4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - sideways.

The EUR/USD currency pair on Wednesday evening and Thursday finally started the movement that many have been waiting for. Recall that the euro/dollar pair has been in a downward movement for more than a month, while this movement was almost recoilless. The US currency has grown over this period by almost 4 cents against the euro. Nevertheless, questions have repeatedly arisen based on which the US dollar feels so confident? As we have already said, the fundamental background does not support the dollar at the moment, and the markets ignore macroeconomic statistics (in most cases). However, the day before last night, the fall of the US currency began, and we expect it will be the beginning of a new long-lasting downward trend. Volatility remains quite weak, so even 50-60 points movement is now considered strong enough. Therefore, in the illustration above, the increase in quotes by 100 points looks like the beginning of a new trend. In principle, we consider this scenario to be quite reasonable at this time. First, the CCI indicator entered the oversold area three times (below the -250 level). And such calls are considered strong signals for a trend reversal. Second, we remind you that the global fundamental factor, which speaks of filling the American economy with hundreds of billions of dollars, has not gone away. As it flooded the economy with $120 billion at least every month, the Fed continues to do so now. The ECB has already announced that it will reduce the volume of asset repurchases in the last months of the outgoing year. And the Fed is still beating around the bush and does not even give a clear answer to the markets when the curtailment of incentives will begin. As a result, the markets have been buying the US dollar upfront for a long time, but this could not continue permanently. We think that now is a good time to start a new upward trend.

The QE program, unfortunately, remains the key moment for the dollar's prospects at this time. We have already said that in recent weeks, the US currency has been growing in price, presumably due to the markets' expectations for the early curtailment of the QE program. Only the markets did not wait for this. The Fed minutes, which were published on Wednesday evening, once again showed that conversations are underway among the Fed board members, but no specific decisions have been made. At the same time, the "asset of the Fed," which includes several members of the monetary committee who constantly appear in the media, continues to say that now is a good time to start giving up incentives. For example, the day before yesterday, the president of the Atlanta Fed and the Vice president of the Fed announced this. However, the markets could get used to these statements. But there are still no real actions. The minutes from the last meeting of the central bank stated that the monetary committee members discussed possible options for reducing QE volume but could not agree on this issue. An option was announced in which the volume of buying treasuries would decrease by 10 billion per month at first, and the volume of mortgage bonds by 5. However, the protocol also states that some FOMC members support a faster winding down. It is unclear how many board members support this or that decision.

It is also absolutely unclear when the QE program will eventually begin to shrink. In August and early September, many expected that this would be announced at the September meeting. Now everyone is waiting for that in November. However, in reality, this decision may be made in December. Thus, there is still no clarity on this issue. Especially considering the latest reports on inflation and Nonfarm. Recall that the labor market began to slow down in its recovery, and inflation began to accelerate again. Therefore, on the one hand, the Fed needs to continue stimulating the recovery of the labor market, and on the other – to think about how to curb inflation, which risks reaching 30-year highs. With such a fundamental background, we believe that the fall of the dollar is a logical development.

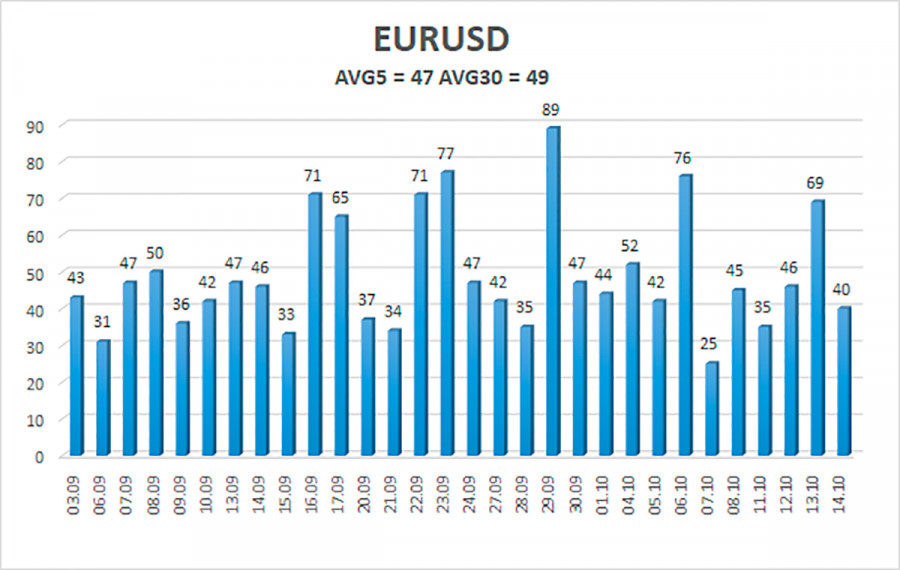

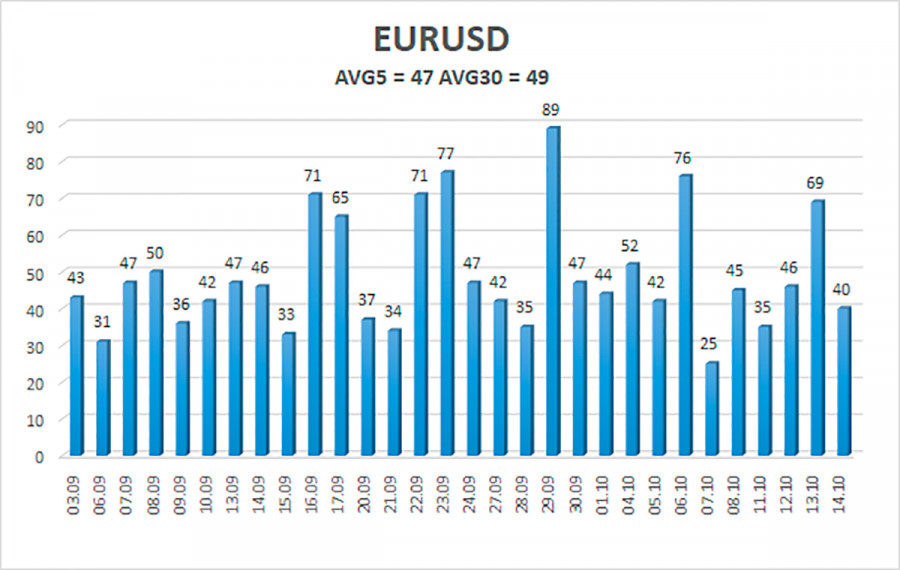

The volatility of the euro/dollar currency pair as of October 15 is 47 points and is characterized as "low." Thus, we expect the pair to move today between the levels of 1.1544 and 1.1638. The reversal of the Heiken Ashi indicator downwards signals a new round of downward movement.

Nearest support levels:

S1 – 1.1597

S2 – 1.1536

S3 – 1.1475

Nearest resistance levels:

R1 – 1.1658

R2 – 1.1719

R3 – 1.1780

Trading recommendations:

The EUR/USD pair has consolidated above the moving average line, so the trend has changed upward. Thus, today, you should stay in buy orders with targets of 1.1638 and 1.1658 until the Heiken Ashi indicator turns down. Pair sales should be opened if the price is fixed below the moving average with targets of 1.1544 and 1.1536. They should be kept open until the Heiken Ashi indicator turns up.

Explanations to the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.