The upcoming week is full of important events. The results of the 5-day trading week will either strengthen the dollar's dominance throughout the market, or return the greenback to its previous positions. If we talk directly about the EUR/USD pair, then here we are talking about the fate of the 10th figure. By and large, the prospect of a downward trend depends on the key support level of 1,1005 (the bottom line of the Bollinger Bands indicator on the monthly time frame) - either the bears push this target, or the bulls eventually take over the initiative and send the price to the range of 1.1240-1.1310, and later in the region of 15-16 figures.

A similar situation was seen in August last year, although a monthly low was marked at 1.1280 back then. Sellers did not find the strength to continue the offensive, after which the price in September returned to the middle of the 16th figure. Another attempt was made in November - the pair fell to the bottom of the 12th figure, but then rose to the mark of 1.1450. In other words, the EUR/USD pair's movement is wavy, so the price dynamics of recent days is not surprising - moreover, the decline looks quite logical, given the previous growth. The only question is will the next "downward wave" be able to break through a powerful price barrier of 1.1005? After all, if the pair consolidates in the area of the ninth figure, it will be more difficult to return, including at the expense of the cascade-like execution of the stops. Therefore, in this case, the role of the "foundation" is much higher, since new price horizons are at stake.

On Monday, April 29, a rather important release will be published - the main index of personal income and spending. This indicator indicates the level of demand in the country and, in general, the level of consumer activity. According to preliminary forecasts, the indicator will show a negative trend - in annual terms, it will drop to 1.6%. Such a result will complement the negative inflationary picture, given the decline in core inflation, wages and the price index of US GDP. A decline in the consumer confidence indicator, which will be published on Tuesday, is also expected. According to forecasts, it will reach 123.5 points, continuing the negative trend.

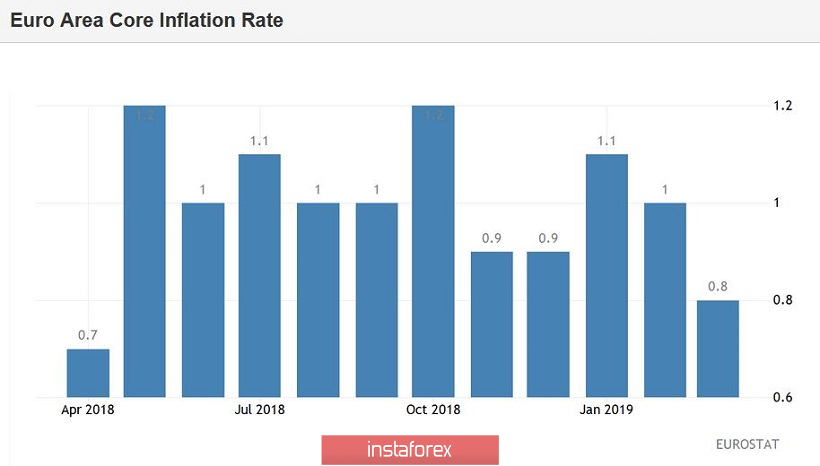

But during the European session on Tuesday, we will find out data on the growth of the European economy in the first quarter of this year. If this release comes out at the level of forecasts, the single currency will receive some support. In quarterly terms, the indicator should rise to 0.3% (from 0.2% in the 4th quarter of 2018), and in annual terms - up to 1.2% (from 1.1% in the 4th quarter). It is worth noting that even a slight increase in the indicator relative to the previous period will reduce the concerns of traders about the possible resumption of the QE program by the European Central Bank. Let me remind you that last week ECB Vice President Luis de Guindos did not rule out this possibility, after which the euro slumped throughout the market. Eurozone GDP growth will reduce the relevance of such concerns. Also, the single currency will respond to the dynamics of inflation in the eurozone: the corresponding release will be published on the last day of the trading week. According to forecasts, the most important indicator for the ECB will recover - both in monthly and annual terms. Core inflation should also return to the 1% mark, after an unexpected decline to 0.8%. And although preliminary data will be the only thing that is published this week, they will have a very strong impact on the euro.

On Wednesday, May 1, the trading floors of most European countries will be closed - as in the CIS countries, Europeans will celebrate Labor Day. But in the afternoon the foreign exchange market will be "hot": the Fed will announce the results of its two-day meeting. The main intrigue of this event is how optimistic/pessimistic members of the regulator will appreciate the controversial macroeconomic statistics of April. On the one hand, there is a solid growth in US GDP, strong corporate reports and Nonfarm, on the other hand, a weak wage growth rate, a downward trend in the price index of GDP, and finally, the continuing decline in core inflation.

In such conditions, it is possible to place the necessary accents in completely different ways. If the Fed decides that "the glass is half full," and the US economy is growing at a faster pace, then the likelihood of a rate hike at the beginning of next year will increase again. But if the Fed members focus their attention on falling inflation (which, in my opinion, is more likely), then the dollar will not only lose its conquered position, but also make it possible for EUR/USD bulls to develop a large-scale correction, within which they will overcome the key mark of 1 1240. Given the fact that the US currency has impressively risen in price across the entire market (putting pressure on the US export sector), it can be assumed that members of the regulator are unlikely to risk tightening their rhetoric. Consequently, the results of the May meeting of the Federal Reserve may provoke or support an upward correction of the EUR/USD.

On Thursday, traders will be trading under the impression of this meeting (since the economic calendar of this day is practically empty), but on Friday, all market attention will be focused on the Nonfarm data. According to preliminary forecasts, the US labor market will demonstrate a positive trend: the unemployment rate will remain at a record-low level of 3.8%, while the number of people employed in the non-agricultural sector will grow by 180 thousand. However, this result is unlikely to impress traders - at least this will not be enough to resume the dollar's rally. But the dynamics of the average hourly wage will be of particular interest, especially in light of the latest inflation data. According to forecasts, the indicator will show a positive result - both in annual and monthly terms. If this forecast is confirmed, the dollar will remain "afloat", but otherwise the attractiveness of the US currency will decrease.

Thus, the most important macroeconomic reports will be published this week, which can affect the motion vector of EUR/USD in the medium term. The May meeting of the Federal Reserve will only increase the price turbulence for the pair, which is inevitable in any case.