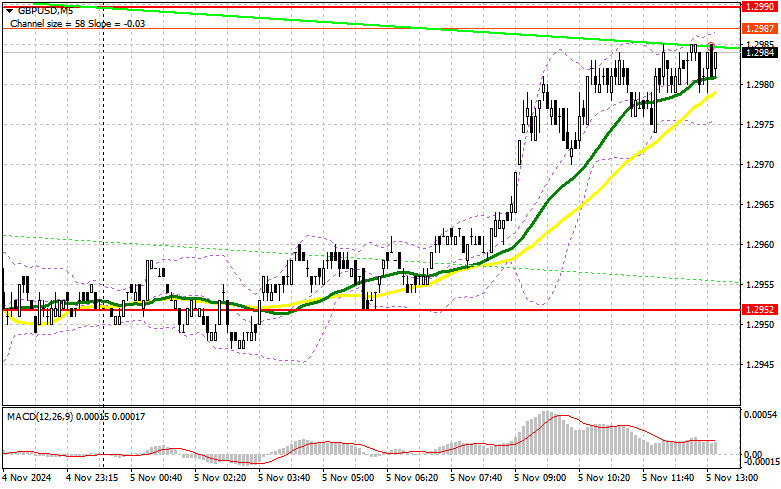

In my morning forecast, I highlighted the level of 1.2990 as a key entry point. Let's take a look at the 5-minute chart to see what happened. The pair rose but didn't reach the level for testing or forming a false breakout around 1.2990, so I ended up without trades. The technical outlook has been revised for the second half of the day.

To Open Long Positions on GBP/USD:

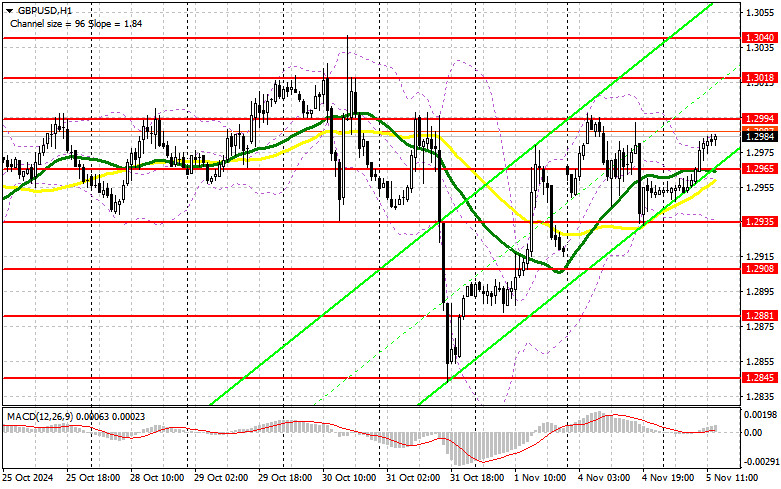

The UK services PMI and composite index were revised upward, leading to pound buying in the first half of the day. However, further movements will now depend on U.S. reports, including the services PMI, composite PMI, trade balance, and ISM services index. Strong statistics could put pressure on the pound, which I plan to leverage. The optimal scenario would involve a decline and the formation of a false breakout around the new support at 1.2965, established earlier in the day. This would confirm a suitable entry point for long positions, aiming for a recovery toward 1.2994. A breakout followed by a retest of this range would create a new entry point for long positions, with potential to reach 1.3018. The ultimate target is 1.3040, where I plan to take profits. If GBP/USD declines without buying activity around 1.2965 in the second half of the day, the pair will likely remain in a sideways channel. This would also likely lead to a further decline and a retest of the next support at 1.2935. A false breakout there would be the only suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2908 low, aiming for an intraday correction of 30–35 points.

To Open Short Positions on GBP/USD:

Sellers are in no rush to act, as they haven't had strong incentives. If there's another upward movement following weak U.S. data, bears should step in near the nearest resistance at 1.2994. A false breakout here would provide an ideal selling opportunity, targeting a decline toward support at 1.2965, where the moving averages provide support for buyers. A breakout and retest from below this range could weaken bullish positions, triggering stop orders and opening the path to 1.2935. The ultimate target would be 1.2908, where I'll take profits. Testing this level would reinforce the bearish outlook for the market. If GBP/USD rises and there's no bearish activity at 1.2994—which is likely—buyers may attempt to reach last week's highs. Bears would then have to retreat to the resistance at 1.3018, where I'll only sell if a false breakout occurs. If there's no downward movement there, I'll look to open shorts on a rebound near 1.3040, aiming for a correction of 30–35 points.

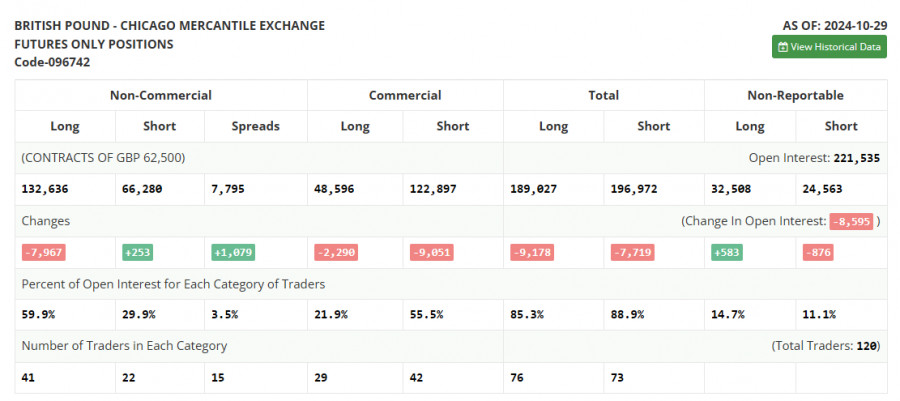

The Commitment of Traders (COT) report for October 29 showed a reduction in long positions and minimal growth in shorts. The Bank of England is expected to cut interest rates at its next meeting, which would likely add pressure on the pound. Additionally, recent UK budget turmoil, with the new Prime Minister planning to fund it through tax hikes, has created an unfavorable outlook for growth. Amid the U.S. election and anticipated rate cuts in the UK, the pound may continue to struggle with growth. The latest COT report indicated that long non-commercial positions dropped by 7,967 to 132,636, while short non-commercial positions rose slightly by 253 to 66,280, leading to a gap increase of 1,079.

Indicator Signals:

Moving Averages:

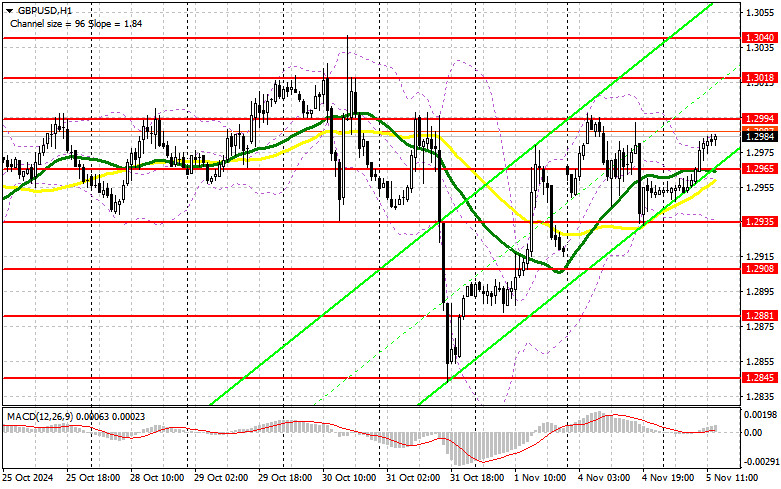

Trading is occurring above the 30- and 50-day moving averages, signaling potential pound growth.

Note: The author analyzes moving average periods and prices on the H1 chart, which differs from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands:

If the price declines, the lower band around 1.2935 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise. Period – 50 (yellow on the chart); Period – 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12, Slow EMA – period 26, SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial Traders: Speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes under specific criteria.

- Long Non-commercial Positions: The total open long positions of non-commercial traders.

- Short Non-commercial Positions: The total open short positions of non-commercial traders.

- Total Non-commercial Net Position: The difference between the short and long positions of non-commercial traders.