The GBP/USD currency pair continued its upward movement on Monday. Although the day began promisingly for the dollar, the British pound quickly regained its strength as the European trading session opened. As a result, the pound's growth persists, leaving the market puzzled as to why it continues to rise.

In our analysis of the EUR/USD pair, we discussed the reasons behind the euro's strengthening. The British pound may be experiencing a similar rise. A correction on the daily timeframe had been anticipated for the pound as well, and Donald Trump indirectly affects the pound through his influence on the dollar. The market seems to be moving away from a currency belonging to a country whose president can impose and revoke sanctions on another nation with little notice.

This situation feels reminiscent of a video game. Imagine pressing a button to begin a battle on-screen; press it again, and the battle ends, giving way to peace, friendship, and prosperity. Watching Trump, it feels as if he is playing a game—there are no lengthy negotiations, no extensive preparations, and no need for voting in Congress or the Senate. Instead, one can simply declare a state of emergency and govern without involving Congress or the Senate. It seems easy, straightforward, and efficient.

The situation in Colombia is worth recounting. The U.S. sent two military planes to Colombia carrying individuals scheduled for deportation, but Colombia refused to accept them. In response, Trump announced a 25% tariff on Colombian imports and imposed travel bans to the U.S. on all Colombian officials. He also threatened to deport all Colombian embassy and consulate staff in the U.S. Colombian President Gustavo Petro quickly retaliated by raising tariffs on U.S. imports by 25%. This series of events unfolded on a Sunday. By Monday morning, however, Colombia had agreed to all U.S. demands, accepted the flights with deportees, and all tariffs were canceled. It was a whirlwind of events.

Despite this, we believe the market cannot remain in a state of constant panic. Eventually, it will recognize that reacting to Trump's news is as futile as trying to predict which way the wind will blow in a week. It's meaningless. The dollar is currently declining as part of a necessary correction, and Trump's actions are merely accelerating this process. Of course, there is a chance that the market will continue to offload the dollar if Trump continues to make unpredictable decisions. If that occurs, the global trend might shift. However, we aren't ready to make that leap just yet.

This week will also feature a Federal Reserve meeting, and it's important to understand how the dialogue between Trump and Powell will unfold this time. Next week, the Bank of England will hold its own meeting. We do not believe that all macroeconomic factors will suddenly become irrelevant. If they remain valid, we are simply witnessing a standard correction on the daily timeframe. Alarm bells should only sound if the exchange rate rises above the 1.2800 level.

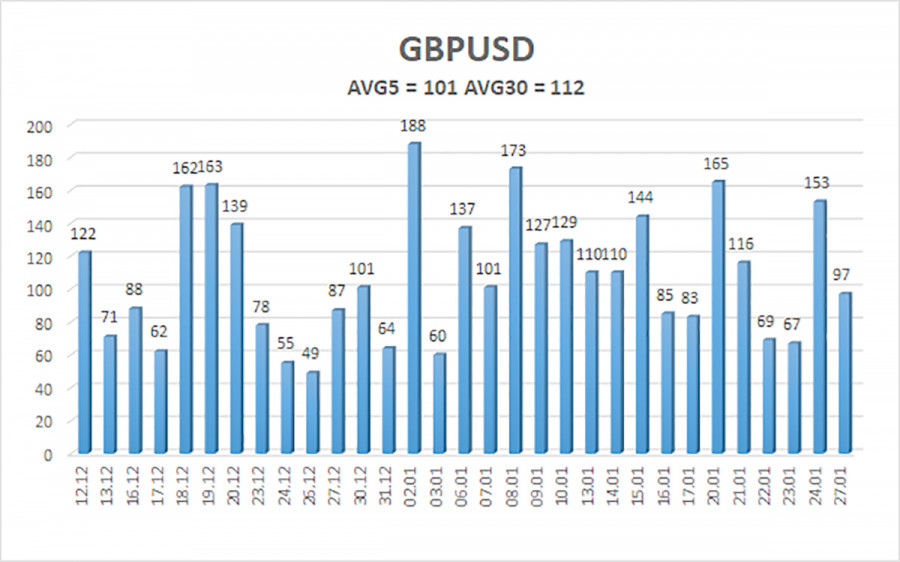

The average volatility of the GBP/USD pair over the last five trading days is 101 pips, which is classified as "medium" for this pair. Therefore, on Tuesday, January 28, we expect the pair to move within a range defined by the levels 1.2374 and 1.2576. The higher linear regression channel remains directed downward, signaling a bearish trend. The CCI indicator has entered the overbought zone and formed a bearish divergence, suggesting the resumption of the downward trend.

Nearest Support Levels:

- S1 – 1.2451

- S2 – 1.2390

- S3 – 1.2329

Nearest Resistance Levels:

- R1 – 1.2512

- R2 – 1.2573

- R3 – 1.2634

Trading Recommendations:

The GBP/USD currency pair continues to exhibit a downtrend. We still do not recommend taking long positions, as we believe that all factors supporting the appreciation of the British currency have already been priced into the market multiple times, and there are no new catalysts emerging.

For those who trade based solely on technical analysis, long positions could be considered if the price consolidates above the moving average, with targets set at 1.2573 and 1.2634. However, sell orders are currently much more relevant, with targets at 1.2207 and 1.2146. For these sell orders to be valid, the pair needs to consolidate back below the moving average.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.