To open long positions on GBP/USD, you need:

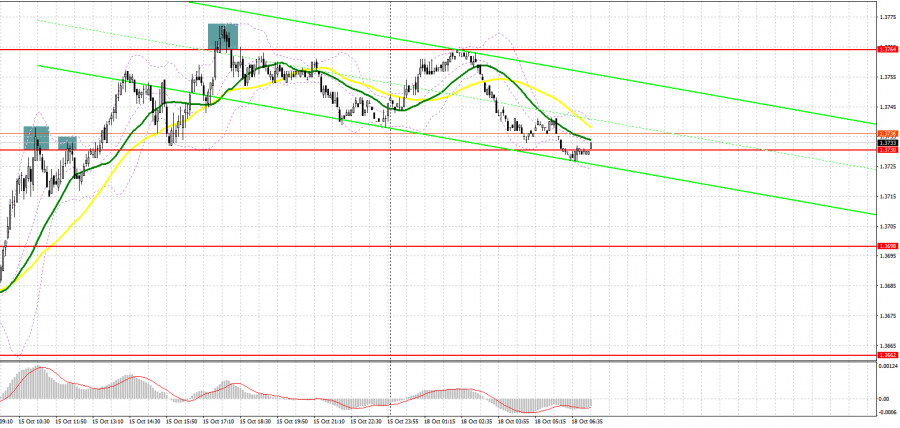

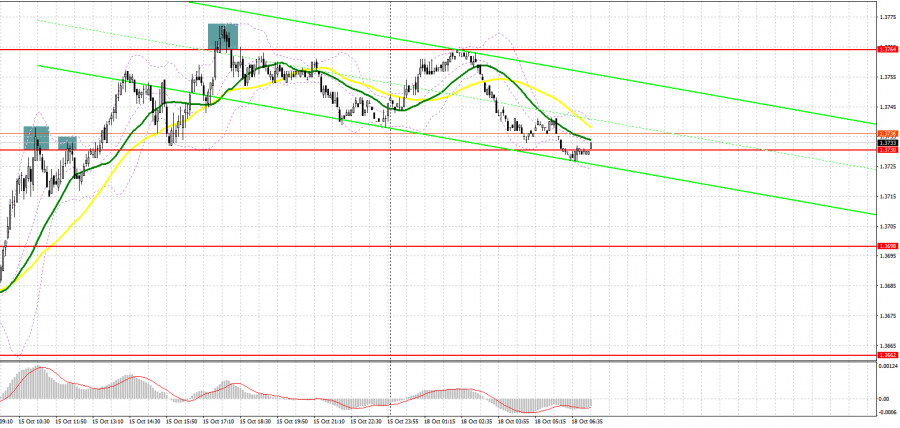

Several interesting market entry points were formed on Friday. Let's take a look at the 5 minute chart and figure it out. A sharp breakthrough and growth to resistance at 1.3730 resulted in forming a false breakout and a signal to open short positions, counting on a downward correction, which amounted to about 15 points. Then we broke through 1.3730, but before the reverse test of this level from top to bottom, just a couple of points were missing, which did not allow us to enter the market. Only a false breakout of the new 1.3764 high in the afternoon led to another entry point for shorts, pushing the pound down 20 points.

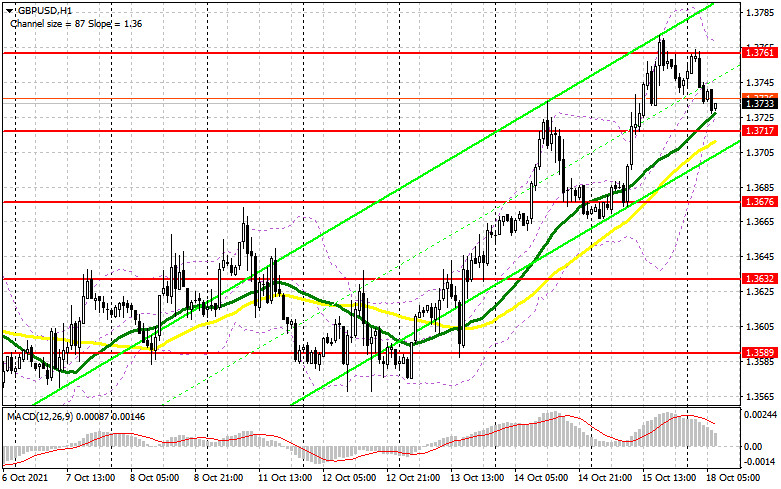

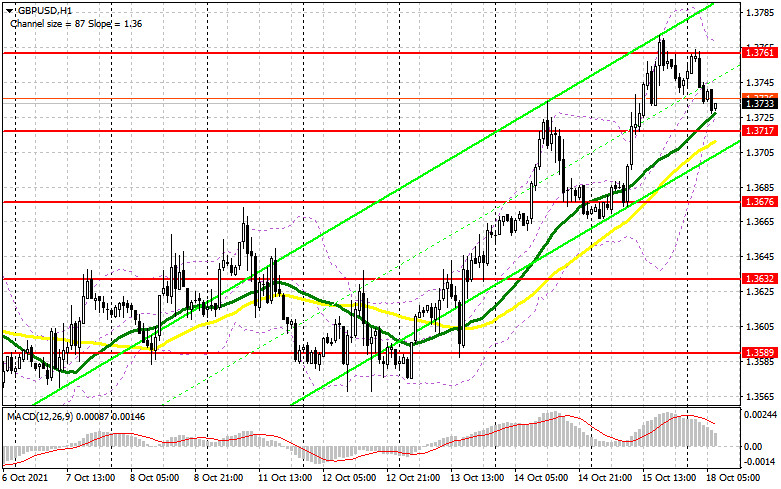

Today there are no important reports on the British pound and we can expect a slight decline in the pair in the short term. Only the speech of the Deputy Governor of the Bank of England for Financial Stability Jon Cunliffe can lead to a surge in market volatility, which will strengthen the position of GBP/USD. Pound bulls need to think carefully about how to protect the support at 1.3717, in the area of which the moving averages, playing on their side, pass. If the bulls miss this level, the pressure on the pound could seriously increase. Therefore, only a false breakout there can create an entry point into long positions with the goal of recovering to weekly highs in the area of 13761. A breakthrough and consolidation above this range with a reverse test from top to bottom will allow the British pound to get out to new local levels: 1.3803 and 1.3839, where I recommend taking profits... The next target is still the 1.3878 area. If the bulls are not active in the 1.3717 area, the optimal buying scenario will be a test of the next support at 1.3676. I advise you to watch long positions of GBP/USD immediately for a rebound but only from a low like 1.3632, counting on an upward correction of 25-30 points within a day.

To open short positions on GBP/USD, you need:

The bears have so far managed to defend the previous week's highs and even formed a rather large bearish movement for the pound during the Asian session. It is quite possible that the pressure on the pair will continue in the first half of the day before the publication of a number of reports on the American economy. Most likely, the bears will focus on protecting the 1.3761 level. Only an unsuccessful attempt to consolidate above this range, as well as the formation of a false breakout there, by analogy with what I analyzed above, can create a signal to open short positions in hopes that the pair would fall. But such a scenario will only lead to GBP/USD hovering in a horizontal channel and will not seriously affect the bulls' plans. Therefore, a more important task is to regain control over the support level of 1.3717, which is much more difficult to do, since there are moving averages playing on the side of the bulls. A breakthrough of this area and its reverse test from the bottom up will form a signal to open short positions based on the test of 1.3676 and then to renew the low in the 1.3632 area, where I recommend taking profits. In case the pound recovers further and the bears are not willing to sell at 1.3761, only a false breakout in the area of the next resistance at 1.3803 will be a signal to open short positions in GBP/USD. I advise selling the pound immediately on a rebound from the larger resistance 1.3839, counting on the pair's rebound down by 20-25 points within the day.

I recommend for review:

The Commitment of Traders (COT) report for October 5 revealed a sharp increase in short positions and a reduction in long positions, which led to a shift in the negative zone of the overall net position. Despite the rather active recovery of the pair a week earlier, it was not possible to continue the bullish trend for the pound. Although all the prerequisites for this were there. The data showed that supply chain problems in the UK remain high enough to push prices upward. It is unlikely that such a development of the situation will force the Bank of England to stand on the sidelines for a long time and watch the inflation spiral unfolding. The minutes of the meeting of the British central bank, which was published a week earlier, indicated that changes in monetary policy could be adopted as early as November this year. Therefore, the only problem that stands in the way of the pound bulls is the US Federal Reserve, which, although not going to raise interest rates, is also heading towards tightening monetary policy. Despite all this, I advise you to buy the pound in case of significant corrections, as the trading instrument is expected to grow in the medium term. The COT report indicated that long non-commercial positions fell from 57,923 to 48,137, while short non-commercials jumped from 55,959 to 68,155, leading to a partial build-up of bears' advantage over the bulls. As a result, the non-commercial net position returned to negative territory and dropped from the 1964 level to the -20018 level. By the results of the week, the closing price of GBP/USD dropped to 1.3606 against 1.3700.

Indicator signals:

Moving averages

Trading is carried out above 30 and 50 moving averages, which indicates the formation of a new bullish scenario.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.3717 will result in forming pressure on the pair.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.