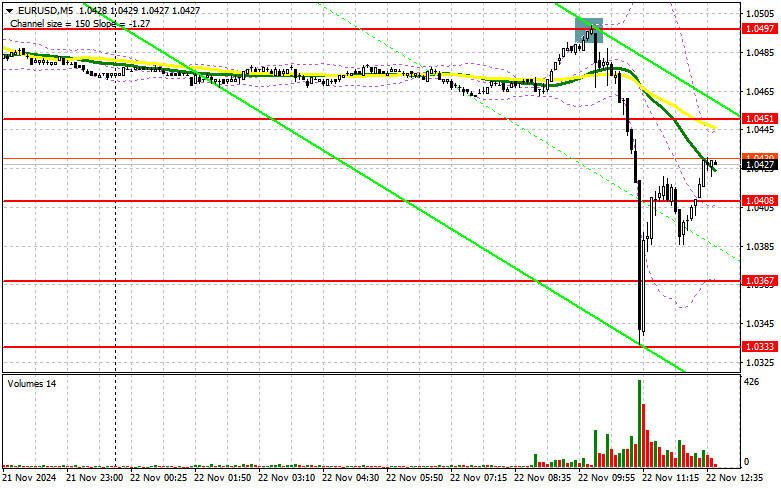

In my morning forecast, I focused on the 1.0497 level and planned trading decisions around it. Let's analyze the 5-minute chart to review what happened. A rise and the formation of a false breakout provided an entry point for short positions, resulting in a decline of over 100 points. The technical outlook has been revised for the second half of the day.

For Opening Long Positions in EUR/USD:

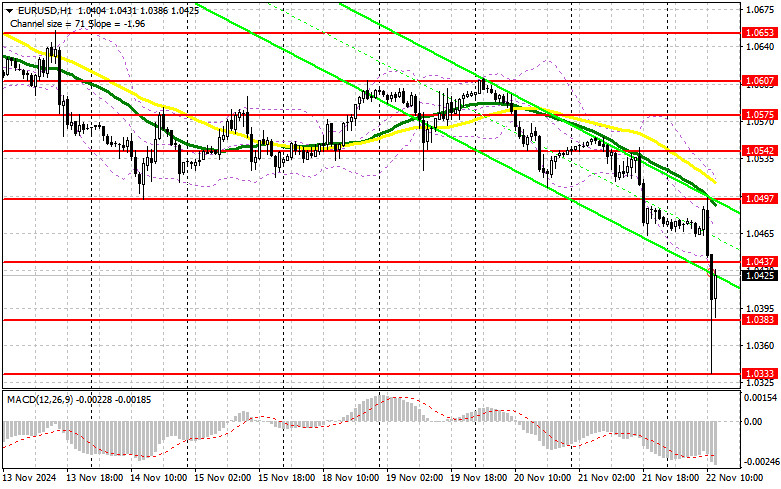

Extremely weak PMI data from the Eurozone triggered a significant sell-off in the euro during the first half of the day. The slowdown in manufacturing and services activity explains recent comments from European policymakers about the need for aggressive interest rate cuts in the Eurozone. Similarly important data is expected from the US in the second half of the day, including the manufacturing PMI, services PMI, composite PMI, University of Michigan consumer sentiment, and inflation expectations. Strong readings from these indicators would further pressure the euro and strengthen the US dollar, so caution is advised when considering long positions.

If the statistics are favorable and the pair declines, I will focus on trading near the support level of 1.0383, which was formed earlier in the day. A false breakout at this level would confirm a valid entry point for long positions, targeting a recovery to the resistance at 1.0437. A breakout and retest of this range would create new opportunities for long positions, with the next target being 1.0497. The farthest target is 1.0542, where I plan to take profits. If the EUR/USD continues to decline and bulls show no activity at 1.0383, the bearish trend will likely persist. In that case, I will only consider entering long positions after a false breakout at the next support level of 1.0333, the new monthly low. Alternatively, I plan to buy on a rebound from 1.0292, targeting a 30–35 point intraday correction.

For Opening Short Positions in EUR/USD:

If the pair rises following the reports, sellers will need to defend resistance at 1.0437. A false breakout at this level, combined with strong US data, would allow for short positions targeting the support at 1.0383. A breakout and a retest of this range from below would likely lead to further declines toward the new monthly low at 1.0333. This move would reinforce the bearish trend in the pair. The farthest target is 1.0292, where I plan to take profits.

If EUR/USD rises in the second half of the day despite strong PMI data, buyers will have a chance to attempt a correction by the end of the week. In this scenario, I will postpone selling until the pair tests the next resistance level at 1.0497, where the moving averages are aligned in favor of sellers. I will sell at this level only after a false breakout. If no downward movement occurs at this level, I will consider short positions on a rebound around 1.0542, targeting a 30–35 point intraday correction.

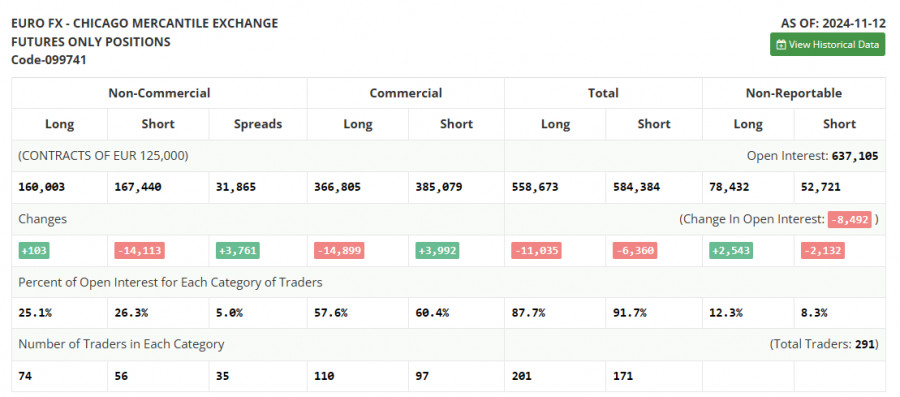

COT Report (Commitment of Traders):

The latest COT report shows a slight increase in long positions and a sharp reduction in short positions. The data reflects the Federal Reserve's decision to cut interest rates and the presidency of Donald Trump. At the current lows, it seems fewer traders are willing to sell the euro, which could indicate a potential bottom for EUR/USD and the start of a medium-term reversal of the bearish trend. However, there is insufficient data to support this conclusion at this time. The absence of significant buyers for the euro is more notable than the reduction in short positions.

According to the latest COT report, non-commercial long positions increased by 103, reaching 160,003, while short positions fell by 14,113 to 167,113. As a result, the gap between long and short positions widened by 3,761.

Indicator Signals:

Moving Averages:

Trading is occurring below the 30-day and 50-day moving averages, signaling renewed downward pressure on the pair.Note: The author uses moving averages based on the hourly chart (H1), which differs from the classical daily moving averages (D1).

Bollinger Bands:

If the pair declines, the lower boundary of the Bollinger Bands near 1.0383 will act as a support level.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise.

- Period: 50 (yellow on the chart)

- Period: 30 (green on the chart)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: Period 12

- Slow EMA: Period 26

- SMA: Period 9

- Bollinger Bands: Period 20

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Represents the total open long positions of non-commercial traders.

- Short non-commercial positions: Represents the total open short positions of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.