The European currency will rise today, as everyone is waiting for changes in the policy of the Federal Reserve System and is ready to buy U.S. dollars in case of any hints of its more active tightening. It is for this reason that I recommend taking a closer look at buying the euro – everyone is waiting, and, as you know, the market does not often go where "everyone is waiting."

Today, the Federal Reserve will announce plans for its first interest rate hike since 2018 and discuss reducing its bloated balance sheet. All this will be done for one reason – to contain the highest inflation in almost 40 years. The Federal Open Market Committee will almost certainly keep its benchmark rate near zero after Wednesday's two-day policy meeting, while sticking to its plan to cut asset purchases in March.

Federal Reserve Chairman Jerome Powell will hold a press conference later today. It is worth noting that no forecasts will be published at this meeting, so the degree of pressure on the market will decrease slightly.

The U.S. unemployment rate fell below 4% last month, these are almost the indicators at which the full employment level observed before the coronavirus pandemic in the United States can be reached. If the FOMC can confirm that the economy is at or close to full employment, it will automatically make it more appropriate to take the first step towards higher interest rates in the near future. Most likely, this will happen at the next meeting, on March 15-16.

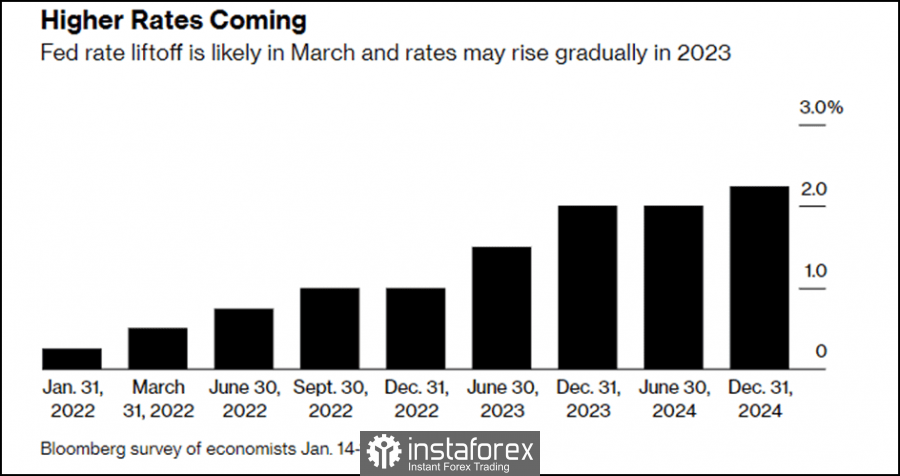

Let me remind you that following the results of the December meeting, politicians announced three rate hikes in 2022. A number of Fed officials supported the first changes in March of this year.

It is expected that following the results of the January meeting, market participants will have an understanding of how the Fed will continue to behave with its set of traditional and non-traditional instruments. The main purpose of the meeting is to inform the markets of their intention to raise rates in March and begin to reduce the balance sheet, which is already clear to everyone. Another thing is whether the Fed will take more aggressive steps in this direction. Until recently, many experts were talking about not four, but even five increases in interest rates this year.

Are there any surprises?

The surprise at the end of the meeting will be the decision to stop quantitative easing in February, and not in March this year. However, even such a move will have a limited impact on the market, since February or March does not play a big role. Now many players are confident that there is no longer a need for stimulus measures.

As for the press conference, Fed Chairman Powell is likely to reiterate the Fed's plans to normalize policy, although it will certainly touch on the COVID-19 issue, which continues to hurt the labor market. Most likely, he will be more careful in his statements than during the December meeting. As for the reduction in the Fed's balance sheet, it seems that such changes can only be expected by September of this year.

The ECB needs to act more actively

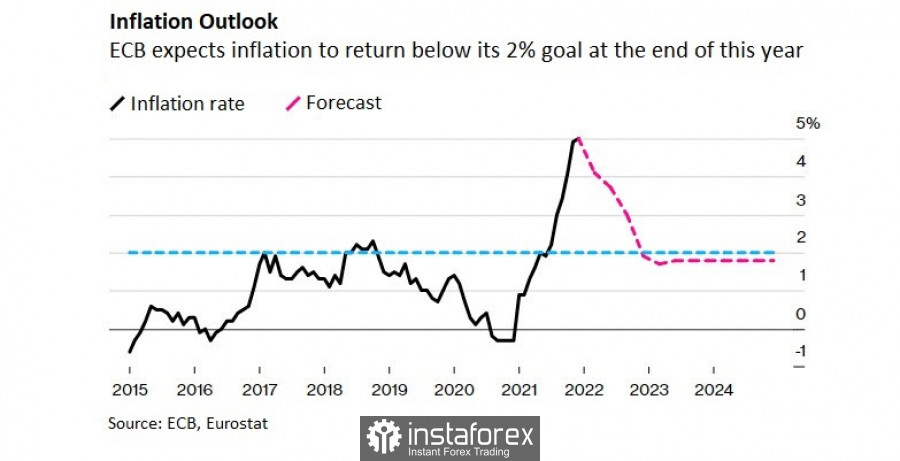

The European Central Bank should prepare to change monetary policy now to prevent the need for more aggressive action in the future, which could lead to turmoil in financial markets, according to a former Federal Reserve official. Inflation in the euro area is likely to be higher than the ECB forecasts, and policymakers can no longer afford to insist that price pressures are temporary. This was concluded by one of the former representatives of the Federal Reserve System.

"The ECB needs to be ready to pivot. Risk management would suggest that they think carefully about how they could talk about an alternative even if they don't think that that's the most likely forecast, because the greatest risk is having to pivot quickly and have tumult in the markets," said former Fed governor Randy Kroszner.

According to the latest data, the ECB forecasts inflation at a record level of 5% - below the target level of 2%.

However, the leadership of the Board of Governors is confident that at the moment the ECB does not need to change its assessment of the inflation forecast. The next decision of the Central Bank on policy is expected in a week, so we'll see. After years of too low inflation, ECB officials are taking a more prudent stance, even as prices are now high, which will help offset past deflation.

Fundamental data

Yesterday, attention was drawn to the S&P CoreLogic Case-Shiller National Home Price Index, which measures average house prices in major metropolitan areas across the country. The report indicated that the index was up 18.8% for the year ended November 2021. Home sales rose to a 15-year high in 2021. Low interest rates have spurred robust demand, and telecommuting has allowed some workers to relocate away from their offices.

Greater competition for the limited number of homes on the market has pushed home prices to record highs. The median price of an existing home in 2021 rose to a record $346,900, up 16.9% from 2020, the National Association of Realtors said. House price growth is expected to slow in 2022 due to rising mortgage interest rates.

The Case-Shiller 10-City Index is up 16.8% for the year. The 20-city index rose 18.3% after an 18.5% annual gain in October.

As for the technical picture of the GBPUSD pair:

Buyers of the pound are not yet very active after yesterday's growth. The bulls need to make more efforts to get beyond 1.3525. Only a breakout of this area will open a direct road to the area of highs - 1.3565 and 1.3615. The nearest support is seen in the area of 1.3480, the breakdown of which will push the trading instrument to the lows - 1.3440 and 1.3390.

As for the technical picture of the EURUSD pair:

Yesterday, the bulls took a very active position on the return of the 13th figure, but it was not possible to protect this level today. A decrease in the trading instrument may lead to an instant sell-off to the areas of 1.1260 and 1.1220. It will be possible to talk about the recovery of risky assets only after a breakthrough and consolidation above the resistance of 1.1315. This will lead to the active growth of EURUSD towards the highs: 1.1360 and 1.1420.