To open long positions on GBP/USD, you need:

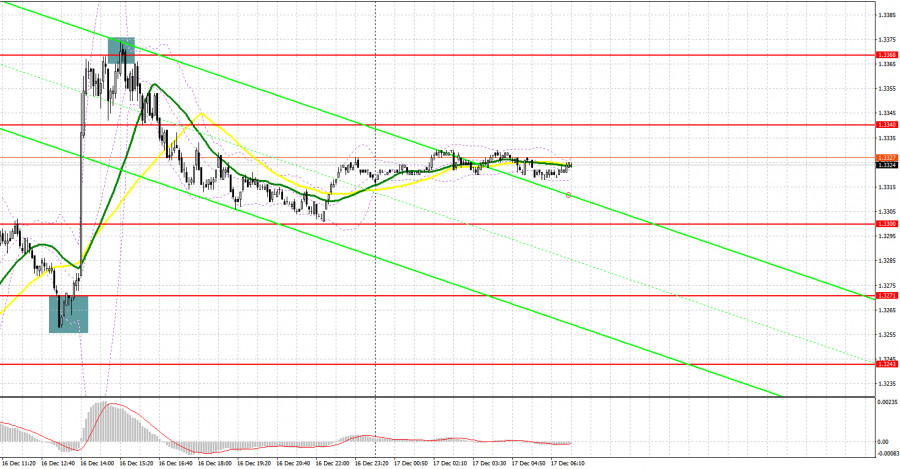

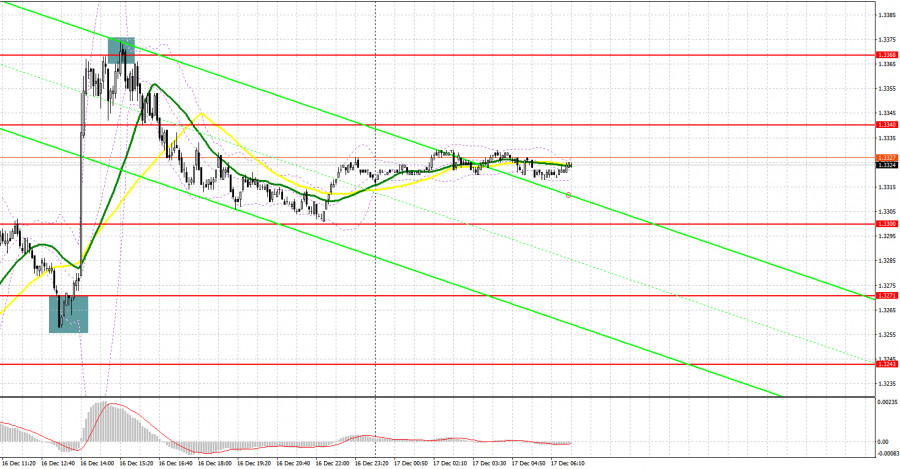

Several rather profitable signals to enter the market were formed yesterday. Let's take a look at the 5 minute chart and see what happened. In my morning forecast, I paid attention to the 1.3270 level and advised you to make decisions on entering the market. A decline in activity in the service sector and small changes in the manufacturing sector in the UK did not prevent pound bulls from rising above the level of 1.3270. However, to my regret, I did not wait for a reverse test of this area from top to bottom, as I noted on the chart, to enter long positions. For this reason, I was forced to miss the signal. The results of the Bank of England meeting were surprising, as the central bank decided to raise interest rates, which led to a sharp rise in the pound in the short term. Even before the decision was announced, a false breakout was formed at the level of 1.3271, at which point I drew attention to it in yesterday's afternoon forecast, which led to a good entry point into long positions. As a result, the pound rose by 100 points. In the second half of the day, an unsuccessful attempt to gain a foothold above 1.3368 led to forming a false breakout and a signal to sell the pound. As a result, the pair fell by about 70 points.

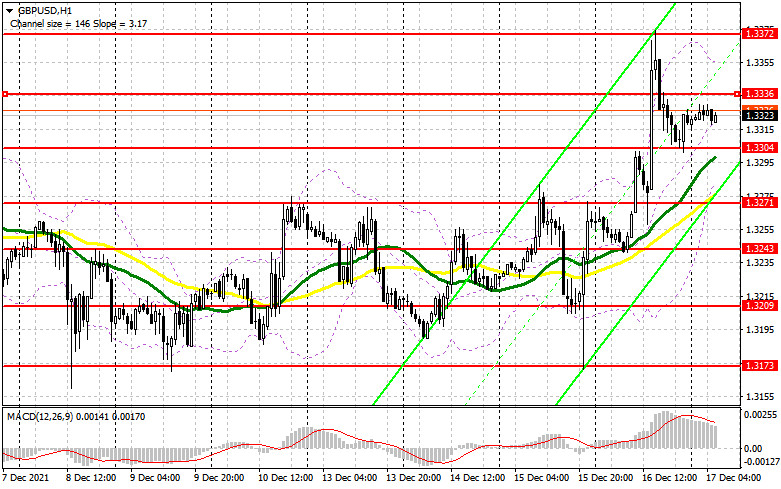

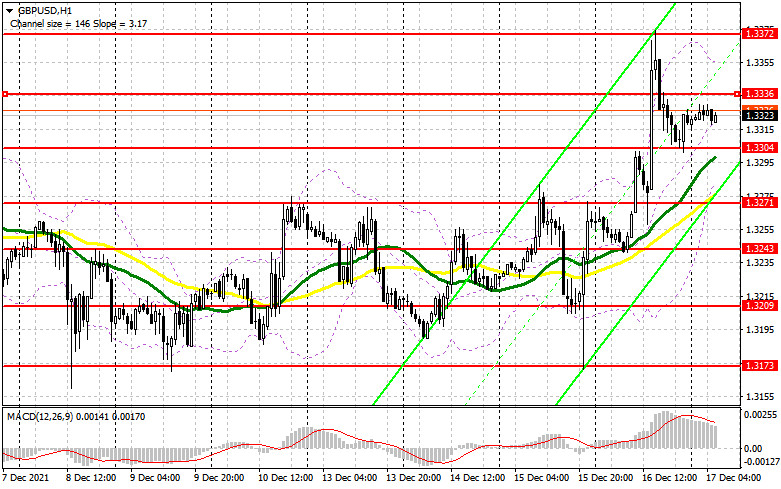

Today we do not have important fundamental statistics, so traders will focus on the continuation of the upward correction, which may well develop into a powerful bullish trend in the near future, especially after the BoE's decision. Of course, the primary task for today is to protect and form a false breakout in the 1.3304 area, where the moving averages, playing on the bulls' side, are held. In this case, you can open long positions with the expectation that the pound would rise and the renewal of the level of 1.3336, which was formed at the end of yesterday. A breakthrough and test of 1.3336 will be an important task, as going beyond this range will allow the bulls to strengthen their positions in order to renew the weekly highs. A downside test of 1.3335, as well as a good quarterly newsletter from the BoE, will provide an additional entry point for buying GBP/USD with the prospect of strengthening to 1.3372. A breakthrough of this range will open the possibility of renewing a high like 1.3407, where I recommend taking profits. The further target is the resistance at 1.3446. The bulls will start to have problems in case the pound falls during the European session and traders are not active at 1.3304, but not so serious, as the upward correction will still be in force. Therefore, forming a false breakout near the next low of 1.3271 will provide an entry point to buy the pound. It is possible to buy GBP/USD immediately on a rebound in the area of 1.3243, or even lower - from 1.3209, counting on a correction of 20-25 points within the day.

To open short positions on GBP/USD, you need:

The bears need to work very hard to get the market back under their control. Trading against a bullish trend is not the right decision, so be extremely careful with short positions today. Bears should not release the pound above 1.3336, as this will lead to the demolition of a number of stop orders and a more active recovery of the pair. Forming a false breakout at 1.3336 will provide the first good entry point to short positions with a subsequent decline to the 1.3304 area. An active struggle will unfold for this level, since there are moving averages playing on the side of the bulls. A breakthrough of 1.3304 will increase pressure on the pound, but will not create serious problems for bulls who would prefer to move lower - to the 1.3271 area. A reverse test of 1.3304 from the bottom up will provide an excellent entry point with the prospect of a decline in the pound to 1.3271. Further targets will be lows: 1.3243 and 1.3209, the renewal of which will put a "cross" on yesterday's bull market after the BoE's decision to raise rates. If the pair grows during the European session and bears are weak at 1.3336, and after a false breakout is formed, the downward movement should occur quite quickly. If we still do not see a decline from GBP/USD, it is best to postpone selling until the larger resistance of 1.3372. I also recommend opening short positions there only in case of a false breakout. Selling GBP/USD immediately on a rebound is possible only from a large resistance at 1.3407, or even higher - from a new high in the 1.3446 area, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) reports for December 7 revealed that both short and long positions decreased. Considering the almost equal reduction of positions, this did not lead to serious changes in the negative delta. Bad data on the UK economy, which came out at the end of last week, clearly spoiled the mood of the buyers of risky assets, counting on an upward correction in the pair ahead of the Bank of England meeting. This week, BoE Governor Andrew Bailey will share his stance on the future of monetary policy. If it continues to be dovish in nature, most likely the pressure on the pound will only grow, as the representatives of the Federal Reserve, on the contrary, are going to curtail stimulus measures, which should support the US dollar. High inflation continues to be the main reason why the BoE may change its mind with the preservation of stimulus measures, however, uncertainty will remain until the results of the meeting on December 16 are announced. An equally serious problem for the UK is the new Omicron coronavirus strain, which could lead to another lockdown and the country's quarantine. So far, the authorities have to closely monitor the development of the situation with the new strain, which negatively affects the economy at the end of this year. The December 7 COT report indicated that long non-commercial positions declined from 52,099 to 48,950, while short non-commercials dropped from 90,998 to 87,227. This kept the negative non-commercial net position almost unchanged. : -38,277 versus -38,899 a week earlier. The weekly closing price dipped slightly from 1.3314 to 1.3262.

Indicator signals:

Trading is carried out above 30 and 50 moving averages, which indicates an attempt by the bulls to continue the pound's growth.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the upper border of the indicator in the area of 1.3360 will lead to a new wave of growth of the pound. A breakout of the lower border of the indicator around 1.3300 will increase the pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.