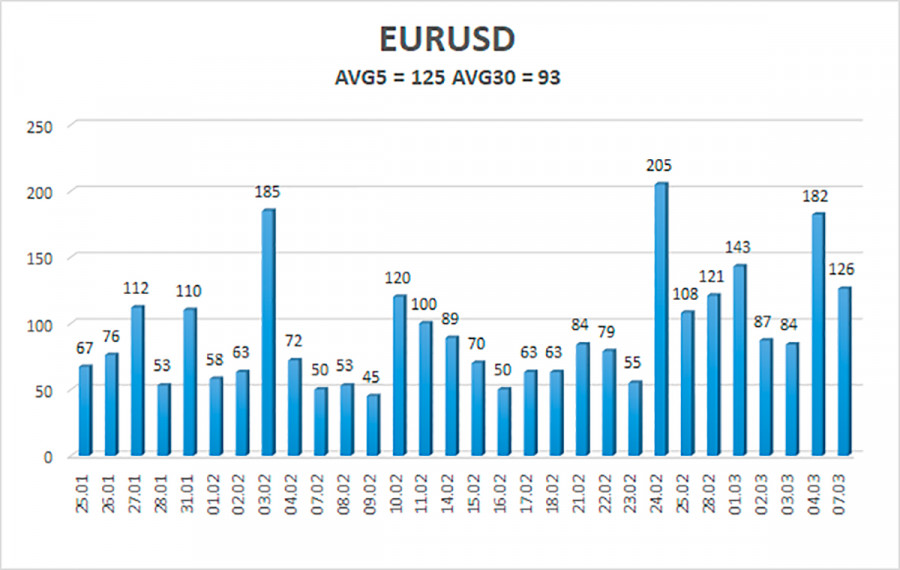

The volatility of the euro/dollar currency pair as of March 8 is 125 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0738 and 1.0982. The upward reversal of the Heiken Ashi indicator signals a round of corrective movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues its strong downward movement. Thus, it is now possible to stay in short positions with targets of 1.0742 and 1.0620 until the Heiken Ashi indicator turns up. Long positions should be opened no earlier than the price-fixing above the moving average line with targets of 1.1108 and 1.1230, which is not expected in the coming days.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.