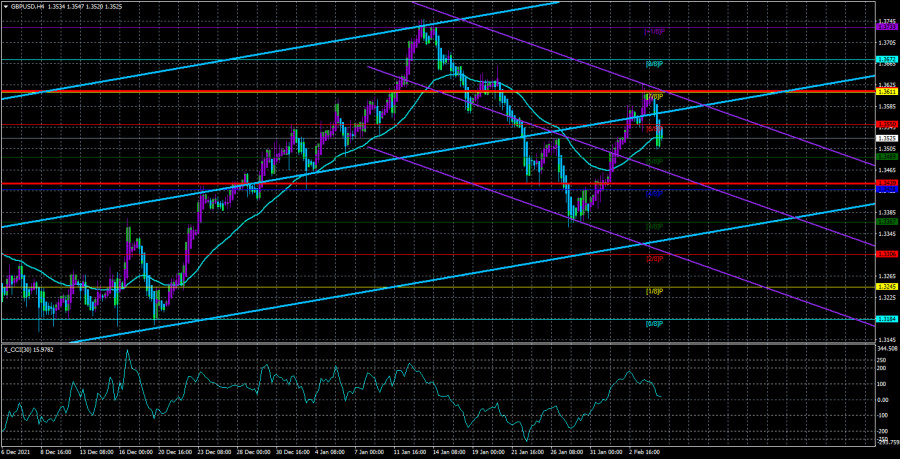

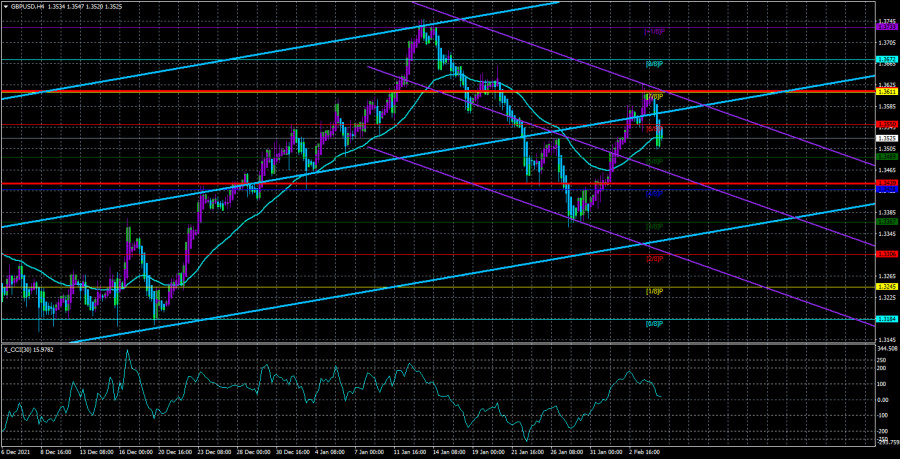

The GBP/USD currency pair made a rather noticeable drop on Friday. It started early in the morning, so American statistics, which turned out to be much better than forecasts, have nothing to do with it. The pound sterling began to adjust on its initiative, although there were plenty of reasons for its continued growth. Recall that a day earlier, the Bank of England decided to raise the key rate, which is a strong "bullish" signal. However, the pound rose in price quite modestly, much weaker than the euro, which had no grounds for growth at all. Such a completely wild discrepancy between the technical picture and fundamental factors makes one wary. Now the market is unbalanced. And if so, it may try to restore the balance in the near future. And this means that illogical and difficult-to-explain movements may also be observed this week. So far, the price remains above the moving average line, so the upward trend continues. A rebound from the moving average may provoke a resumption of the growth of the British currency. In general, the British currency retains chances for further growth. Recall that, unlike the euro, the pound is supported by the Bank of England, which has already raised the key rate twice and intends to do so at least twice more this year. Therefore, if anyone should become more expensive now, it is the pound, not the euro currency. At the same time, if the pair is fixed back below the moving average, it will mean a new trend change to a downward one. Recall that the COT reports on the pound and the picture on the 24-hour TF are now quite ambiguous. Therefore, any development of events can be expected in the coming week.

There are few hopes for statistics from the UK!

There will also be an extremely small amount of macroeconomic statistics in the UK in the new week. All the most important publications are scheduled for Friday, February 11. On this day, the GDP for December in various calculations, the change in industrial production, as well as the balance of visible trade will be published. Naturally, the most important will be the GDP report, but we also note that this will not be the quarterly value, which is considered the most important, but only the monthly one. Therefore, the market reaction to such high-profile reports may be scanty. The situation is no better in the States. A single inflation report on Thursday and that's it. Of course, Andrew Bailey or Jerome Powell can give speeches during the week. However, what to expect from functionaries immediately after the meetings of the Bank of England and the Fed? Everything has already been saying.

It turns out that this week the macroeconomic and fundamental background will be practically absent. And in the current circumstances, this is even good. We have already drawn attention to the fact that the pairs traded not quite logically last week. Therefore, this "joyless" week can put everything in its place. Both major pairs can trade exclusively on "technique", which is even good. But, of course, there is also the possibility of a flat on individual days. If we turn to the general background in the UK, then absolutely nothing interesting is happening there now. The topic of the next "wave" of the pandemic has stalled. The theme of Boris Johnson's "coronavirus parties" is the same. And no other interesting information has been received recently.

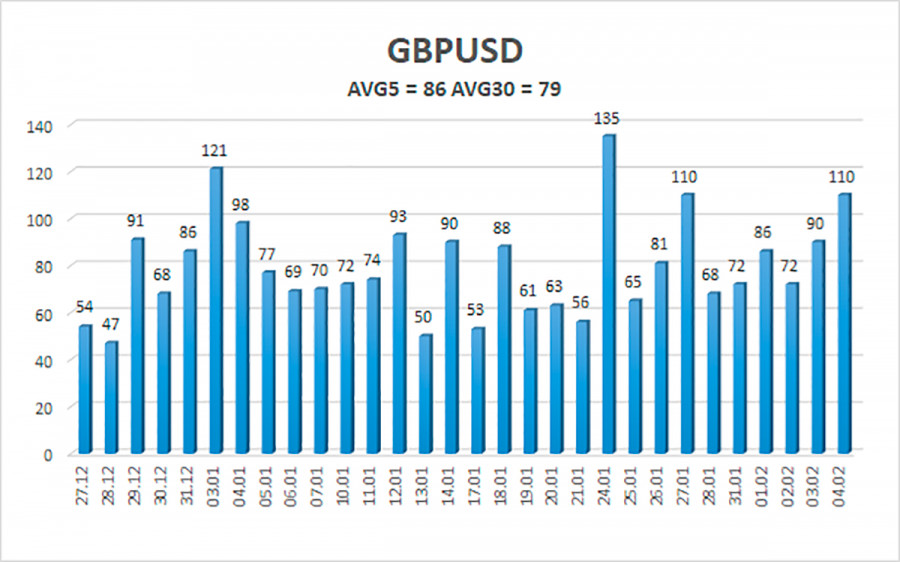

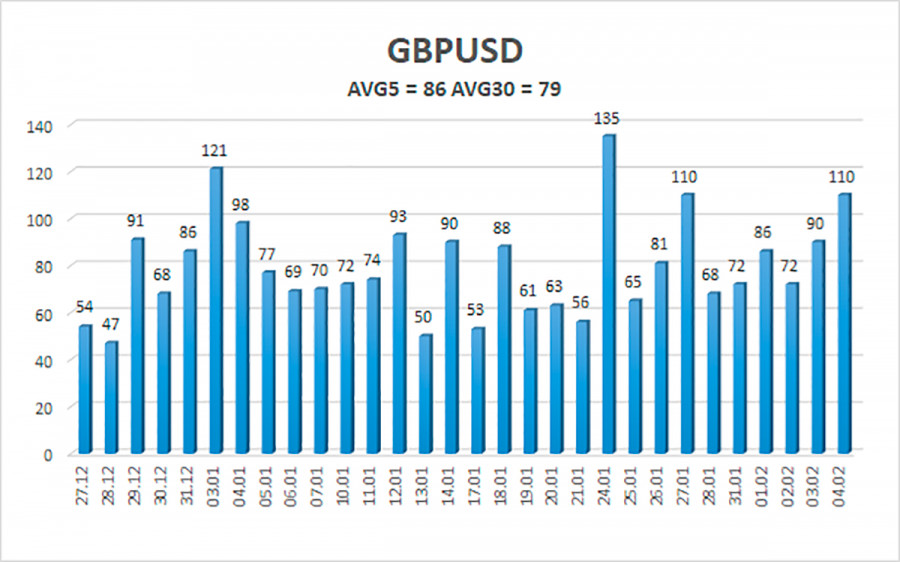

The average volatility of the GBP/USD pair is currently 86 points per day. For the pound/dollar pair, this value is "average". On Monday, February 7, therefore, we expect movement inside the channel, limited by the levels of 1.3439 and 1.3612. The reversal of the Heiken Ashi indicator downwards signals a round of downward correction.

Nearest support levels:

S1 – 1.3489

S2 – 1.3428

S3 – 1.3367

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3611

R3 – 1.3672

Trading recommendations:

The GBP/USD pair began to adjust in the 4-hour timeframe. Thus, at this time, it is recommended to consider options for new long positions with targets of 1.3611 and 1.3672 if the price bounces off the moving average. It is recommended to consider short positions if the pair is fixed below the moving average, with targets of 1.3439 and 1.3428, and keep them open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.