交易员计算器

Take advantage of a trader’s calculator by InstaForex to estimate the following parameters:

- a margin size per trade

- a pip value

All you need to do is enter a few basic data such as a particular financial instrument, the currency of your account, a trade size in lots, and leverage. Hence, you can reckon a trading plan for 300+ trading instruments that will save a lot of your time.

If you want to use a trader’s calculator by InstaForex, you do not have to register in advance or install any software. Parameters entered are processed online. The company’s powerful servers ensure flawless connection so that a trader can instantly figure out the best market entry point and other variants of a trade.

Important!

A pip value for currency pairs is calculated based on the current exchange rate of a particular pair.

Please take notice that 1 lot with InstaForex equals 10,000 units of a base currency.

Here are formulas for calculating a pip value of currency pairs and CFDs.

Calculation of a pip value:

1. XXX/USD

Pip value = 1 * (number of lots)

2. USD/XXX

Pip value = 1 / (USD/XXX) * (number of lots)

3. AAA/BBB

A pip value = (AAA/USD) / (AAA/BBB) * (number of lots)

Calculation of a pip value for CFDs:

Pip value = number of contracts * contract size * tick value

Why does InstaForex suggest a lot size of 10,000 instead of a standard lot size of 100,000 units of a base currency?

InstaForex offers its clients an opportunity to trade Forex applying three lot sizes in parallel within the same trading account. Three lot sizes are designated as Micro Forex, Mini Forex, and Standard Forex. To put this technology into practice, the company introduced an unconventional lot size of 10,000 units. For example, if a trade size equals 0.01 lot, this makes a pip value as low as $0.01. In other words, this is an absolute minimum that allows holders of accounts with $5,000 - $10,000 to manage their risks with utmost efficiency. Besides, a lot size of 10,000 units simplifies calculations of a pip value when opening positions.

Look at the following trade parameters:

- Trade size is 0.01 InstaForex lot = pip value is $0.01

- Trade size is 0.1 InstaForex lot = pip value is $0.1

- Trade size is 1 InstaForex lot = pip value is $1

- Trade size is 10 InstaForex lots = pip value is $10

- Trade size is 100 InstaForex lots = pip value is $100

- Trade size is 1,000 InstaForex lots = pip value is $1,000

A pip value is specified in a base currency of a currency pair’s quote.

InstaForex lots ensure convenient calculations and the possibility of trading three lot sizes inside the common trading account. This is a major advantage of trading conditions with InstaForex.

See Also

-

Trump's tariff hammer: countries hit hardest

Trump's tariff hammer: countries hit hardest -

Trump hits pause, not stop: which tariffs remain in force

Trump hits pause, not stop: which tariffs remain in force -

Three female policymakers to change political landscape in EU

Three female policymakers to change political landscape in EU -

Seven unforgettable places in Australia

Seven unforgettable places in Australia -

Five billionaires who gained most wealth in 2024

Five billionaires who gained most wealth in 2024 -

Top five countries for wine tourism

Top five countries for wine tourism -

Superpowers shaping global agenda in 2025

Superpowers shaping global agenda in 2025

- 2025-05-04 16:15:41U.S. Factory Orders Excluding Transportation Decline in March Amidst Economic HeadwindsQuick show2025-05-04 16:15:41U.S. Factory Orders See Significant Surge, Climbing to 4.3% in MarchQuick show2025-05-04 16:15:41Portugal Retail Sales Rise at Slower PaceQuick show2025-05-04 16:15:41Canadian Stocks Advance on FridayQuick show2025-05-04 16:15:41Mexico Manufacturers Business Sentiment at 4-Year LowQuick show2025-05-04 16:15:41Baltic Dry Index at Near 1-Month HighQuick show2025-05-04 16:15:41Brazil Manufacturing PMI Falls AgainQuick show2025-05-04 16:15:41US Light Vehicle Sales Above ForecastsQuick show2025-05-04 16:15:41S&P 500, Nasdaq, Set for 9-Session RallyQuick show2025-05-04 16:15:41Chile Economic Activity RecoversQuick show

- 2025-05-04 16:15:41US Mortgage Market Takes Dramatic Turn as MBA Purchase Index PlummetsQuick show2025-05-04 16:15:41TSX Up for 4th WeekQuick show2025-05-04 16:15:41US Stocks Rally on Strong Jobs Report, China TalksQuick show2025-05-04 16:15:41WTI Oil Falls Ahead of OPEC+ MeetingQuick show2025-05-04 16:15:41New Zealand Dollar Gains as CFTC Net Positions Improve to -21.5KQuick show2025-05-04 16:15:41Speculative Bets on Yen Rise as CFTC Reports Increased Net PositionsQuick show2025-05-04 16:15:41Bullish Sentiment Surges as Speculative Net Positions in Brazilian Real Climb to 68.3KQuick show2025-05-04 16:15:41Australian Dollar Speculative Positions Narrow Slightly as Market Conditions ShiftQuick show2025-05-04 16:15:41Swiss Franc's Speculative Position Slightly Strengthens as Traders Show Renewed InterestQuick show2025-05-04 16:15:41Mexican Peso Speculative Long Positions Surge by 44.6% in Latest CFTC ReportQuick show

- 2025-05-04 16:15:41Canada Speculative Net Positions Remain Unchanged at -67.2KQuick show2025-05-04 16:15:41Speculators Increase Bearish Bets on Wheat as Net Short Positions Widen to -116.8KQuick show2025-05-04 16:15:41CFTC Reports a Rise in Soybean Speculative Net Positions in the USQuick show2025-05-04 16:15:41Silver Speculative Net Positions Climb to New Heights in Latest CFTC ReportQuick show2025-05-04 16:15:41S&P 500 Futures Speculative Positions Increase Short Bets, Reflecting Market CautionQuick show2025-05-04 16:15:41U.S. Natural Gas Speculative Positions Take a Deeper Dive in MayQuick show2025-05-04 16:15:41Nasdaq 100 Speculative Positions Decline to 30.9K Amid Market AdjustmentsQuick show2025-05-04 16:15:41Gold Speculative Positions See Decline: CFTC Data Signals Change in Investor SentimentQuick show2025-05-04 16:15:41Crude Oil Speculative Net Positions Increase in Latest CFTC ReportQuick show2025-05-04 16:15:41Corn Speculative Net Positions Decline as U.S. CFTC Reports New FiguresQuick show

- 2025-05-04 16:15:41CFTC Reports Decline in Speculative Net Positions for Copper in the U.S.Quick show2025-05-04 16:15:41Aluminium Speculative Net Positions in the US Turn Negative After Reaching a Tipping PointQuick show2025-05-04 16:15:41Euro Zone EUR Speculative Positions Surge: CFTC ReportsQuick show2025-05-04 16:15:41UK GBP Speculative Net Positions Rise by 3.5K, Signalling Increased OptimismQuick show2025-05-04 16:15:41Colombia Factory Sector Grows AgainQuick show2025-05-04 16:15:41Belgium Car Registrations Show Recovery in April as Decline SlowsQuick show2025-05-04 16:15:41U.S. Baker Hughes Total Rig Count Declines Slightly to 584Quick show2025-05-04 16:15:41U.S. Baker Hughes Oil Rig Count Declines Slightly in Latest UpdateQuick show2025-05-04 16:15:41Mexico's Manufacturing Activity at Lowest Level Since PandemicQuick show2025-05-04 16:15:41Week Ahead - May 5thQuick show

- 2025-05-04 16:15:41Italy Sees Sharp Decline in Car Registration Growth Rate for April 2025Quick show2025-05-04 16:15:41European Markets Up, FTSE 100 Hits Longest StreakQuick show2025-05-04 16:15:41Oil Declines on Anticipation of Higher Supply from OPEC+ MeetingQuick show2025-05-04 16:15:41Singapore Manufacturing at Near 2-Year LowQuick show2025-05-04 16:15:41Mexican Manufacturing PMI Drops Further in April, Points to Slowing EconomyQuick show2025-05-04 16:15:41Denmark's Currency Reserves Experience Uptick in April 2025Quick show2025-05-04 16:15:41Ibovespa on Weak NoteQuick show2025-05-04 16:15:41US Factory Orders Rise Sharply as ExpectedQuick show2025-05-04 16:15:41U.S. Durable Goods Orders Stagnate, No Growth in March Excluding Transport SectorQuick show2025-05-04 16:15:41Slight Uptick in U.S. Durable Goods Orders Excluding Defense in MarchQuick show

- 2025-05-04 16:15:41U.S. Factory Orders Excluding Transportation Decline in March Amidst Economic HeadwindsQuick show2025-05-04 16:15:41U.S. Factory Orders See Significant Surge, Climbing to 4.3% in MarchQuick show2025-05-04 16:15:41Portugal Retail Sales Rise at Slower PaceQuick show2025-05-04 16:15:41Canadian Stocks Advance on FridayQuick show2025-05-04 16:15:41Mexico Manufacturers Business Sentiment at 4-Year LowQuick show2025-05-04 16:15:41Baltic Dry Index at Near 1-Month HighQuick show2025-05-04 16:15:41Brazil Manufacturing PMI Falls AgainQuick show2025-05-04 16:15:41US Light Vehicle Sales Above ForecastsQuick show2025-05-04 16:15:41S&P 500, Nasdaq, Set for 9-Session RallyQuick show2025-05-04 16:15:41Chile Economic Activity RecoversQuick show

- 2025-05-04 16:15:41US Mortgage Market Takes Dramatic Turn as MBA Purchase Index PlummetsQuick show2025-05-04 16:15:41TSX Up for 4th WeekQuick show2025-05-04 16:15:41US Stocks Rally on Strong Jobs Report, China TalksQuick show2025-05-04 16:15:41WTI Oil Falls Ahead of OPEC+ MeetingQuick show2025-05-04 16:15:41New Zealand Dollar Gains as CFTC Net Positions Improve to -21.5KQuick show2025-05-04 16:15:41Speculative Bets on Yen Rise as CFTC Reports Increased Net PositionsQuick show2025-05-04 16:15:41Bullish Sentiment Surges as Speculative Net Positions in Brazilian Real Climb to 68.3KQuick show2025-05-04 16:15:41Australian Dollar Speculative Positions Narrow Slightly as Market Conditions ShiftQuick show2025-05-04 16:15:41Swiss Franc's Speculative Position Slightly Strengthens as Traders Show Renewed InterestQuick show2025-05-04 16:15:41Mexican Peso Speculative Long Positions Surge by 44.6% in Latest CFTC ReportQuick show

- US equity indices continue to climb despite lingering economic uncertainty. Investor optimism is being driven by expectations of progress in trade talks between the US and China. Nevertheless, ongoing economic

Author: Ekaterina Kiseleva

13:14 2025-05-02 UTC+2

56

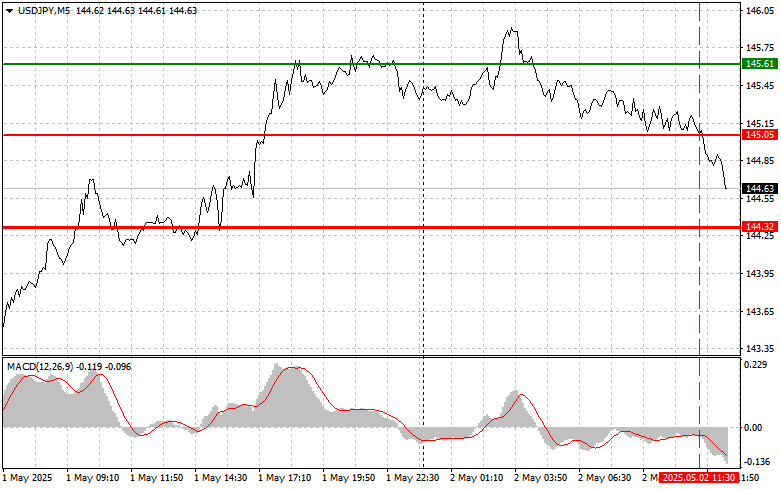

Trade Analysis and Advice for the Japanese Yen The test of the 145.05 level occurred when the MACD indicator had already moved significantly below the zero mark, which limitedAuthor: Jakub Novak

12:24 2025-05-02 UTC+2

76

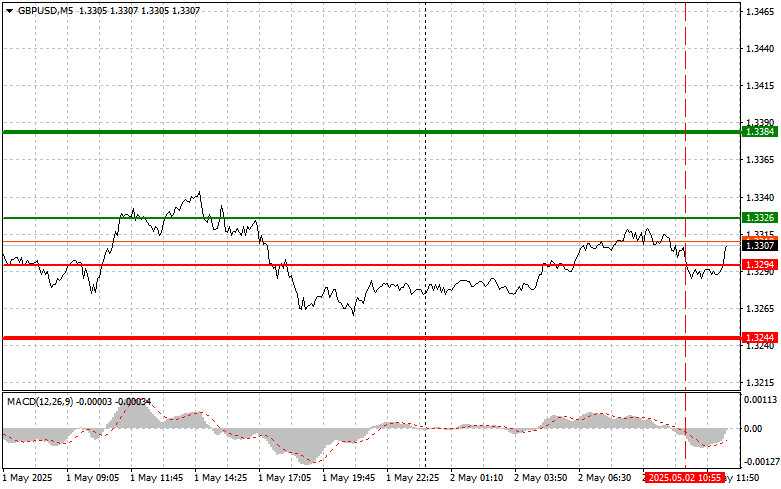

Trade Analysis and Advice for the British Pound The test of the 1.3294 level in the first half of the day occurred when the MACD indicator had already moved significantlyAuthor: Jakub Novak

12:19 2025-05-02 UTC+2

64

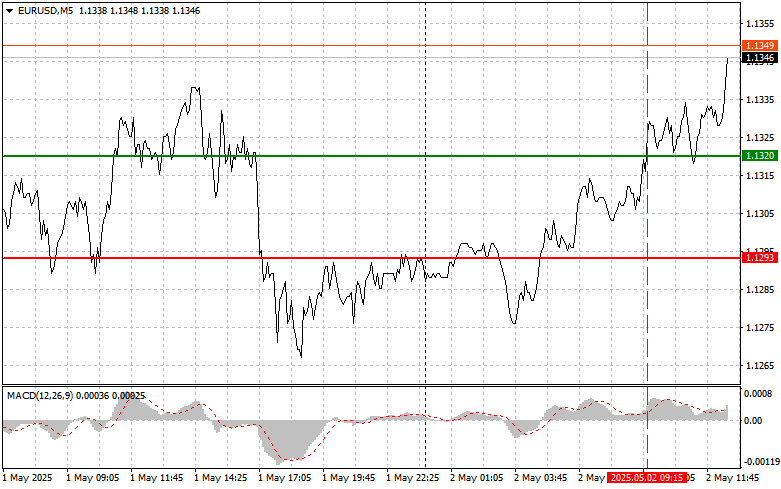

- Trade Analysis and Advice for the Euro The test of the 1.1320 price in the first half of the day occurred at a time when the MACD indicator had already

Author: Jakub Novak

12:17 2025-05-02 UTC+2

74

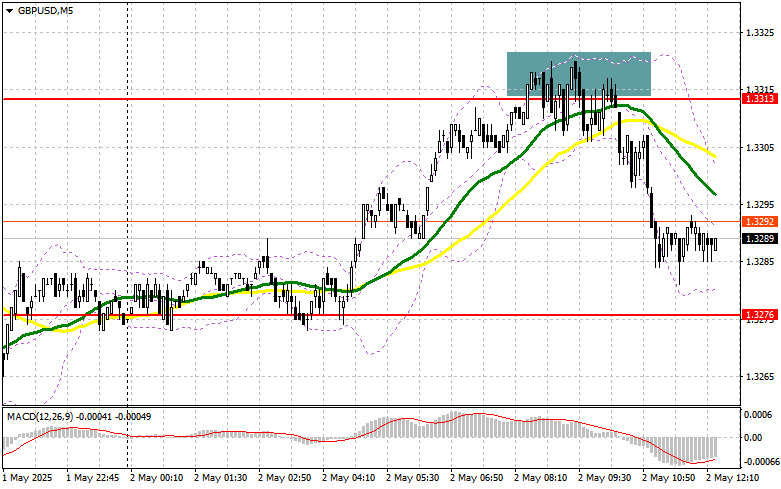

In my morning forecast, I focused on the 1.3313 level and planned to make trading decisions from there. Let's take a look at the 5-minute chart and break down whatAuthor: Miroslaw Bawulski

12:14 2025-05-02 UTC+2

56

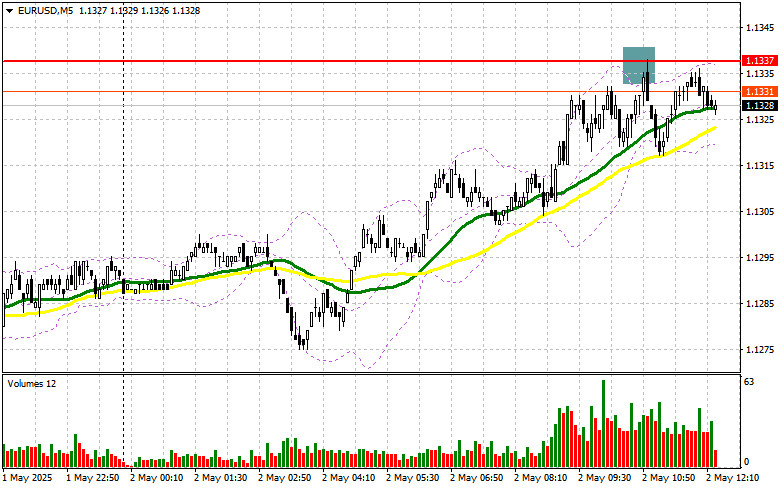

In my morning forecast, I highlighted the 1.1337 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened thereAuthor: Miroslaw Bawulski

12:06 2025-05-02 UTC+2

53

- The EUR/USD pair is attracting buyers today, breaking a three-day losing streak and attempting to build intraday momentum above the psychological 1.1300 level. This indicates a renewed interest from buyers

Author: Irina Yanina

11:59 2025-05-02 UTC+2

41

Employment growth in the U.S. likely slowed in April, although the unemployment rate is expected to remain unchanged, pointing to healthy but moderate demand for labor. However, the Trump administration'sAuthor: Jakub Novak

10:08 2025-05-02 UTC+2

45

The European currency continues to lose ground against the U.S. dollar as traders increasingly place bets on the European Central Bank's upcoming monetary policy decisions. According to data, the chancesAuthor: Jakub Novak

10:03 2025-05-02 UTC+2

43

InstaForex gives away $4,000 for World Football Day. Join now!

Do you love football? So do we. And we also love rewarding our clients. To celebrate World Football Day, InstaForex is launching the Chancy Deposit campaign! The prize is $4,000. To participate, simply top up your trading account and wait for fortune to play on your side. Football teaches us to take risks, win, and never give up. The same rules apply in trading. Top up your account, and maybe you will score your biggest financial goal this spring! Register.