The GBP/USD currency pair resumed its downward movement on Thursday, which aligns with our expectations. Let's recall that the pound sterling, like the euro, had been rising for two consecutive months without showing the slightest desire to correct itself. This would have been fine if the fundamental and macroeconomic backdrops favored the pound. However, British statistics consistently need to improve. The Bank of England increased the key rate 12 times, and inflation did not decrease below 10%. The economy has shown zero growth for four quarters. Despite this, a recession has been avoided (for now), as Andrew Bailey and his colleagues regularly remind us. Regarding astronomical inflation, they prefer to fend it off with predictions of its rapid decrease in the future. Why, meanwhile, with a lower rate, is inflation decreasing in the EU? Why, with a slightly higher rate level, is inflation falling in the US? These questions remain unanswered.

Therefore, we have repeatedly said there is no reason for the British currency to grow for the past two months. The movement was purely inertial, as traders wanted to maintain a promising trend on which they could earn. This explains the strong growth of the British currency. But every fairy tale comes to an end sooner or later. Even those factors favoring the pound have already been factored into the market three times over. The Bank of England is highly likely to raise the rate another 1-2 times, which has long been factored into the market with a surplus. Therefore, there is only one way for the pound to go now – down.

Of course, you can never be 100% sure about anything in the market. No one knows what will happen in the future, and over the past four years, the world has faced so many different types of catastrophes that it makes you want to ask the Almighty for at least a pause.

Interest rate – the key to everything

On Wednesday, Bank of England Chairman Andrew Bailey once again stated that inflation would slow down in April and more than halve by the end of the year. Mr. Bailey still needs to remember his previous forecast of 2.9% inflation by the end of the year. However, he remembered to remind me that the economic expectations at the end of last year were significantly more negative than the current state of the economy. According to Bailey, the British economy is withstanding the pressure of high rates for now, and the banking sector is stable. He also noted that there has been a recent slowdown in the labor market and that unemployment has started to rise. But overall, the economy is in a stable state.

Yesterday, Deputy Chairman of the Bank of England, Dave Ramsden, said that the quantitative tightening (QT) program has a low economic impact. He noted that tightening would be gradual, with a sum close to £100 billion a year continuing to be withdrawn from the economy. His colleague Ben Broadbent confirmed that the QT program continues to operate but named a different figure - £80 billion a year. Broadbent is worried that a larger sum may negatively affect market liquidity. As we can see, British officials didn't provide the market with anything important, just like the Bank of England's head did a day earlier.

The pound continues to fall solely based on "technique." It was overbought for a long time and remained so, as a 250-point drop will not bring the market to equilibrium. We ignore the buy signal from the CCI indicator, considering it erroneous. The price declines for the first time in a long time after it settles below the moving average line. On the 24-hour TF, the pair has the potential for a decline to the Senkou Span B line, which is at 1.2170. We expect a decline to the last local minimum near the 1.1800 level in the future. There is no basis for new growth in the British currency.

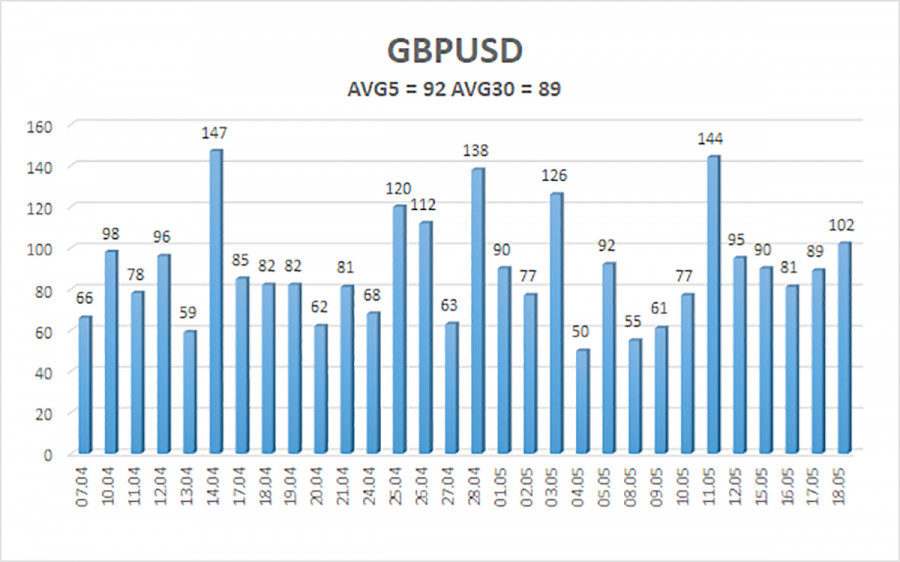

The average volatility of the GBP/USD pair for the last five trading days is 92 points. For the pound/dollar pair, this value is "medium." On Friday, May 19, we expect movement within the channel to be limited by the levels of 1.2306 and 1.2490. An upward reversal of the Heiken Ashi indicator will signal a new round of corrective movement.

Nearest support levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe continues its confident movement to the south. Therefore, you should stay in short positions with targets at 1.2329 and 1.2306 until the Heiken Ashi indicator turns upwards. Long positions can be considered if the price exceeds the moving average, targeting 1.2573.

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction to trade now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) means that a trend reversal is approaching in the opposite direction.