GBP/USD surged on Wednesday. We will not consider the results of the Federal Reserve meeting in this article, nor the pair's movements as a market reaction to it. It will take some time to analyze this event and its market reaction. However, we can draw conclusions about the US inflation report, which was the second most significant event of the week.

But let's start with the UK reports that were released on Tuesday and Wednesday. The unemployment rate rose to 4.4% (which was above forecasts), the number of unemployment benefit claims increased by 50,000 (which was five times higher than forecasts), GDP did not grow by a tenth of a percent in April, and industrial production contracted by 0.9% month-on-month (against expectations of -0.1%). Four out of five reports turned out to be worse than forecasts and expectations. Only one report seemed upbeat for the British currency – wages grew stronger than expected, which slightly raises the probability of the Bank of England maintaining its rate at its peak level for a longer period. As we can see, the British currency edged down on four weak reports and basically ignored them. Meanwhile, just one report on US inflation, which does not change the Fed's monetary policy strategy at all, instantly triggered a 100-pip decline in the dollar. This is all you need to know about the logic behind the British pound's movements.

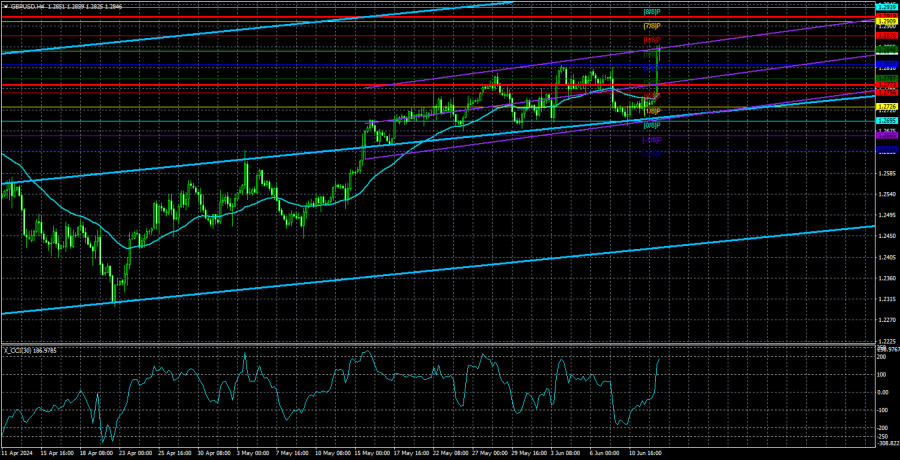

If the euro showed growth yesterday within a downtrend or at least a tendency to fall in the short-term, the British pound just continued to rise. The uptrend remains intact. Another consolidation below the moving average had no effect. The pound remained in a sideways channel for several weeks and then calmly resumed its rise. Therefore, there has been absolutely no change in the technical picture of the GBP/USD pair. The market's attitude toward the British pound remains unchanged. The pound continues to rise for any reason and without. All the macro data that support the dollar and oppose the pound are only formally acknowledged by the market. Conversely, all economic reports that oppose the dollar and support the pound are vigorously acted upon.

Thus, another hope for a logical resumption of the downtrend has gone to waste. The British pound can continue to rise in such a mode indefinitely, as there is no correlation of movements with fundamentals and macroeconomics. By the way, according to the CCI indicator, three or four bearish divergences have already formed, clearly visible in the chart above. However, even this couldn't stop the pound from rising.

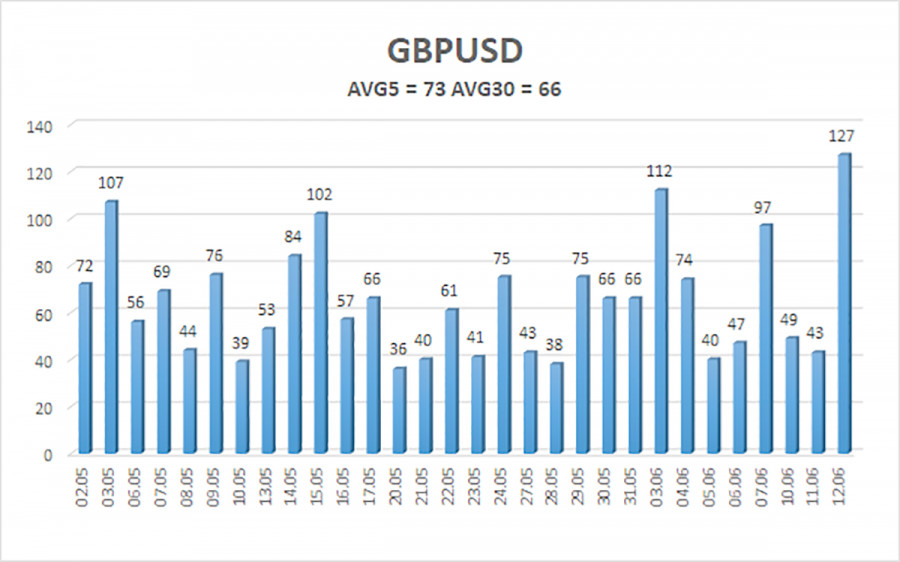

The average volatility of GBP/USD over the last five trading days is 73 pips. This is considered an average value for the pair. Today, we expect GBP/USD to move within the range bounded by the levels of 1.2773 and 1.2919. The higher linear regression channel is pointing upwards, suggesting an uptrend. The CCI indicator entered the oversold area three times in the month before last, and the British currency started a new phase of growth. However, this correction should have ended a long time ago.

Nearest support levels:

S1 - 1.2817

S2 - 1.2787

S3 - 1.2756

Nearest resistance levels:

R1 - 1.2848

R2 - 1.2909

R3 - 1.2939

Trading Recommendations:

The GBP/USD pair once again consolidated above the moving average line so the uptrend remains intact. There were no grounds for such a strong growth on Wednesday, but the market, as usual, solved the problem in the simplest way - by buying the pair. Inflation in the U.S. fell by only 0.1%, which did not imply such a strong fall of the dollar. Now the British currency can continue its illogical rise, but the results of the Fed meeting should still be taken into account. The pound can't grow forever either. But the illogical movements we have seen in the last two months are very confusing.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.