Analyzing Monday's trades:

GBP/USD on 1H chart

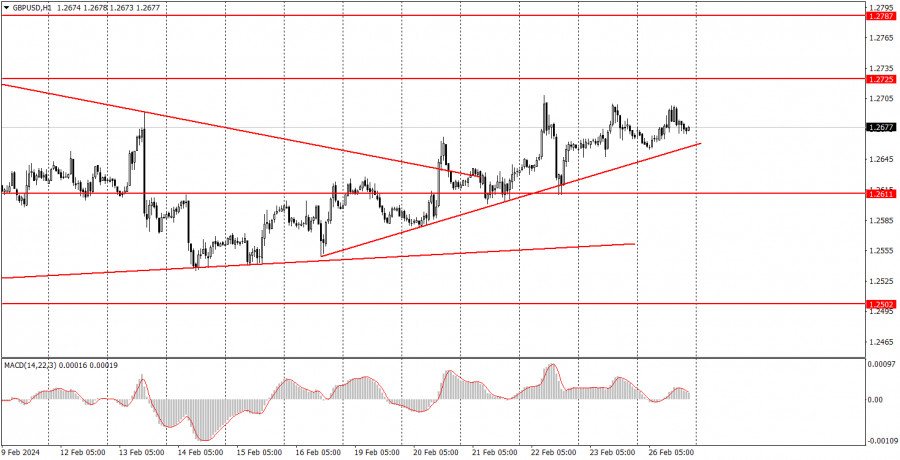

The GBP/USD pair showed modest movements on Monday but maintained a short-term upward trend. Thus, the rise of the British currency may continue for some time. However, we want to remind traders that we are currently in a flat market globally. Within this flat, both upward and downward trends may form, but they do not make much sense, as the price has been within a limited price range for several months. After overcoming the trendline, we can expect the same progressive movement downward.

It was challenging to expect strong movements and high volatility from a "boring Monday." Therefore, we did not see either the first or the second. Later in the week, the situation with news and reports should improve slightly, but it will not change drastically. The pound has the potential to rise up to the level of 1.2787, but movements can be very chaotic, similar to the past three months.

GBP/USD on 5M chart

Another very inaccurate bounce from the level of 1.2688 was formed on the 5-minute timeframe on Monday. We even adjusted this level to 1.2691. It was challenging to identify this bounce, and novice traders could open deals here that did not result in profit. However, due to low volatility at this time, almost any signal carries potentially very weak profit prospects. If there are no movements, expecting profit is very difficult.

Trading tips on Tuesday:

On the hourly timeframe, the GBP/USD pair has exited the sideways channel of 1.2611-1.2787 and is trying hard to start a downward trend, but it is not succeeding well again.

There are now two upward trendlines on the said timeframe, but overall, the pound continues to trade sideways (in the medium term). We continue to expect only declines from the pound, but the market continues to trade the pair in the most chaotic and illogical manner. At present, the local upward trend is still in place.

The key levels on the 5M chart are 1.2270, 1.2310, 1.2372-1.2387, 1.2457, 1.2502, 1.2544, 1.2605-1.2611, 1.2648, 1.2691, 1.2725, 1.2787-1.2791, 1.2848-1.2860, 1.2913, 1.2981-1.2993.

There are no important events planned in the UK, while there is one important report in the U.S.—the durable goods orders. A strong market reaction can be expected only during this publication.

Basic trading rules:

- Signal strength is determined by the time taken for its formation (either a bounce or level breach). A shorter formation time indicates a stronger signal.

- If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be disregarded.

- In a flat market, any currency pair can produce multiple false signals or none at all. In any case, the flat trend is not the best condition for trading.

- Trading activities are confined between the onset of the European session and mid-way through the U.S. session, after which all open trades should be manually closed.

- On an hourly timeframe, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

- If two levels lie closely together (ranging from 5 to 15 pips apart), they should be considered as a support or resistance zone.

- When the price moves in the correct direction by 20 pips after opening a trade, a Stop Loss should be set to break even.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines represent channels or trend lines, depicting the current market trend and indicating the preferable trading direction.

The MACD(14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a signal source.

Important speeches and reports (always noted in the news calendar) can significantly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Establishing a clear strategy coupled with sound money management is the cornerstone of sustained trading success.