Long positions on GBP/USD:

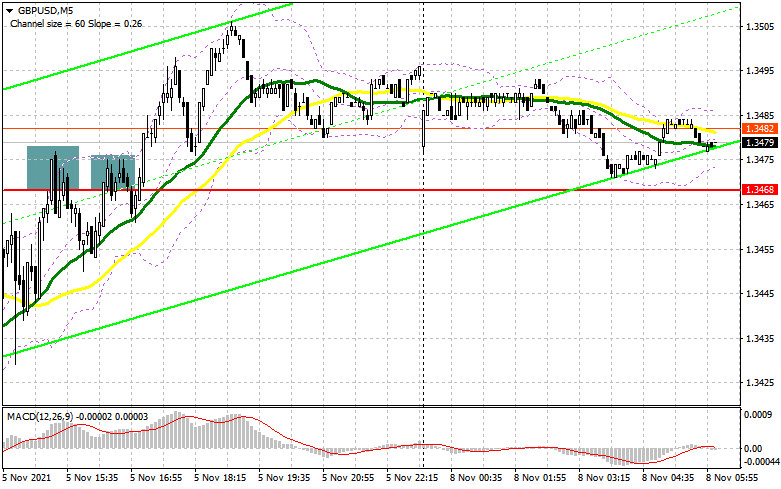

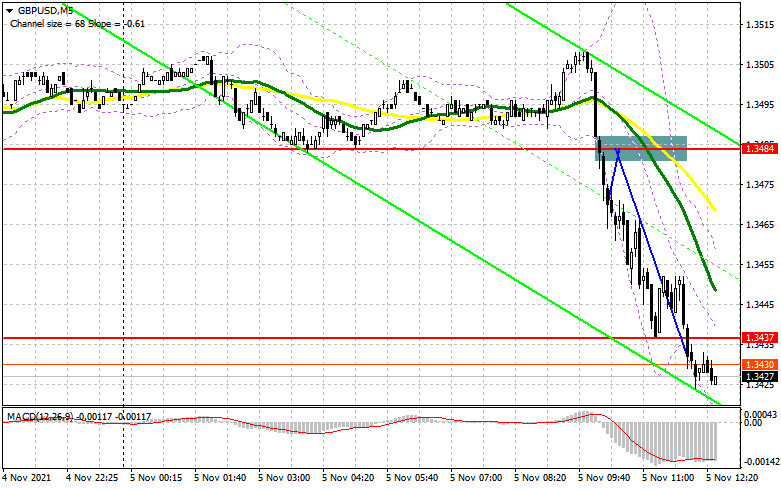

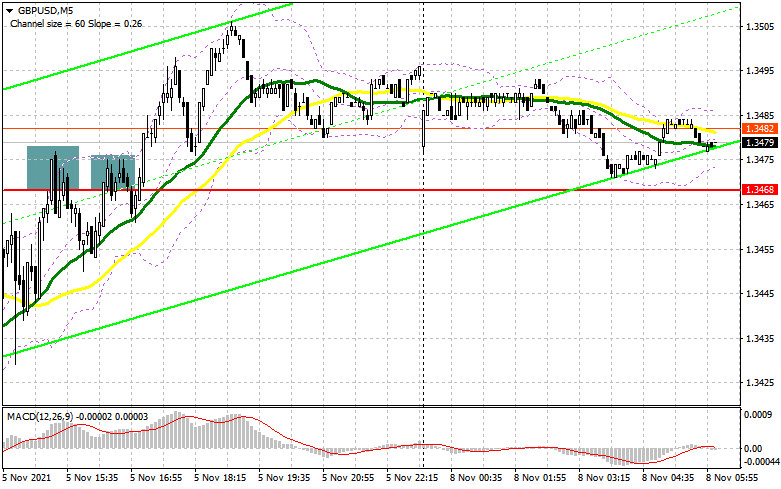

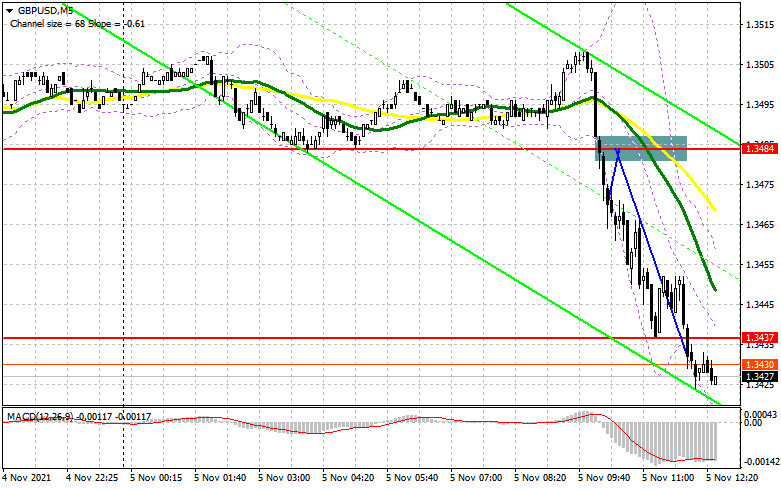

There were several entry signals on Friday. Let's look at the M5 chart and analyze the entry points. The pound sterling remained under pressure after the recent announcement made by the Bank of England's governor. In the previous review, the focus was on the level of 1.3084 where I told you to consider entering the market. An instant breakout of this range without a retest top/bottom made it impossible for the SELL entry point to form. Nevertheless, it was still possible to sell the pair due to the bearish trend that occurred in the market after a plunge. As a result, GBP/USD fell by more than 50 pips to the support level of 1.3437. The released US labor market statistics had no effect on the weak pound sterling. An upward correction and a false breakout at 1.3468 pushed the pound downward by just 15 pips.

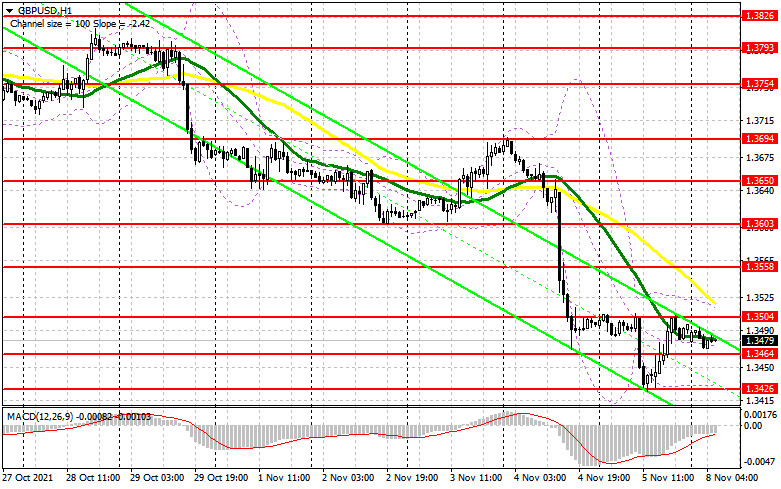

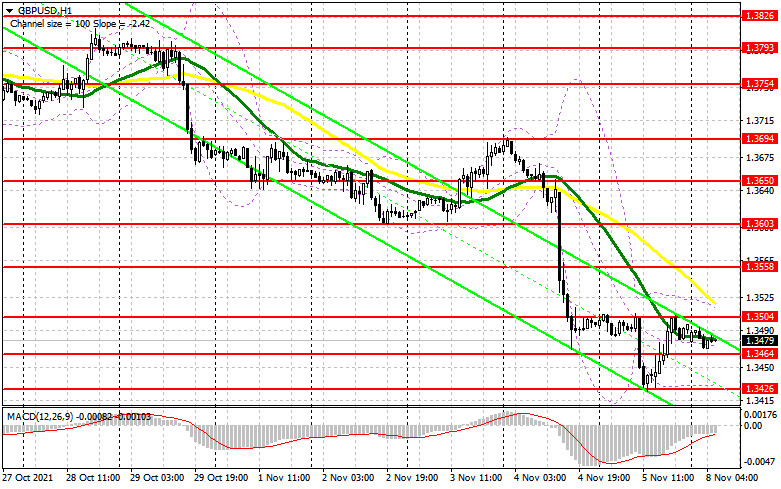

Today, amid the lack of important fundamental data, the only event in focus will be Governor Andrew Bailey's speech. He lost investors' trust after changing his stance on monetary policy last Thursday, which led to a fall in the pound sterling. The crucial task for bulls would be to protect the support level of 1.3464. Only in case of a false breakout at this level, there could be a chance for an upward correction intraday. If so, the price is likely to head towards the resistance level of 1.3504. An equally important task would be to regain control over this level. A breakout and a retest of this mark top/bottom are likely to produce a BUY signal, which could lead to the pair's rise to 1.3558 and 1.3603, where traders should consider locking in profits. A further target is seen at the high of 1.3650. The quote could approach it if only Governor Bailey says that inflation is posing a threat to the economy and actions should be taken immediately. Anyway, this is unlikely to happen. In case of a downward movement in the first half of the day and the lack of bull activity at around 1.3464, long positions could be opened after a retest of the support level of 1.3426. At the same time, traders could go long from this mark in case of a false breakout there. Long positions on GBP/USD could be opened immediately on a bounce from a new low of 1.3375 or even lower, from the support level of 1.3308, allowing a 25-30 pips correction intraday.

Short positions on GBP/USD:

So far, the market is under bear control. Nevertheless, not so many traders are willing to sell the pair. All sellers should do at the moment is to break and retest the level of 1.3464 bottom/top. If so, a SELL signal will appear. Divergence formed on Friday has almost been priced in. Therefore, if the above-mentioned scenario plays out, it will become possible to sell the pound. In case of a breakout at 1.3464, the quote is likely to head towards lows of 1.3426 and 1.3375, where traders should consider looking in profits. A further target is seen at 1.3308. However, the price will be able to go there only in case of Governor Bailey's dovish stance on monetary policy during the meeting. If there is an upward correction in the first half of the day, a false breakout at around 1.3504 will generate a SELL signal. If GBP/USD rises above this mark, it would be wise to sell the pair after the price approaches the resistance level of 1.3558. Short positions immediately on a bounce could be opened from 1.3603 or from the new high of 1.3650, allowing a 20-25 pips correction intraday.

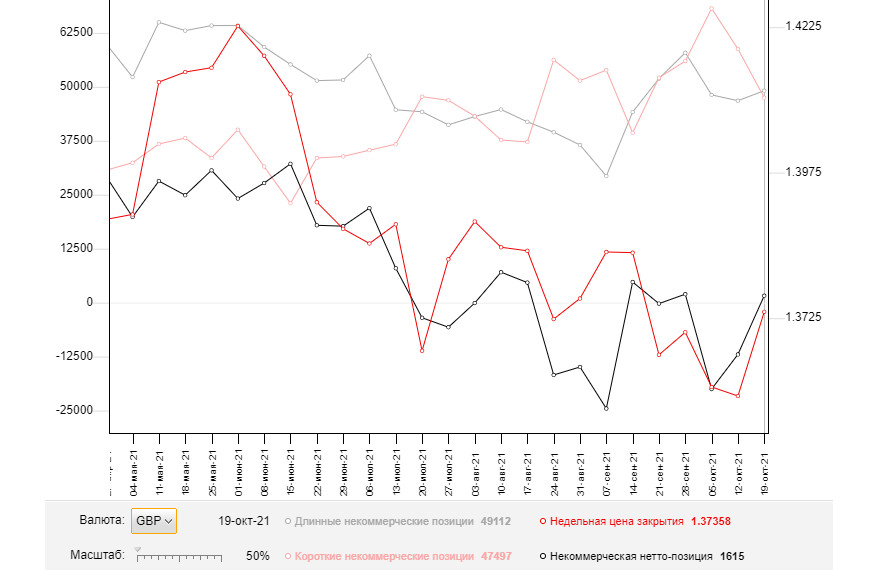

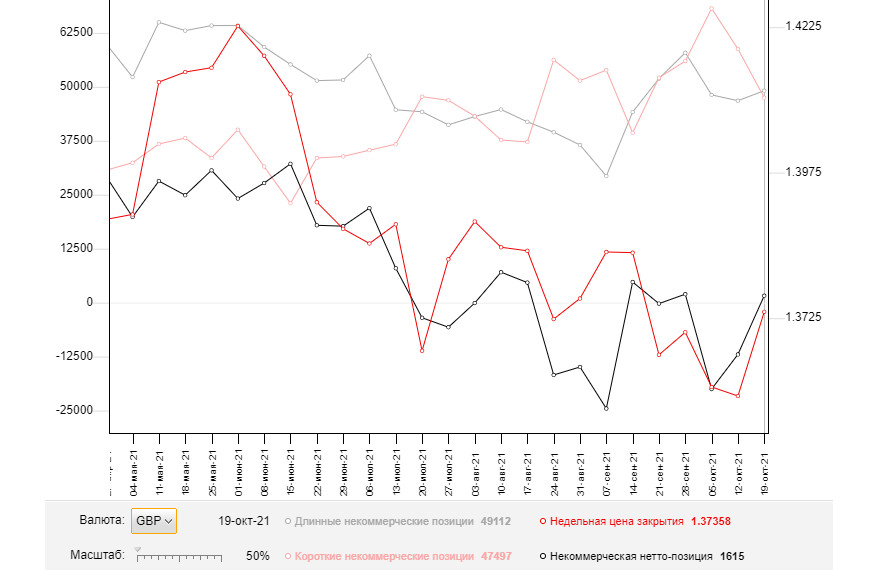

Commitment of Traders:

The Commitment of Traders report as of October 19 logged a decrease in short positions and an increase in long ones, reflecting an upward trend in the market. The Bank of England's decision will determine GBP's further direction in the short term. After a downward correction, bulls are highly likely to start buying the pound at a more favorable price regardless of the BoE's decision. Andrew Bailey's speech could have a positive effect on the market because the inflationary pressure issue would force the regulator to take action sooner or later. I expect the pound sterling to be bullish and think that traders should take advantage of every decrease in price in the short term. The COT report also showed an increase in long non-commercial positions to 49,112 versus 46,794 and a drop in short non-commercial positions to 47,497 from 58,773. As a result, the non-profit net position turned positive. The delta came at 1,615 versus -11,979 a week earlier. The GBP/USD closing price soared to 1.3735 from 1.3591.

Indicator signals:

Moving averages

Trading is carried out below 30- and 50-period MAs, indicating the continuation of the bearish trend in the short term.

Important! The period and prices of moving averages are viewed by the author on the hourly H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands

In case of growth, the quote is likely to encounter resistance at the upper band at around 1.3505. Support is seen at the lower band at around 1.3426.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.