Analysis of transactions and tips on trading EUR

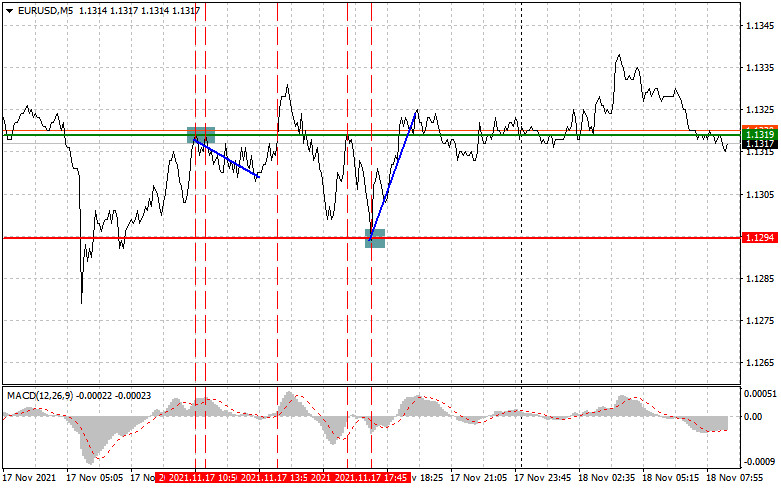

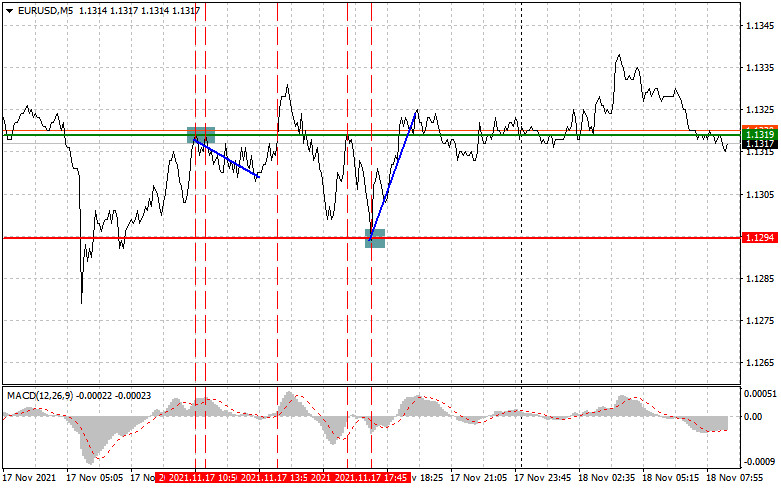

Yesterday, trading activity was somehow affected by the fact that the euro was trading in a narrow channel. The first two attempts to test 1.1319 occurred at the very beginning of the European session. However, at the time of reaching this level, the MACD indicator was located in the overbought zone. It restrained the upward momentum. So, many traders switched to short positions. However, a major drop in the pair did not happen. The quotes lost only 10 pips. In the afternoon, the price broke above 1.1319 but there were no signals to enter the market due to a discrepancy with the MACD indicator. Only in the afternoon, the euro tumbled, testing the level of 1.1294. The MACD indicator entered the oversold area. So, a new signal was formed to open long positions, which brought about 25 pips of profit.

The eurozone consumer price index report did not surprise traders as its reading completely coincided with economists' forecasts. Therefore, bulls were unable to give a boost to the euro in the first half of the day. Several Fed members made a speech during the New York session. however, market participants mostly ignored it. Today, in the morning, the economic calendar does not contain any important reports for the eurozone. This is why traders are likely to focus on the speech of Fabio Panetta, a member of the Executive Council of the European Central Bank. In the afternoon, the US will unveil the Philadelphia Fed Manufacturing Index as well as the weekly jobless claims report. These reports are unlikely to have a huge impact on the market. Rafael Bostic, John Williams, and Mary Daly are scheduled to deliver a speech by the end of the day.

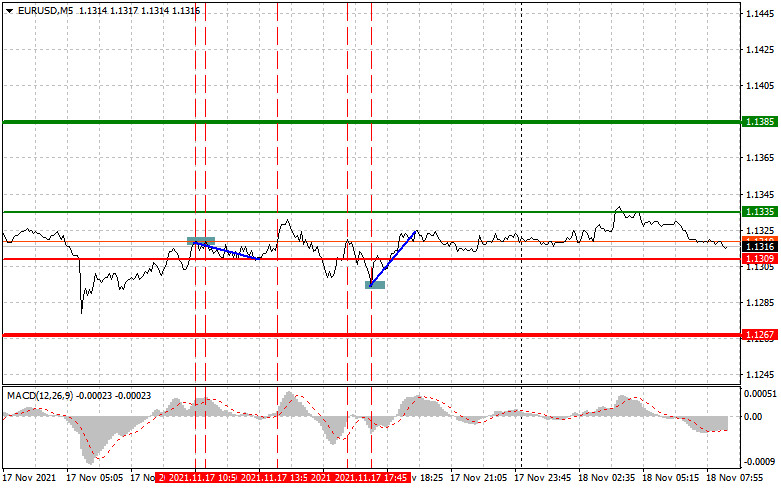

Entry points to open long positions

Scenario 1: it is recommended to open long positions on the euro when the price reaches 1.1335 (the green line on the chart) with the target level of 1.1385. At the level of 1.1385, it is better to lock in profits and sell the euro, counting on a movement of 10-15 pips in the opposite direction from the level. The euro may climb higher amid the newly formed upward correction. Important! Before opening long positions, make sure that the MACD indicator is above the zero mark and it has just started to rise from it.

Scenario 2: it is also possible to open long trades on the euro today if the price approaches 1.1309. The MACD indicator should be in the oversold area, which will limit the downward movement of the pair. As a result, it may trigger an upward reversal. The euro is likely to rise to the opposite levels of 1.1335 and 1.1385.

Entry points to open short positions

Scenario 1: it is recommended to open short positions on the euro after the price declines to the level of 1.1309 (the red line on the chart) with the target level of 1.1267 level. At this level, it is better to close trades and open long positions, counting on a movement of 10-15 pips in the opposite direction from the level. Bulls may try to take the upper hand if the US economic reports turn out to be upbeat. The speeches of the Fed policymakers may also facilitate the growth of the US dollar. Important! Before opening short positions, make sure that the MACD indicator is below the zero mark and it has just started to decline from it.

Scenario 2: it is also possible to sell the euro today if the price declines to 1.1335. The MACD indicator should be in the overbought area, which will limit the upward movement of the pair. So, the pair is highly likely to maintain its downward movement. The price may fall to the opposite levels of 1.1309 and 1.1267.

Description of the chart:

The thin green line is the entry point to open log positions.

The thick green line is the estimated price where you can place the Take Profit order or lock in profits by yourself as the price is unlikely to climb above this level.

The thin red line is the entry point to open short positions.

The thick red line is the estimated price where you can place the Take profit order or lock in profits by yourself as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to study overbought and oversold zones.

Important. Novice traders need to make very careful decisions when entering the market. Before the release of important fundamental reports, it is best to stay out of the market to avoid losses because of sharp fluctuations in the exchange rate. If you decide to trade during the news release, then always place Stop Orders to minimize losses. Without placing Stop Orders, you may lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan, following the example of the one presented above. Intraday traders are likely to incur losses by making spontaneous trading decisions based on the current market situation.